|

Is the Net bubble bursting?

|

|

May 26, 1999: 4:35 p.m. ET

Several factors are driving the sector down, but analysts expect a recovery

|

NEW YORK (CNNfn) - Sooner or later, all bubbles deflate, either suddenly bursting or slowly leaking. With Internet stocks down sharply since last month, Wall Street watchers are wondering if the air finally has been let out of that bubble.

Despite Wednesday's rebound, largely due to investor bargain hunting, Internet stocks are significantly weaker than they were during their April highs.

Analysts said fears of rising interest rates play a part in the latest downturn, as well as a new-found investor desire for Internet firms to start showing actual profits.

Adding fuel to the fire, Morgan Stanley Dean Witter's influential Internet analyst Mary Meeker said Wednesday she expects a 20-percent correction to Morgan Stanley's already-battered Internet index.

And another factor -- rising margin debt -- could be dragging down the sector as a whole.

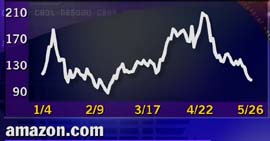

For a small-scale indication of how Internet stocks are performing in general, look no further than e-commerce bellwether Amazon.com Inc. (AMZN).

Based on Tuesday's closing price, shares of the Seattle-based company -- usually a darling among Internet investors -- are down about 50 percent from their high of 221-1/4.

Until now, analysts have gleefully ignored the fact that Amazon has done nothing but bleed losses during its entire existence. But a recent warning from company executives that the firm's losses will widen at a greater rate than its revenue growth sent shivers down investors' collective spine.

Amazon is 50 percent off its 52-week high

Sara Zeilstra, e-commerce analyst at Warburg Dillon Read, said Amazon's recent woes are an indication that investors finally are beginning to face reality.

"Everyone always looked at e-commerce as a situation where all these virtual companies are going to be great someday," she said. "The problem is you can't build a business with virtual cash. These companies are getting closer to maturity, and investors are saying, 'We floated you for a while, but we want to start seeing a payoff.' "

Analysts also pointed to the fact that the Federal Reserve is leaning toward tightening interest rates, meaning investors may be taking money out of their stock holdings to buy bonds.

"Higher interest rates tend to make higher-value stocks look less attractive," said Mark Cavallone, an Internet analyst at S&P Equity Group.

On the margins

Some analysts have begun citing a new element -- an increase in margin debt -- as another factor driving Internet stocks lower.

As Internet shares blasted through the roof at the end of 1998 and early 1999, investors increasingly borrowed money from brokerages to invest in the high-flying sector.

Investors often buy stocks on margin, whereby they leverage their purchase by borrowing up to 50 percent of the stock price from a brokerage.

But when stock prices tumble, brokers may issue a margin call -- requiring investors to put up additional money in their margin accounts -- to protect themselves.

If a brokerage issues a margin call of 75 percent, for example, that means investors must put additional money into their margin accounts if their investments fall below 75 percent of the original value. If investors don't meet the call, they must sell the stock to pay back the loan.

As more investors sell shares as they try to meet their margin calls, stock prices fall further.

Some analysts say that's what's happening now. According to Charles Biderman, chief executive officer of investment research firm TrimTabs.com, investors are cashing in their positions to meet their margin calls.

"My opinion is we're seeing market liquidations of many of the former high-flying Internet stocks," Biderman told CNNfn. "A lot of the stocks are down. Margin calls happen when stocks decline by more than 35 percent. And we're seeing more than 35-percent declines in many former high flyers."

Biderman said margin debt for customers of New York Stock Exchange member firms reached $40 billion over the last two months.

"It's unprecedented in terms of percentage gain ever, in terms of borrowing money to buy stock," he said.

Like Biderman, Merrill Lynch analyst Don Kapetanakis attributed much of the Internet sector's problems to the weight of margin calls. Initial selling in various highly leveraged shares forced investors caught short to liquidate, he said, triggering a cycle of additional sell orders that has begun to feed on itself.

But Charles Schwab Corp. (SCH), the No. 1 discount and Internet broker, has seen only a slight increase in margin calls over the past few weeks, according to a company spokesman. The brokerage hasn't changed its margin maintenance requirements since last November.

And not all analysts agree that margin calls are creating a negative pull on the sector as a whole. Cavallone said rising margin debt is likely more of a factor in the downturn of what he termed "second-tier" Internet stocks -- that is, companies that recently have begun trading publicly and those held largely by day traders and individual investors.

"With the stocks I follow -- like America Online (AOL) -- those tend to be driven by institutional investors," Cavallone said. "I'm of the opinion that margin inflow has had more of an effect on the second-tier names."

Comeback on the horizon

In a research report, Morgan Stanley's Mary Meeker said she expects "more weakness" from Internet stocks, which will likely make investors more cautious about the sector.

"It isn't uncommon this time of year for prices of technology stocks to contract when catalysts are insufficient," Meeker wrote.

Meeker also noted she wouldn't be surprised if Morgan Stanley's Internet index -- already down 33 percent from its April high -- fell another 20 percent.

Nevertheless, analysts hesitate to call the latest Internet downturn a correction, or characterize the selloff as an indication that the bubble has burst.

"My view continues to be a general, high-volatility sideways stock action through the summer," said Alan Braverman, Internet analyst at Banc of America Securities. "After the summer, however, I am a strong bull in terms of believing that the stock action will move up."

If anything, the sector's recent downturn is merely another reminder of how volatile Internet stocks are and will continue to be.

"We're in a seasonally slow time," Zeilstra said. "There hasn't been any news, and it's no secret that these companies are driven by press releases. I think we'll start seeing a comeback in the next couple of weeks as the quarter comes to a close. Companies will begin reporting [quarterly earnings] and that will give people a reason to buy. [The sector] will go up another 20 percent and the volatility will continue."

-- by staff writer John Frederick Moore with additional information from wire reports

|

|

|

|

|

|

|