|

Viacom tunes in to CBS

|

|

September 7, 1999: 5:41 p.m. ET

All-stock merger, valued at $35.6B, is media industry's biggest to date

By Staff Writers M. Corey Goldman & Tom Johnson

|

NEW YORK (CNNfn) - Viacom Inc. and CBS Corp. announced a blockbuster $35.6 billion merger Tuesday, a move which is designed to bring the network of Dan Rather in touch with the MTV generation.

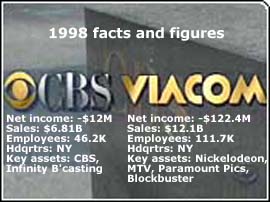

The all-stock deal, the largest media marriage in U.S. history, combines the broadcasting might of CBS with the cable and movie-producing power of Viacom, whose properties include Paramount studios, the children's network Nickelodeon, MTV and VH1.

Viacom, the name of the combined company, will be the second-biggest media concern behind CNNfn parent Time Warner Inc. (TWX), and among the leading producers of entertainment, news, sports and music.

For CBS, the deal allows the "Tiffany network" to reach out to a younger generation of viewers, something that has vexed CBS for years.

"This is a fantastic fit that will more than likely prove to be a lucrative arrangement long term," said Vinton Vickers, a media analyst at ING Barings in New York. "It will also undoubtedly open the door to other arrangements in the industry."

Viacom, currently the fourth-biggest entertainment company, will swap 1.085 of its Class B shares for each share of CBS, or $48.89 a share, very close to CBS's closing stock price Friday of 48-15/16. Viacom's Class B shares ended the day Friday at 45-1/16.

The agreement began the day Tuesday with a price tag of nearly $35 billion, plus $1.4 billion in assumed debt. However, by the end of the day Tuesday, the value of the deal topped $35.6 billion as shareholders greeted the deal enthusiastically. CBS's (CBS) stock surged 1-3/4 to 50-11/16 while shares of Viacom (VIA.B) rose 1-1/78 to 46-15/16.

Both companies' shares were on the rise all last week on speculation of some kind of merger announcement.

Media mega-merger

Viacom will be headed by Viacom Chairman Sumner Redstone, with 56-year-old CBS President Mel Karmazin as president. Assuming he remains with the company, Karmazin will be next to succeed Redstone when he retires -- solving a nagging problem for the 76-year old media mogul: the lack of an obvious heir apparent.

At a news conference in New York Tuesday, Redstone practically gushed over Karmazin's qualifications while chiding his new lieutenant for "seducing" him into the deal. At the same time, however, Redstone also hinted his journey into retirement may not be as close as it appears.

"Without Mel Karmazain, this deal would not have happened," Redstone said. "I insisted that Mel come along with the deal. The guy is brilliant.

"That being said, I'm still feeling pretty good, I like what I'm doing and I have a lot left to do with Viacom."

Karmazin is highly-regarded in the industry for being a shrewd business man who runs an efficient network. Since assuming control of CBS earlier this year, the company's stock price has tripled while the network went on to earn a number one ranking last season when measured by total viewers and households.

Karmazin said he had no operational changes slated for the new entity. Instead, he indicated he hoped to fuel the company's growth through further investments, rather than cutting costs.

Click on the graphic for an in-depth look at the largest media deals of all-time.

Tuesday's agreement, which the companies said had an "enterprise value" of $80 billion -- a figure that includes the market capitalization and outstanding debt of both companies - is the largest in dollar terms between two media companies, far outstripping the $18.28 billion that Disney (DIS) paid in 1995 for Capital Cities/ABC in the last major media merger.

Even so, the Viacom-CBS deal could get usurped by other marriages going forward, analysts said.

The Federal Communications Commission last month altered the rules to allow one company to own more than one television station in a single market without counting against the national coverage cap. That raised speculation almost immediately that media companies would begin courting one another.

Talks escalated quickly

Indeed, Karmazin said it was exactly that rule change that led him into courtship discussions with Redstone less than two weeks ago. Initially those discussions focused on purchasing some of Viacom's fledging UPN network stations, but quickly escalated into an outright union.

Now, Redstone and Sumner face an intriguing battle with regulators in Washington. Once complete, the merger will result in Viacom boasting national coverage of 41 percent of the country. Federal laws dictate that no broadcast company exceed 35 percent.

Karmazin said Tuesday he hoped to coax regulators into altering those rules, calling them "no longer relevant" in the world of broadband cable and the Internet. Karmazin and Redstone will travel to Washington Wednesday to make their case to FCC commissioners. However, if regulators persist, Viacom may be forced to divest of all or part of the struggling network.

The CBS/Viacom union will produce the nation's second-largest media company behind Time Warner

Regardless, the combined company will be a leader in the cable industry, one of the largest film and TV sitcom producers and one of the biggest radio and outdoor advertising companies through the ownership of Infinity Broadcasting Corp., Vickers said. "Late Night with David Letterman," "Everybody Loves Raymond" and "JAG" are among the shows on CBS's fall roster.

Analysts see the marriage as an opportunity for CBS to broaden its scope to a more youthful audience, something it has been reproached for losing out on in the past. CBS Television President Leslie Moonves said he envisioned several cross-promotional opportunities for Viacom's more youth-oriented channels, such as MTV and VH-1, and CBS's traditional broadcast network.

And all the things CBS has - brand name recognition, its billboard business, a huge radio and Internet presence -- will fit well with what Viacom has -- television markets that CBS doesn't currently have access to, a Hollywood film and television studio, the home and movie theater market, and theme parks.

A powerful combination

"I think it's an extremely powerful combination," said Jessica Reif-Cohen, media analyst at Merrill Lynch. "They each have very complementary businesses and they will collectively produce very significant cost savings," she said, adding that she sees the newly formed company posting an impressive 15 percent growth rate during the next two years.

Tommy Pickles, one of the characters in the popular Rugrats children's show, and Dan Rather, host of the CBS Evening News, will be working for the same boss

Viacom also has performed well, posting strong earnings and boosting its balance sheet with the recent public offering of Blockbuster Inc. (BBI). The Dallas-based chain last month priced 31 million shares at $15 each, putting an extra $465 million on parent Viacom's books. Viacom retained more than 80 percent of Blockbuster following the offering.

"With Viacom and CBS performing at the top of their games, the timing for this could not be better," Redstone said. "We both saw that we could create a media giant and that's what we both set out to do."

Viacom currently owns 19 television stations. CBS will own 16 after a few outstanding acquisitions are completed. Viacom also owns 50 percent of the struggling UPN network, of which Chris-Craft Industries Inc. owns the rest.

The Viacom-CBS marriage is a reunion in some respects. The FCC in 1970 forced CBS to spin off the company that became Viacom as a separate program syndication unit, after the commission ruled that television networks couldn't own a financial stake in the shows they broadcast and couldn't directly sell syndicated re-runs of those shows to local television markets.

|

|

|

|

|

|

Viacom

CBS

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|