|

Timing your 401(k) dollars

|

|

September 9, 1999: 7:12 a.m. ET

Reaching the $10K limit too early in the year can rob you of employer benefits

By Staff Writer Shelly K. Schwartz

|

NEW YORK (CNNfn) - As a 401(k) plan participant, you're probably already aware that Uncle Sam puts a ceiling on how much you can contribute each year on a tax deferred basis.

Currently, that limit is $10,000.

What you may not realize, however, is that when you hit that limit can -- in some cases -- make a big difference in how much you ultimately take home in employer matching benefits.

"Don't early max your 401(k) plan," warns Tom Grzymala, a certified financial planner and president of Alexandria Financial Associates. "You want to spread your contributions evenly over the course of the year."

The bottom line

That's because some - though, not all -- employer-sponsored plans that offer matching benefits on a concurrent basis (alongside your own monthly contributions) stop contributing for the year once you hit the $10,000 IRS limit.

Put more simply, if the percentage of your eligible income going into a 401(k) plan is too high, you could hit the limit in the middle of the year. You'd be foregoing the employer match benefits for the remaining months of the year.

Consider this example:

Say your eligible annual salary is $125,000. If you contribute 15 percent to your retirement plan, you will have reached the $10,000 mark by July. That means your employer match will come to a halt and you would ultimately receive about $3,300 in matched contributions at the end of the day.

That example is based on an employer-sponsored plan that matches 100 percent of contributions up to 5 percent of your salary.

Had you lowered your contribution rate to 8 percent of your annual salary instead, you would have been able to enjoy fatter paychecks throughout the year and you would have spread that $10,000 contribution out more evenly during the course of the year. You'd reach the IRS limit at the end of December.

And since your employer continued matching your contributions throughout the year, you'd be looking at roughly $6,300 in employer matched benefits instead. That's a $3,000 difference.

"We have clients who do that," said John F. Merwin, an administrator with The Pension Specialists Ltd. In Rockford, Ill., a third party 401(k) plan administrator and consulting firm. "As soon as someone stops deferring (or reaches the $10,000 limit), they also stop the matching contributions."

Merwin added there are hundreds of different types of 401(k) plan procedures out there. Employers can draw them up virtually any way they see fit.

That means it's up to you to find out how your company's matching contributions are distributed.

Do the math

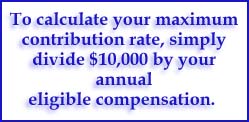

To avoid the dangers of what some industry insiders call "front-loading" your 401(k), the wisest thing to do is to calculate your maximum contribution rate.

Simply divide $10,000 by your annual eligible compensation. Round down to the nearest whole percentage if it doesn't automatically calculate to one. Now you know what percentage of your income you can safely contribute each paycheck.

Keep in mind that if your salary is greater than $160,000 a year, all this is a moot point. The IRS won't allow 401(k) contributions to be withheld on compensation that exceeds that amount.

The equalizer

Grzymala said there is one other benefit you'll likely forego if you hit the $10,000 limit -- and stop contributing -- before the end of the year.

"If you put all of your money in during the first six months of the year you are not getting the benefit of dollar cost averaging," he said.

That means you lose the ability to diversify your risk by regular, equal dollar investments in the stock market.

The benefit of employer matching programs, particularly those that contribute throughout the year, is that the money invested is exposed to investment growth throughout the year -- along with your own contributions.

Moreover, he said, by spreading your contributions out more evenly, he said, you also get the benefit of dollar cost averaging -- that's the diversification benefit you gain from putting the same amount of money into your plan periodically throughout the year.

If you do feel it necessary to saturate your 401(k) plan early on and hit the tax deferred limit prematurely, Grzymala said the best advice at that point is to take the money you had been investing and diversify on your own.

"My advice is you should start saving in taxable accounts outside your 401(k) plans," he said. "You can balance out your large-cap 401(k) plan and put your money into whatever your heart desires."

Since most 401(k) plans are invested in large-cap mutual funds and some fixed-income securities, such as bonds, you may want to consider buying into small- or mid-cap stocks, or even international funds to more evenly spread your risk.

Such diversity, Grzymala noted, helps eliminate so-called "unsystematic risk" from your portfolio. This category of risk comes into play when valuations in certain sectors of the market begin to swing for reasons unrelated to interest rate changes or other blips on the regulatory radar screen.

Here's how it works:

To be sure, the danger of top-heavy investing in your 401(k) plan does not apply to everyone.

For starters, many plans still distribute their match on a year-end basis. In other words, they wait to see how much you've put in for the year -- and to make sure you don't quit your job -- before kicking in their fair share.

For plans like that, when you hit the $10,000 is neither here nor there.

Moreover, many of us never get to that IRS limit in the first place -- making the issue of "front-loading" a moot point.

Indeed, the Employee Benefit Research Institute in Washington reports that only 8 percent of 401(k) participants in 1997 contributed the full tax deferrable amount. At the time, the IRS limit was $9,500.

And lastly, some plans either agree to continue contributions after an employee reaches their own contribution limit, or they restrict the percentage of their salary that employees contribute to 15 percent -- which again makes "front-loading" a non-issue for all but the highest paid employees.

"This isn't a problem for many people today since a lot of people contribute 15 percent of their salary and it's not quite there (at the $10,000 mark)," said Terry Balding, a CFP and 401(k) specialist in Sun Prairie, Wis. "But it may become a bigger problem very soon, as incomes continue going up."

Just to be safe, if you are saving up to $10,000 a year in your 401(k) plan and you haven't been spreading your contributions out during the year, experts say it can't hurt to double check with your benefits department to find out whether your ambitious savings plan is doing more harm than good.

And, at the very least, Grzymala said you should be contributing as much as your employer is willing to match.

"Some employers restrict their matching to 2 percent of your salary, but please, please put in at least as much as they are willing to match," he said. "Otherwise you are leaving money on the table. That's an automatic return on your money and you don't have to do anything."

|

|

|

|

|

|

|