|

Banking on the Net

|

|

June 18, 1999: 11:40 a.m. ET

Among slowest to go online, banks now set for Internet growth

By Staff Writer Tom Johnson

|

NEW YORK (CNNfn) - Bruce Luecke's eyes lit up like a Christmas tree as he watched a record number of holiday shoppers, credit cards in hand, flock to the Internet last year.

The powerful flow of e-commerce onto the Web didn't have a dramatic impact on Luecke's bottom line per se. But as president of Bank One Corp.'s interactive delivery business, it did help quell the notion that consumers still are overly fearful about conducting financial transactions online.

Whether consumers ever completely manage to clear that psychological hurdle remains to be seen. But encouraged Internet bankers like Leucke now hope to proactively begin marketing their products, which thus far have served as little more than window dressing for a bank's more traditional business lines.

"The growth of the Internet and what you can do via the Internet, it's becoming so much more a part of everyday life," Leucke said. "That fear is really starting to go away. Now, banks have a short-term opportunity to grow this business."

Enticing online banking offers have grown in popularity during the last year.

Leucke and others view their window of opportunity as narrow because unlike many industries, banks thus far have generally been very slow to develop the online medium as anything more than a vehicle to retain customers and highlight retail products.

In fact, an Ernst & Young study published last year said the most compelling reason for banks to launch Internet products is simply to keep their customers from leaving for another institution that offer a similar service.

Most banks "don't seem to have a compelling business case for the Internet," said Phil Lawrence, a partner with Ernst & Young. "Here you have a bunch of people who don't know how to make money on it, they don't know if their customers want it, but they're afraid of competitors taking business away."

Lawrence said despite Internet bankers' renewed enthusiasm for future growth prospects, he expects "that trend will hold" as banks struggle to define what level of resources they are willing to devote to a medium that many still believe won't ever completely take off.

But there are several glimmers of hope, most notably the emerging demographics of the typical online customer. Belying predictions to the contrary, the nation's older population is signing up for the service just as quickly as their younger, technology-savvy children and grandchildren.

New changes in store

With customers signing up for Internet banking at an accelerating clip, many institutions are devising plans to create online services as stand-alone products that can attract customers globally and, hopefully one day, start returning a profit.

To do so, industry officials and analysts agree banks must develop Web products that not only cater to both retail and commercial customers, but also offer unique options that can't be found in a traditional bricks and mortar branch.

"In the next three years, there is going to be a gigantic transition online," said Scott Appleby, an online financial services analyst with BancBoston Robertson Stephens. "It's still going to be a challenge for these companies to basically separate out an online unit. But without doing so, they are going to fall behind what other companies are doing out there."

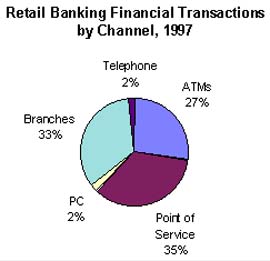

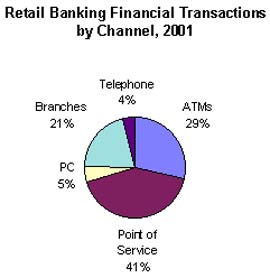

Consumers use of PC banking is projected to increase only marginally during the next few years.

Source: Ernst & Young

That includes a growing host of pure Internet banks that have found success enticing consumers with offers of high interest rates and low fees.

The mere presence of these companies -- including the likes of NetB@nk Inc (NTBK)., TeleBanc Financial Corp. (TBFC) and CompuBank -- have created a sense of urgency among traditional institutions to ramp up their Internet offerings.

"There's been a huge learning curve among customers out there," said Jonathan Lack, an executive vice president with Houston-based CompuBank, the world's first nationally chartered virtual banking institution. "The consumer is a fast learner and they are moving at a faster pace of accepting the Internet than anyone ever anticipated."

Still, most believe traditional banks still hold a distinct advantage over their online counterparts in that they are known quantities. But that advantage is expected to be short-lived.

Luecke's 340,000 current customers dwarf Compubank's several thousand. But Lack is projecting his company, just now in its third quarter of operation, will grow to 1 million accounts within five years, a prediction few traditional banks would likely be willing to make.

Slow to react

Most banks did not offer any form of online banking as little as two or three years ago when pure Internet banks first appeared on the scene. Even then, many banks -- predominately the industry's largest -- rolled out only simplified products allowing customers to check balances and transfer funds.

"I don't think they knew what their expectations were at the time," said Jim Bruene, editor of Online Banking Report. "It was trial and error for a while.

"What's happening now started about a year ago when e-commerce stocks started to take off, customers started shopping online and the comfort level grew. Now, you can be sure you are not going to take a gamble by pumping resources online."

Many banks have had a difficult time connecting with consumers on what their online banking products should entail.

Many banks are reacting accordingly.

Among those that already have or are planning to roll out new Internet banking products this summer are industry leaders Citigroup (C), First Union (FTU) and Bank One (ONE).

Unlike previous services, these products attempt to offer both retail and commercial customers the option of conducting practically every transaction they could in a bank except getting cash. That includes everything from bill payment services to applying for loans, all in a matter of minutes.

"We plan to add additional service with more aggregation of content that is financial based," said Michael Daley, a senior vice president with First Union, whose institution recently became the industry's first bank to join with Sun Microsystems and Netscape to build an integrated e-commerce system for its commercial customers.

"These aggregations are a huge enhancement and a huge growth area for our offering, he said.

Analysts still skeptical

But whether they are enough remain to be seen. Analysts still doubt that most banks ever will devote enough resources to Web-based development to make the medium an effective -- and profitable -- business line.

Ultimately, that means little bottom line help for investors either, leaving some banks squeamish about devoting too much cash to developing a truly comprehensive product.

"Trench warfare is coming," Lawrence said. "As the market becomes more efficient, the profit tends to leave the market. So there's a sense of, 'Why rush?' Some institutions will choose to play the game, some will not. For the bulk of the market, the solution seems to be, having a mixed approach."

For the time being, though, the game doesn't appear to be limited to the industry's largest players, despite their deeper pockets.

Several community banks, some with as little as a few hundred million dollars in assets, have launched Web products to compete with their multi-billion dollar counterparts.

"I was concerned that the big banks were going to come and cherry pick my customers," said Bazile Lanneau Jr., chief financial officer of Britton & Koontz, a $185 million Natchez, Miss.-based bank that has offered some form of online banking for four years now.

"For all banks, Internet banking is a defensive posture," he said. "I take a functional approach to all of this. I don't believe people come to banking sites to be entertained."

But banks clearly are moving in that direction, combining a bit of pizzazz with their broader range of options.

Citibank and Wells Fargo (WFC) routinely are mentioned as the best banking sites on the Web.

San Francisco-based Wells Fargo was named top site by Ziff-Davis, an online technology news site. In a more recent poll, Citibank was named the world's top online banker by an international division of IBM Finance. Wells Fargo ranked fifth while NetB@nk finished seventh.

|

|

|

|

|

|

|