NEW YORK (CNNfn) - In the 1950s, it was bowling centers. In the 1980s, biotechs. Now the investing brat pack is chasing Internet IPOs, and technology manager Paul Wick is shaking his head.

It isn't that Wick hasn't been at the cutting edge of investing. It's just that the veteran manager is doing it differently than most.

"People get swept up in manias," said Wick, 36, manager of the well-regarded Seligman Communications & Information Fund and the Seligman Henderson Global Technology Fund.

Wick has been at the helm of the communications fund for 10 years, watching the meteoric rise of Microsoft, a top holding, as well as the unraveling of semiconductors, which bruised his returns in the mid-1990s. Along the way, he's generated 10-year annualized returns of 25 percent.

And while he's sat out most of the Internet "mania," Wick is slipping into the sector with a new type of closed-end fund, the Seligman New Technologies Fund, which invests in online ventures before they go public.

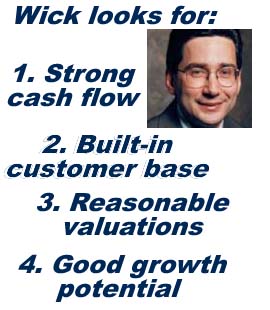

He looks for companies with reasonable valuations that generate "boatloads" of cash, have a built-in customer base, and promising growth opportunities.

He also doesn't like to see a lot of competitors. "It's like having the wind at your back," Wick said.

A golf and tennis buff who is getting married in the fall, Wick grew up in upstate New York. He received his undergraduate and business school degrees from Duke University before joining Seligman in 1987.

The communications fund, with $4.2 billion in assets, is up 16.6 percent year to date as of July 31, according to fund-tracker Morningstar. It has a coveted five-star rating from Morningstar, putting it in the top 10 percent of its category.

The global technology fund, with $672 million in assets, is up 31.2 percent in the same time. The New Technologies Fund, which debuted in late July with a $580 million offering, is up 4.33 percent.

Wick's litmus test for tech stocks means that he loves both industry giant Microsoft (MSFT) and small names such as Cognex (CGNX), which makes a highly-specialized system with a camera that is used in manufacturing processes.

Microsoft represented 2.6 percent of the communications fund and 3.1 percent of the global technology fund as of June 30, according to Morningstar.

"Everyone knows Microsoft is the best company in America," Wick said. "Yes, it's expensive. But the earnings are always highly understated and they're generating billions and billions of dollars in free cash flow."

Cognex is a favorite because it is the world's leading maker of critical subsystems that generate automatic "repeat" customers, he said.

From software to semis

Wick is particularly optimistic about soaring mainframe software companies such as BMC Software (BMCS), Compuware (CPWR) and Computer Associates (CA). Software companies represent 24 percent of the communications fund.

"They are among the three most profitable software companies in the high tech industry," Wick said.

And semiconductors such as Applied Materials (AMAT), Novellus Systems (NVLS) and Teradyne (TER) are beating earnings estimates. Semiconductors and semiconductor capital equipment companies each represent about 10 percent of the communications fund.

"The chip industry is on fire now," Wick said. "It looks pretty apparent we're in the early stages of an upturn in the entire semiconductor industry."

But he won't be increasing the weighting any time soon, in part because the communications fund got burned in late 1995 and early 1996 when semiconductors had their first major downturn.

"That's one of the reasons we are now a little less aggressive in terms of running with enormous weightings in any sector," Wick said.

The communications fund was ranked in the top one percent of its category in 1993 and 1994, but fell to the 54th percentile in 1995 and the 72nd percentile in 1996.

Internet-shy

Why did he fall from the top of the performance charts? Part of the reason is he has steered away from most Internet stocks. Wick can't justify the steep valuations. He said he hasn't changed -- it is the market that has grown more speculative.

"Instead of generating cash, they're burning cash," Wick said about the sector. "We are not jumping into Internet stocks at these valuations. I think the Internet sector is going to continue to sink."

Wick predicts that venture capitalists and other insiders who own stocks in Internet companies will be dumping their shares in the next six months.

He pointed out that theglobe.com (TGLO) debuted at 10, shot up to 90, and is now trading around 10.

"You'll see a lot of stocks take it on the chin," Wick said. "It's happening to dozens of Internet companies."

But one of his favorite stocks in both the communications fund and the global technology fund is Check Point Software Technologies (CHKP), an Internet name earning big profits. The company is the world's largest maker of "firewall" protection software.

Wick thinks private Internet companies look a lot more attractive because valuations are so much more reasonable. The idea of the New Technologies Fund was to let investors get in on explosive Internet stocks while there is still good money to be made. He first started investing in private companies in the communications fund about two years ago.

The fund is like a hybrid between a traditional open-end fund and a closed-end fund. (A closed-end fund has a finite number of shares and trades like a stock, at a premium or a discount of its net asset value, on the New York Stock Exchange).

The new technologies fund doesn't trade on the Big Board and does quarterly share repurchases.

Scott Cooley, an analyst at Morningstar, said Wick has a good long-term record, but his unwillingness to pay for the riskiest stocks has held him back a bit in recent years.

"We used to think he was a risk-taker when he made a sizable bet on chip stocks, but now there are way riskier funds, like Internet funds," Cooley said.

Cooley said the communications fund may be a good bet for people who don't want to "go out on a limb."

"I'd rather put my money with somebody like that (Wick), who has been around a while through ups and downs," Cooley said. Wick also has a strong staff working with him to dig up the best values, Cooley said.

Howard Baron, a certified financial planner at Lincoln Financial in Hollywood, Fla., said the funds have an "impeccable" reputation.

"They have a good name," Baron said. "If I sold no-load funds, I would use them. They are highly rated."

Scott Kahan, president of Financial Asset Management Corp. in New York, said the communications fund is a highly-rated fund that has lagged its peers in recent years. But investors don't have to worry, because it should outperform peers when the market broadens out or turns bearish.

"Many peers are holding the same handful of stocks," Kahan said. "He's sticking to his beliefs. He's not buying what everyone else is buying."

Wick's ability to withstand an Internet-absorbed market doesn't stop him from laughing at the thought he is considered conservative these days.

"It shows you the extent to which other people have gone overboard and have rationalized what they're doing in terms of investing in nosebleed valuation IPOs that are highly speculative," Wick said.

While he's optimistic about technology, Wick said he'll remain cautious about the big Internet names. He's content to dabble at the edges of the sector through the new technologies fund.

Online giants such as Amazon.com (AMZN), eBay (EBAY) and America Online (AOL) may do reasonably well, he said. The question is whether they will "grow into their valuations."

"They are trading at 50 to 100 times next year's revenues, and there haven't been too many instances in market history where you've had that kind of phenomenon."

Time will tell.

|