|

AMR sets Sabre spin-off

|

|

December 14, 1999: 12:45 p.m. ET

Split of reservation system from American Airlines parent to exceed $6B

By Staff Writer Chris Isidore

|

NEW YORK (CNNfn) - AMR Corp., owner of American Airlines, is selling its majority stake in Sabre Inc., the world's largest travel reservation system, which the company once bragged was a key to its business.

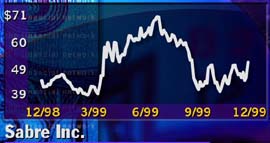

The spin-off, worth more than $6 billion based on the Monday closing price of Sabre's stock, has been expected and is part of a trend of major carriers selling their holdings in computer reservation systems, or CRS. The trend started when AMR put up about 18 percent of Sabre (TSG) through an initial public offering in October 1996.

AMR shareholders are to get 0.7 shares of Sabre for each AMR share they now own. Sabre shareholders, including AMR, will get a one-time dividend of $5.21 per share from Sabre, for a total of $675 million, as part of the deal. Sabre will borrow much of the money needed for the dividend.

More IT work possible for Sabre

Analysts who follow AMR and those who follow Sabre both said Tuesday the deal is a good thing for their respective companies. Both stocks were trading up strongly Tuesday.

The CRS analysts believe the company was being hurt in performing information technology outsourcing work for other airlines as long as it was owned by AMR. Outsourcing IT already provides almost 40 percent of Sabre's revenue, but about 80 percent of that work is done for American. Analysts also believe that the stock was not being fully appreciated by investors with most of the shares held by AMR.

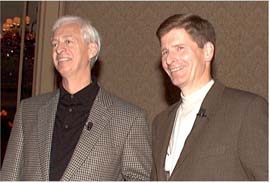

Photo source: AMR Corp.

Donald Carty, chairman of AMR Corp., and William Hannigan, the new Sabre chief executive, announce the spin-off of Sabre from AMR Tuesday in a deal worth about $6.3 billion.

"This is fabulous for Sabre," said Jim Marks, analyst at Credit Suisse First Boston. "They are the most qualified by far for outsourcing, but we always believed the AMR ownership stopped big U.S. airlines from using them."

Donald Carty, the chairman of AMR, and officials from Sabre also echoed this belief during a telephone press conference Tuesday.

"I think it's fair to say one of factor influencing the timing of this action is many, many airlines are looking at outsourcing of technology capability," Carty said. "Some of them don't object to American's ownership, especially those that are our partners. On the other hand, an awful lot of the potential customers would rather not have their information systems housed in a competitor."

Sabre also will get the right to sell previously restricted software to other airlines as part of the deal.

Will sale let airlines cut CRS fees?

But some airline analysts also liked the idea, and the stock of AMR (AMR) opened higher Tuesday after the announcement. The fees that airlines pay to CRS companies have been regularly rising at about 5 percent annually. While carriers have been able to cut commissions paid to travel agents in recent months, they've haven't been able to do anything with the CRS. Some airline analysts hope the spin-off will let them try to do so.

"With the decreased ownership interest, American and others will be more vigorous in trying to control distribution costs going to the CRS," said Sam Buttrick, analyst at PaineWebber.

Carty and Sabre officials would not discuss the future of CRS pricing, but they admitted that the trend by airlines to try to sell directly to the customers via the Internet rather than through the conventional CRS-travel agent system is reducing the cost of distribution for the carriers.

"Obviously the move away from traditional distribution will drive our costs way down, that's far more important than what CRS fees we pay," Carty said.

But Marks said he doesn't think that the airlines will have the leverage to cut CRS fees they way they do with the travel agents. That, along with regulation in some cases, is why all the major carriers other than Southwest Airlines use all the major CRS companies, he said.

If an airline refused a CRS rate hike, the service would drop the carrier, its travel agents would not be able to book flights on the airline and that would severely cut bookings. Agents still handle between 80 to 90 percent of reservations.

"There is no way any airline can goof around with that much of their market share," he said.

Uncertain future for CRS

Buttrick agrees that CRS revenue generally has been more consistent than the cyclical results from air travel, providing some help for AMR and other carriers in down times. But he believes that Internet booking and other changes in the industry make the CRS companies a riskier investment.

"Sabre is clearly very good at what it does. It has a dominant franchise position," Buttrick said. "But I think the simple question for investors to ask if the owners and the primary customers of the CRS firms are selling, what's the argument for buying?"

Besides the sale of Sabre, UAL Corp. (UAL), owner of the leading carrier United Airlines, announced in April it was cutting its stake in the Sabre competitor Galileo International Inc. (GLC) to 15 percent from 32 percent. Air France, Iberia, Lufthansa and Continental Airlines (CAL) started Amadeus Global Travel Distribution, but Continental sold its stake to the public as well. The next CRS spin-off expected by the industry is Worldspan LP, a joint venture owned by Delta Air Lines (DAL), Northwest Airlines (NWAC) and Trans World Airlines (TWA).

The move away from airline ownership of the CRS might lead to some mergers within the CRS industry, Carty said, although he said that is not the plan or reason for the spin-off.

"It is conceivable that some of the weaker CRS companies might look to combine," Carty said. "But because of its strength, there's no need for Sabre to rush around and look other CRS companies to acquire."

New boss, product for Sabre

AMR also announced that it hired William Hannigan, the president of SBC Communications Inc.’s (SBC) unit SBC Global Markets, as chief executive of the newly independent company. Hannigan succeeds Michael Durham, who resigned in September.

Sabre has been positioning itself for the shift in airline ticket sales and reservations through the Internet. It provides the back-office support for some of the online reservation services. It also owns one of the largest Internet travel sites, Travelocity.com, which is merging with Preview Travel Inc. (PTVL), in a deal expected to close early next year. Sabre will own 70 percent of the combined company, while Preview Travel shareholders will own the other 30 percent. And those two companies announced a marketing alliance with Priceline.com Inc. (PCLN).

Carty praised Sabre's strength in Internet sales, and said that the spin-off will let Sabre concentrate on developing its web sites while American concentrates on selling direct to customers at its own site.

AMR's stock was up 3-31/32, or 6 percent, to 67-5/8 in midday trading Tuesday. Sabre's stock was up 1-7/8, or 4 percent, to 53-3/4.

|

|

|

|

|

|

|