|

Investing is for DRIPs

|

|

July 6, 1998: 11:32 a.m. ET

Dividend reinvestment plans let you buy stocks and avoid the broker fees

|

NEW YORK (CNNfn) - Want to make your broker mad? Want to buy stocks without paying a commission? Want to make money in your spare time? Consider dividend reinvestment plans.

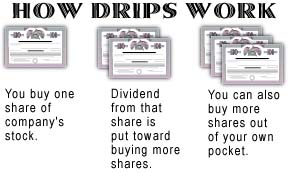

These plans, known somewhat unenticingly as DRIPs, allow you to buy your stock straight from the company as long as you own one share already.

More than 1,000 companies offer dividend reinvestment plans and the numbers keep growing. These companies include some of the top businesses around, including such Dow industrial stocks as IBM (IBM), Chevron (CHV) and McDonald's (MCD).

Additionally, more and more overseas firms which trade as American Depositary Receipts in the United States are also offering DRIPs, including British Telecom, France's Elf Aquitaine and Japan's Sony.

All dividend reinvestment plans start with owning one share (although a small few require more, such as Hewlett-Packard (HWP) which has a 10 share minimum).

There are various ways to get that first share. You can go to your broker, but if you do, make sure they register the share in your name, said Charles Carlson, editor of DRIP Investor.

Your broker will try to talk you out of this since some brokerages prefer to keep the share registered under their street names. "Be prepared to withstand 48 reasons why it's a bad idea," said Carlson.

Under street name ownership, the shares are held by the broker and maintained in an account for the investor.

Fortunately for you, there are ways to bypass the broker completely, even when buying your first share. Increasingly, many firms are offering direct stock purchase plans (DSPs) which can save you hundreds of dollars in broker fees.

For example, if you want to buy 200 shares of a company at $25 per share, broker fees could run anywhere from $75 to $150 but if you buy the stock directly from the company, it may cost you only a nominal fee of $15 or so to cover the processing costs.

So far, only about 400 companies offer this, including such notables as Procter & Gamble (PG) and Exxon (XON). But David Venghaus, executive director of the Society for Direct Investing, expects this trend to keep growing.

"There is research that shows shareholders tend to be more loyal customers of their products," said Venghaus.

Additionally, individual investors -- the kind who participate in DRIPs -- tend to be the buy and hold investors eagerly sought by companies who hate to see widespread defections after a poor earnings report, he said.

Start DRIPing

Once you're a shareholder of record, you'll have to enroll. Contact the company's shareholder relations department for a DRIP application and prospectus, which will give you all the information you need about the plan.

Dividend reinvestment plans have two advantages. First, as the name would apply, once you have one or more shares, the dividends you earn are then applied by the company toward the purchase of more shares.

However, once you're in, you can also send money into the company to buy more shares. "This is where the real oomph comes in," said Carlson, who explained these optional cash payments can often be as little as $10-$25.

Some companies even give you opportunities to buy their stock at less-than-market prices, usually at a discount of about 2 percent to 5 percent. However, this usually applies to shares purchased with reinvested dividends so the amount of stocks you would be able to buy is somewhat limited.

Trading via the Pony Express

Investors accustomed to speed-of-light trading practices might be frustrated by DRIPs, which operate more like the Pony Express.

"When you call your broker and tell him to buy IBM, he goes out and buys it immediately," said Venghaus. "When you buy directly from IBM, you send in a check, fill out a form and it takes a couple of days."

This can affect the amount you purchase. In those days between when you want to buy or sell more stock, the share price might fluctuate. So, your $100 may buy you more or less stock than you bargained for.

You can't even be sure the company will process your sell or buy request as soon as they receive it. Many companies process these orders every other day or even every other week, waiting until an amount of orders accumulate so they can take care of several at once.

Carlson noted if you expect to sell some shares at a certain date, you can write the company ahead of time and request them to send you the actual stock certificates. Once you have those in hand, you can walk into any brokerage and sell them at the exact time you want.

DRIPs will also require you to be a much more diligent and organized investor than you may be now.

Carlson, for example, participates in 17 different DRIPs and gets 17 different statements. When you buy stocks through your brokerage, they send you a consolidated statement with your entire portfolio on one form.

Your bookkeeping habits will become especially crucial around tax time. Dividends, even if they're reinvested, are considered taxable income. Each year, your DRIP companies will send you a 1099 form with this information.

Dividend reinvestment plans have proved so popular that even brokerages are trying to get in on the act, but don't be fooled by imitations.

Some brokerages have taken to offering DRIPs of their own. They'll say they won't charge you a fee to reinvest dividends to buy more shares of that company's stock.

However, if you want to buy additional shares out of your own pocket, you'll have to pay a commission, taking away the main advantage of a traditional DRIP. In the end, it's better to make the additional effort and participate in these programs on your own.

-- by staff writer Randall J. Schultz

|

|

|

|

|

|

|