|

Home insurance for less

|

|

January 10, 2000: 6:35 a.m. ET

Shopping around, higher deductibles can save you money

By Staff Writer Nicole Jacoby

|

NEW YORK (CNNfn) - You can’t own a home without it, but that doesn’t mean you should pay through the nose for a good homeowners policy.

Although the home insurance market has stabilized somewhat in recent years, prices still vary dramatically in certain parts of the country.

"You can pay as much as 100 percent higher than the lowest priced company and paying 50 percent more is not uncommon,” said Bob Hunter, director of insurance for the Consumer Federation of America.

Unfortunately, many consumers fail to shop around and end up shelling out high premiums for average coverage. In fact, says Hunter, there is little correlation between price and service.

"Paying less doesn’t mean less coverage. Some of the companies with the best service records have the lowest prices,” said Hunter.

Comparison shopping

Your state insurance department should be your first stop when shopping for a new homeowners policy. These agencies -- most of which have Web sites and toll-free numbers -- are an excellent source of information regarding available policies and premiums in your state.

In many cases, they have already done your homework for you, comparing the cost and performance of a variety of insurers. You will also be able to check whether complaints have been filed against a given company.

You may also want to take a look at companies, such as Amica and USAA, that don’t use insurance agents, since you may save yourself the cost of commission.

Once you have narrowed your choices down to about three companies, you will want to compare the discounts offered by each. A good insurance agent will ask you a series of questions to see whether you qualify for certain rebates, but you should always inquire whether they have gone through the entire list of available discounts.

Some companies that sell homeowners, auto and liability coverage will take 5 to 15 percent off your premium if you buy two or more policies from them.

Discounts also may include lower premiums for non-smokers, who have a reduced risk of causing fires in the home, and individuals with favorable credit ratings. Senior citizens often qualify for lower rates as well, since they tend to spend more time maintaining their homes and are more likely than working people to spot fires or other potential dangers.

Be careful of getting blinded by discounts, however.

"The bottom line is the most important,” said Hunter. "A lot of times companies that offer the most discounts start with the highest prices.” In other words, one policy may be $700 after multiple discounts, while another may be $300 without any.

Raising your deductible

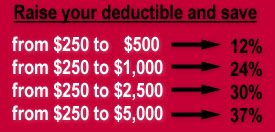

One of the most effective ways of lowering your insurance costs is by raising your deductible.

Deductibles are the amount of money you pay toward a loss before your insurance coverage kicks in. Deductibles on homeowners’ policies typically start at $250.

Increasing your deductible from $250 to $500 alone could lower your premiums by more than 10 percent. Raising it to $1,000 could cut payments by up to 24 percent and boosting it to $2,500 could save you 30 percent. A deductible of $5,000 may yield as much as 37 percent savings.

Just remember that higher deductibles may require bigger cash outlays in the event of damage or theft.

"It really depends on how much money you can stand to pay out of pocket,” said Madelyn Flannagan, spokeswoman for the Independent Agents of America. "If you have a lot of little claims, you are going to have to pay those yourself.”

Having said that, if you set aside the money you are saving by raising your deductible, you should have enough to cover small emergencies, plus you’ll be earning interest on that amount.

"Generally speaking, if you are an average risk owner, you will do much better with a higher deductible,” said Hunter.

When buying a new home

The type of home and its location will be the biggest factor in determining how much you pay for insurance.

If you are in the market for a new home, you may want to consider properties that cost less to insure.

Houses made of brick, for instance, are universally less expensive to insure than those with frame construction.

The electrical, heating and plumbing systems will also come into play. Houses with newer systems may cost as much as 8 to 15 percent less to insure than those with older systems.

Finally, the closer your home is to a full-time fire service, the lower your insurance payments are likely to be.

Other considerations

Making improvements on your existing home can also lower your insurance costs. And in some cases, the money saved through lower premiums will make up for the cost of repairs or improvements.

"People tend to get a lot of discounts for improvements. If your wiring is over 20 years old or the roof needs to be replaced, the cost savings in insurance might pay for those repairs,” said Flannagan.

Beefing up home security can be among one of the best ways to lower premiums. Items as simple as burglar alarms, smoke detectors and dead-bolt locks can reduce costs by at least 5 percent. Reductions of 15 to 20 percent may be possible if you install sophisticated sprinkler systems and fire or burglar alarms that ring at safety monitoring facilities.

But not all systems qualify for discounts, and they can be expensive, so find out which type of system your insurer recommends. You should also compare how much the device would cost to how much you’ll save in premiums over time.

Keep policies up to date

Whether your home is new or old, you should reassess its value about once a year to make sure your coverage is up to date.

You may be overpaying for coverage if some once valuable have depreciated. That 5-year-old fur coat, for instance, may no longer be worth the $20,000 you paid for it.

On the flip side, you may have purchased new electronics, constructed an addition or made other repairs that have improved the worth of your home.

"People tend to undervalue their homes because they don’t want to pay the premiums,” said Flannagan. "But if they don’t have enough insurance they might be penalized (when damage occurs.) You’re really better off being realistic.”

|

|

|

|

|

|

|