|

ECNs agree to link

|

|

September 15, 1999: 9:55 p.m. ET

Electronic communications networks to consolidate quotes, trades

By Staff Writer Alex Frew McMillan

|

NEW YORK (CNNfn) - Seven electronic communications networks, or ECNs, and an after-hours trading platform are linking up to form a trading network, ECN executives confirmed Wednesday night. They expect to formalize their announcement Thursday morning.

Archipelago, Bloomberg Tradebook, Brut, Instinet, Island, REDI-Book and Strike have signed a "nonbinding memorandum of intent" to increase access to information such as quotes and trades after hours. MarketXT, which is an after-hours-only alternative trading system that operates like an ECN, has also signed the agreement.

The announcement, which has been pending for some weeks, is not a formal business contract or merger. One ECN insider characterized the agreement as a statement of principals, an affirmation of "mom and apple pie." But it is the first step toward the consolidation many observers expect in the industry.

Bloomberg Tradebook CEO Kevin Foley confirmed the agreement is aimed at guaranteeing ECN customers "get the best offers regardless of what ECN they're on."

Brut, Bloomberg and Strike plan to offer trading to 6:30 p.m. as of Oct. 1. For a breakdown of the owners of the ECNs, click here.

The statement says that "the participants believe in and recognize the critical importance of transparency to a fair and efficient market." The ECNs, some of which already link to each other, will step up their efforts to make sure they are all interconnected.

They agree that centralized data processing and linking "will foster efficiency." The statement also stresses cooperation to "facilitate best execution of customer orders" and in working with the Securities and Exchange Commission.

As part of the agreement, the ECNs will pool information on quotes and trades, to provide a consolidated book of stock orders and executions. A customer using Island, for instance, will see the best bid and ask prices placed on the other participants. To date, ECNs kept separate order books in after-hours trading.

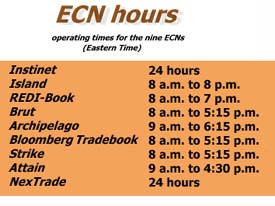

During the regular trading day the ECNs are linked via Nasdaq's SelectNet system. As of Oct. 1, SelectNet will extend its hours until 6:30 p.m. ET. But some ECNs already have longer hours.

"The key here is connectivity," one ECN executive said. "Everybody is going to see everyone else's books."

ECNs are electronic quasi-exchanges that let buyers or sellers of stock meet without middlemen such as Nasdaq market makers. Their customers, broker-dealer companies, including retail brokerages, and institutions such as hedge funds and pension funds, also benefit from cheap trade execution. The ECNs have little overhead, relying on computers to match trades, and have relatively few employees.

There are nine ECNs. The two-smallest, Attain, an ECN owned by All-Tech Investment Group, and NexTrade, are not part of the agreement. Officials at Attain, which mainly serves as a platform for day traders at All-Tech, and NexTrade, based in Clearwater, Fla., were not available for comment Wednesday night.

Still unresolved is the issue of whether the ECNs will cooperate to route trades to each other if they aren't executed within a particular ECN. Instinet and Island only execute trades they can match internally. Other ECNs such as Archipelago and Bloomberg Tradebook farm out trades they aren't able to match in-house. Island has stated that it doesn't want to open its trading to other ECNs, though it will share information. It already publishes its book of trades on the Web.

With electronic communications networks adding new owners almost daily and extending their hours, the nine ECNs are tough to keep track of. On Wednesday, Island, the second-largest ECN, started operating from 8 a.m. to 8 p.m. ET. Island, which is based in New York City, shares a parent company with the online brokerage Datek Online. The brokerage began allowing retail investors to trade during the same time.

The same day, financial-television news network CNBC joined a long line of high-profile investors in Archipelago, a Chicago-based ECN. Its owners now include E*Trade, J.P. Morgan, Goldman Sachs and the biggest ECN, Instinet, which like Bloomberg Tradebook focuses on Wall Street and institutional customers rather than retail brokerages.

The list of owners in the different ECNs has become complicated, as Wall Street companies cover their bases, faced with an uncertain trading future. Both Island and Archipelago have filed with the Securities and Exchange Commission to operate as exchanges. Exchange status would allow them to list their own stocks and would give them access to New York Stock Exchange trading.

Nearly all ECN trading is of stocks that are listed on Nasdaq, where ECNs now account for around 30 percent of the volume. The ECN trades operate through Nasdaq, but ECNs that break off as for-profit exchanges would compete head to head with the main markets.

NexTrade has been overhauling its exchange filing privately with the SEC since it first submitted it in March. It expects to formalize its public filing, known as an S-1, within the next two months.

|

|

|

|

|

|

|