|

More responsible shopping

|

|

November 30, 1999: 7:06 a.m. ET

Consumers are using their plastic more -- but using it smartly, a study shows

By Staff Writer Alex Frew McMillan

|

NEW YORK (CNNfn) - Americans are using their plastic more, but also using it more responsibly, according to a company that tracks credit card spending.

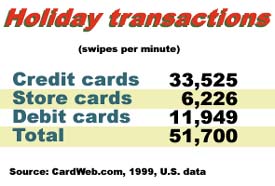

U.S. consumers will swipe $126.5 billion on charge cards over the holidays, CardWeb.com predicts, up 14 percent over last year. That means they'll use their cards more than 1.6 billion times, spending $156 million every hour in the 29 days between Thanksgiving and Christmas.

But shoppers seem to be savvier, according to Robert McKinley, CardWeb.com's CEO. "There seems to be a more responsible use of credit," he said, noting that average debt levels are growing at just 3 percent. That's well below the double-digit growth rates in debt that consumers ran up in 1995 and 1996.

"There seems to be a more chastened consumer here. They don't mind using their cards. They just don't like paying interest -- that seems to be out," McKinley said.

With credit card interest rates hovering around 18 percent -- and increasing after the Fed's recent decision to raise rates for a third time this year -- carrying a balance on your credit card is far from ideal. "It's a very expensive way to borrow money," McKinley said.

American consumers finally seem to have wised up to that fact. Consumers will put more than $100 billion on credit cards during the December billing period. But they will have paid off $80 billion of that by January, CardWeb.com predicts.

Average balances are still hefty, though. The average household that uses plastic carries a balance of almost $5,850 in credit-card debt, with around $1,180 owed on store cards on top of that. In other words, the average household using credit cards owes a little more than $7,000 in all. In the United States, 78 million households -- or 76 percent -- have some kind of plastic.

But more people are paying off their balances, particularly aging Baby Boomers. People who do carry a balance pay off 16 percent of their total debt each month, according to McKinley. In other words, on a $1,000 balance, the average American pays down $160 when his or her next bill is due.

There's no sign that U.S. consumers are worried about their spending levels, even though consumer spending is rising at its most rapid rate since August. Consumers "are armed and dangerous," said Gary Shoesmith, director of the Center for Economic Studies at Wake Forest University.

He has noticed that consumers are increasing their spending at a faster clip than their income is increasing. In fact, the growth in real consumer expenditures has outgrown the growth in real disposable income by roughly 2 percent the past three quarters, he said.

That means shoppers must be making use of new-found wealth on top of new wage income, converting stock market gains for spending on big-ticket items, he suggests.

It makes sense to go on a spending spree from one perspective, according to Shoesmith. Wage inflation is running much faster than price inflation, meaning you're more likely to have money in the future from your job to pay off goods you buy now.

But Shoesmith agrees that the large increases in consumers' debt levels seen in the mid-'90s have subsided. Though they're still using credit, "consumers are looking at their wealth situation and spending more," he said.

That's not really a problem from an economic point of view until the United States hits a recession. Debt levels don't create a recession, they just make one worse once it arrives and consumers stop spending. "They start retiring debt during the course of a recession, and that makes the recession longer." The implication: start retiring debt now when times are good.

Despite the decreased emphasis on debt, "we're going to see a bumper Christmas," Shoesmith said. "Consumers are going to pull out the stops." Consumer durables like furniture and computers have been roaring this year, averaging more than 12 percent jumps the past four quarters, on an annualized basis.

As shoppers stock pile money to ward off any Y2K concerns, he thinks consumers may extend their shopping spree into early next year. Rather than putting any cash they take out of the bank back in their accounts, they're likely to blow it early in the New Year.

A CNNfn Web site poll seems to support his idea that this will be a bumper Christmas. More than 42 percent of respondents said they expected to spend more than they had in the past during this Christmas season. And 50 percent of shoppers anticipate doing their shopping late in the season, closer to Christmas and Kwanzaa.

Despite the increased spending, American consumers are showing more sensible shopping habits. Another sign that consumers are learning how to use plastic more sensibly is the increased popularity of debit cards, McKinley noted. While credit cards still account for the bulk of charge activity, debit card usage is growing much faster. Over last year, debit card usage is up 43 percent.

Customers have shown they like the convenience of plastic but many are put off by the so-called "nuisance fees" involved with credit cards -- annual fees, late fees, over-limit fees and the like. "They're able to go to debit cards and do the same thing," but without those extra costs, McKinley pointed out.

Much has been made of the growing popularity of shopping via the Internet this year. Since 90 percent of the transactions that use the Web involve some kind of payment card, plastic is expected to be a prime beneficiary of the Web boom. Just under 57 percent of respondents to the CNNfn poll said they planned to buy more online this year than in the past.

"This is one Christmas where you can truly plasticize everything," McKinley noted. Consumers are using charge cards to pay for smaller and smaller items. He expects that trend to continue with prepaid cards for smaller items.

"We'll get to the point very soon where if you want to buy a newspaper you just put a smart card into a machine there on the street," McKinley said.

Just over 20 million households are "unbanked," but even those people are starting to convert to using plastic. Pilot programs are rolling out around the country that let employees use an ATM card to tap into an account at their employer's bank and pull out their paycheck, even if the employee doesn't have an account there.

"The cashless society, that whole idea, is really here now," McKinley said.

|

|

|

|

|

|

|