|

Boeing buys Hughes unit

|

|

January 13, 2000: 9:20 p.m. ET

Aerospace giant nabs GM Hughes satellite division for $3.75B in cash

By Staff Writer Jamey Keaten

|

NEW YORK (CNNfn) - Expanding into the commercial satellite business, Boeing Co. on Thursday announced it would purchase the satellite-making unit of Hughes Electronics Corp. for $3.75 billion in cash.

Boeing, the Seattle-based leader in airplane manufacturing, said it expects the purchase to increase revenues and earnings in its space and communications unit by more than one-third and provide a platform for future growth.

"Boeing intends to be No. 1 in space," Phil Condit, Boeing's chairman and chief executive officer, said in a statement. "This acquisition is a significant step forward in executing our goal of becoming the industry leader in integrated, space-based information and communications."

Boeing said the purchase offers a strong complement to its existing satellite business, which focuses on sales to the U.S. government. "From an intellectual capital standpoint this is an extremely attractive enterprise," said Condit.

For Hughes, a leading maker of commercial satellites, the move offers an exit strategy for a segment that has trimmer profit margins than its higher-profit service businesses, such as DirecTV.

Hughes plans to plow the cash from the sale of the satellite division into DirecTV or into its broadband high-speed data services delivered via satellite. Hughes also owns a network services unit that makes boxes used to deliver DirecTV.

Hughes to take charge

Meanwhile, Hughes announced plans to narrow the focus of its wireless business, which will lead to a charge of $275 million, or 40 cents per share, in its fourth quarter.

Hughes now expects to report a loss per share of 58 cents to 60 cents in the quarter. Analysts polled by First Call Corp., an earnings tracking firm, had expected a loss of 28 cents per share.

Hughes said the move is part of plans to concentrate on broadband, or high-speed communications systems. Hughes said it will discontinue its line of cellular and narrowband, local loop communications products as a result.

"These strategic moves accelerate the transformation of Hughes into a highly focused entertainment and data information services and distribution company," Michael T. Smith, chairman and CEO of Hughes, said in a statement.

"We will now be in a stronger position to fuel the growth of our high-growth service businesses, focus more intensely on customer needs, and devote resources to the integration of new broadband and interactive services."

Hughes is a wholly owned subsidiary of General Motors. The sale to Boeing may revive speculation that General Motors (GM) will spin off the remainder of Hughes to shareholders.

The Hughes businesses sold to Boeing expect 1999 revenue of $2.3 billion, Boeing said. Boeing said its space and communications division would have annual revenue of about $10 billion after the deal is done.

The boards of the two companies have voted in favor of the sale. Boeing said the deal is expected to add to earnings in the first year of operations after the deal's closing, expected for June.

In its statement, Boeing cited industry projections that the space and communications market is set to grow from a current $40 billion a year to $120 billion annually by 2010.

Also as part of the transaction, Boeing will buy Hughes Electron Dynamics, a supplier of electronic components used in satellites, and Spectrolab, a provider of solar cells and panels for satellites.

Boeing said those three businesses have a combined workforce of about 9,000 employees, mainly in the Los Angeles area.

In an unrelated development, Boeing said late Thursday it had reached a tentative three-year contract with its No. 2 union, the 22,600-member Society of Professional Engineering Employees in Aerospace, avoiding a threatened strike.

The deal followed weeks of escalating threats by SPEEA to strike for the first time ever over Boeing's proposals to require a 10-percent employee contribution for medical coverage and cut certain benefits without guaranteed pay raises or bonuses.

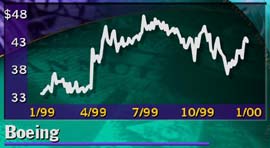

Shares of Boeing (BA), one of 30 components of the Dow Jones industrial average, fell 11/16 to 42-3/8. Shares of General Motors (GM), which is also a Dow issue, were unchanged at 76-3/8, and El Segundo, Calif.-based Hughes Electronics (GMH) jumped 7-3/16 to 114.

General Motors said it expects to realize a pre-tax gain of about $2.2 billion from the sale, Reuters reported.

|

|

|

|

|

|

|