|

Assessing sovereign risk

|

|

August 3, 1999: 10:57 a.m. ET

What sovereign ratings represent and how they affect the markets

By Staff Writer Jeanne Sahadi

|

NEW YORK (CNNfn) - Perhaps you are global investor Mark Mobius' soul mate or you simply are tempted by the prospect of high-yield returns in countries not your own.

In either case, it pays to be informed.

While there is no way to take the risk out of investing overseas, there are ways to assess how much risk you are assuming when you put money into a bond or bond fund from another country.

A good first step is to check a country's sovereign ratings, which are issued by credit rating agencies such as Moody's and Standard & Poor's.

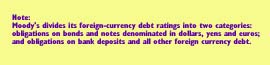

The ratings, assigned to a government's foreign and local currency debt, are assessments of the likelihood a nation will default on its payments to creditors.

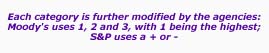

Broadly speaking, the ratings are divided into two categories: investment grade and speculative grade.

The agencies consider a host of factors when determining a nation's creditworthiness. Among them: inflation trends, per capita income, public external debt, patterns of economic growth and bank lending, the stability of political institutions, the exchange rate policy, budgetary constraints and the degree of central bank autonomy.

In short, anything that might affect a government's ability or willingness to pay back what it owes.

"Nothing in principle about a sovereign rating is different than a corporate or bond rating," said David T. Beers, managing director of Standard & Poor's sovereign ratings group.

Capping others' prospects

Once sovereign ratings are assigned, they usually set a ceiling for the ratings of corporate and government bonds issued from a given nation.

So "even if [ company has] very good financials, it will be difficult in a weak country . . . [because] the government tends to interfere with your payments," said Jaime Sanz, vice president of the sovereign rating group for Duff & Phelps Credit Rating Co.

In other words, a company may be impeded from repaying creditors by a politically or economically unstable government since the sovereign can impose exchange rate controls, for example, or devalue the country's currency, which then will affect the company's ability to repay or raise money abroad.

Offering unbiased information

Unlike a government, corporation or brokerage, sovereign ratings offer "an independent view of what a country looks like (and) give investors a comparative view," said Sanz. "The information we produce is unbiased. We're not trying to sell the bonds or to get business from a government."

Much of the agencies' research, outside of their meetings with government officials and other key figures, is based on information in the public domain.

"Information isn't the problem. Analyzing the information becomes the challenge," said Vincent Truglia, managing director of Moody's sovereign risk unit.

And so does transparency. The more forthcoming a country is with its economic and banking data, the more likely its ratings will accurately reflect its circumstances.

"If there's an attempt to deceive, there's little you can do," Truglia said, noting that, for instance, in the months prior to devaluing its currency and setting off the Asian financial crisis in 1997, Thailand tried to hide the fact that its Central Bank was attempting to stabilize the baht by selling off most of the country's international reserves -- a key instrument in managing currency volatility.

But those on the Street say there is something the agencies can do: a better job.

Agencies vs. the Street

Most professional investors agree that assessing the creditworthiness of national governments is a complicated art.

Nevertheless, many believe the agencies did not sound the alarm early enough ahead of the Asian crisis and then proceeded to issue several downgrades in rapid succession once the extent of the countries' problems came to light.

That resulted in a certain loss of confidence in the long-term value of sovereign ratings.

"Investors used to look at ratings for a barometer as to whether to sell or buy bonds," said Joyce Chang, the former managing director of emerging markets fixed income research at Merrill Lynch, who, like others, said she relies heavily on in-house country research for her decision-making.

The agencies, while acknowledging that both they and the markets learned much from the Asian crisis, say their job is not to predict crises but rather to assess the fundamental risk factors that may lead a country to default on its debt.

"Ratings find it very difficult to speak to more event-based risk," Truglia said, noting that "there are going to be instances where ratings are far from perfect."

Leaders or followers?

And far from timely, some say.

"The ratings agencies have actually followed the market as opposed to lead the market," said Jose Barrionuevo, director of global sovereign strategy for Lehman Brothers. "Their impact is limited in that sense."

He noted how the spreads on 10-year bonds from investment grade Colombia and speculative grade Argentina have been equally wide recently.

Since spreads -- the difference between a bond's yield and that of a safe-haven U.S. Treasury bond of similar maturity -- widen as the level of perceived risk rises, the similarity indicates the Street has priced in a downgrade for Colombia, which has been crippled by a violent left-wing insurgency, a raging drug war and its worst economic downturn in 50 years.

So why have ratings?

Of course, it's the nature of the markets to position themselves to profit from -- or protect against -- anticipated future events.

And the future event in this instance is not only the prospect of Colombia defaulting on its payments, but the effect a downgrade has on investors' perceptions of a country and its bonds.

Which speaks to just one of the ways ratings influence the markets.

Despite their criticisms, professional investors and analysts said they use sovereign ratings as benchmarks in their own country research. And they noted that ratings are particularly valuable when a country is new to market and hence unfamiliar.

What's more, some portfolio managers are required to limit their holdings to either investment grade instruments or to a specific level of investment grade issues. Hence, they must change their holdings when a sovereign rating is changed significantly.

"If they upgrade (say) Mexico, you bring in a whole new spectrum of portfolio managers," said Barrionuevo.

And that may happen sooner rather than later.

In late June, Moody's said it was placing Mexico's long-term foreign currency country ceiling on review for upgrade. That day, the price of Mexican sovereign bonds, which are rated speculative grade, got up to a two-point boost as their spreads narrowed, indicating the investments are perceived to be more secure.

Providing an essential view

No matter who you speak to about sovereign ratings, two things become clear.

The dance between the agencies and the markets is a complex one. Sovereign risk assessment is a "dynamic process," S&P's Beers said, especially given the fact that the majority of sovereigns rated in the past six or seven years have been classified as speculative grade.

And most agree ratings provide an objective view of a country's creditworthiness, albeit one that should be used together with other research when making investment decisions.

"Gathering information is the most important thing" investors can do in a marketplace overwhelmed by it, Sanz said. But, he added, "It's important to know where that information is coming from."

|

|

|

|

|

|

|