NEW YORK (CNNfn) - You don't pay your mutual fund manager to sit around but he might not be doing you any favors by constantly changing around your fund's investments.

Turnover, the rate at which a fund manager buys and sells stocks, has many implications for a fund's shareholders, even if the manager is making stock picks that add value to the fund.

Obviously, the main part of a fund manager's job is to maximize the overall return of the fund. To accomplish this, he will buy the stocks he expects will go up in value and sell off ones which he thinks have peaked in order to acquire new stocks.

Some managers, however, are reluctant to sit by complacently with a buy and hold strategy. They will be ever on the move, creating a high turnover rate.

For example, if, over the course of one year, a manager completely replaces the stocks he has in his portfolio, the mutual fund has a turnover rate of 100 percent. If he replaces half, it would have a 50 percent turnover, and so on.

However, 100 percent is not the maximum. Some fund managers rarely let their funds pause for breath. The Maxus Laureate Fund (MXSPX), a capital appreciation investment, had a turnover rate of 1,511 percent over the past year, according to Lipper Analytical Services.| Fund | Turnover | 1 Yr. Return

| | Maxus Laureate Fund | 1,511% | 17.08%

| | Proactive:Opti Dynamic | 1,237% | N/A

| | MFS Core Growth; A | 1,043% | 34.72%

| | Rydex: OTC Fund | 972% | 29.74%

|

Source: Lipper Analytical Services

Others take the opposite approach. The Fidelity Exchange fund (FDLEX), a growth and income fund, and the Citifunds Large Cap Growth fund (CFLGX) had no turnover in the past year.

The more wheeling and dealing your fund manager does, the worse your return can be, a 1997 study by Morningstar Inc. indicated.

According to the study, funds with less than a 20 percent turnover rate had an average three year return of 23.90 percent, while those with a 100 percent turnover rate had an average return of 17.55 percent.

Fund turnover tends to vary according to the investment parameters of the fund. Small-cap growth funds have an average turnover of 136 percent. By contrast, large-cap growth funds' average turnover is 64 percent.

"Turnover tends to add value in small cap growth funds," said Russ Kinnel, head of equity research at Morningstar.

"Many small cap stocks may have a few great years and then fall off the earth. You don't want to be there for the downs," he explained.

Turnover and taxes

You may not care about your fund's turnover rate during most of the year, but you will when April 15 rolls around.

Every time your fund manager sells one of his stock holdings at a profit, a capital gain is incurred. As a shareholder in the fund, the taxes on that capital gain are passed on to you, slicing off some of the investment return you get from the fund.

Changes last year in tax laws made the turnover tax bite an even bigger one. According to the revisions, capital gains on stocks held for 18 months or more are taxed at a 20 percent rate.

However, if your fund has a high turnover -- making it unlikely many stocks are held for 18 months -- they can be taxed up to 39.6 percent.

These capital gains on profitable stocks could be offset by the fund manager selling other stocks at a loss, but Sheldon Jacobs, editor of the newsletter No-Load Fund Investor, said most are unwilling to take these measures.

"They say 'Most of the shareholders are in IRAs' and taxes aren't a factor in IRAs," explained Jacobs. "They say 'I'm being paid on overall performance.'"

In general, the lower the fund's turnover rate, the higher its tax-efficiency. The average equity fund has a turnover rate of about 80 percent.

Analysts advise as a fund approaches turnover of 30-40 percent or below, it is reaching a better tax position.

High turnover has other negative effects, said John Markese, president of the American Association of Individual Investors.

"There are also higher transaction costs," he said. "The more you turn over your investments, the more transaction costs you will incur."

Markese also said funds which are doing more buying and selling incur higher spread costs. Fund managers, especially those who handle small-cap investments, often are faced with differences between the bid and ask prices, and these differences reduce the return you get.

Big funds with lots of assets with which to buy and sell must especially be careful with their turnover.

As a fund gobbles up a large amount of a stock, it will drive up its price before it's through, just as unloading a large stock position will drag the price down, hurting the return either way. Giants like Fidelity's Magellan have thus been forced to adopt a more moderate turnover rate.

Turnover shouldn't be the only criteria you use to pick a fund, since it in itself is not positive or negative.

A fund with high turnover can rack up wonderful returns. And even with the capital gains tax factored out, you'll still end up with a solid dividend which could be higher than a fund with lower turnover.

Some funds are better suited to higher turnover anyway. Morningstar's report found the riskiest funds benefit most from higher turnover while more staid stock funds, such as those which deal with Dow-sized companies, benefit least since these firms' stocks are less likely to fluctuate wildly.

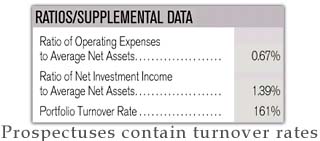

Mutual fund prospectuses and annual shareholder reports give you the historical turnover rates for the fund and you can use these to guide you in your investment choices.

If you're looking for low turnover, indexed funds offer some of the lowest turnover around. Since many follow larger benchmarks such as the S&P 500 index, they tend to mimic the lower turnover of the overall market. They perform better then most mutual funds as well.

High turnover can flip your fund from a strongly-performing one to an inefficient one. Sometimes the best thing a fund manager can do is leave stocks alone. So even if your manager seems like he isn't earning his pay, he could be earning you more money.

-- by staff writer Randall J. Schultz

|