|

Boeing beats 4Q estimates

|

|

January 19, 2000: 2:37 p.m. ET

Record aircraft sales, improved costs help it double income in '99

|

NEW YORK (CNNfn) - Boeing Co. gunned its engines over Wall Street Wednesday as the world's largest commercial jet maker reported a better-than-expected gain in fourth-quarter results.

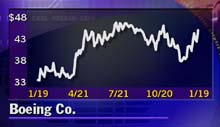

In the wake of the announcement, Boeing (BA) shares rose 1-15/16 to 46-15/16 in Wednesday afternoon trading.

The Seattle aerospace company, the nation's largest exporter, posted net income of $662 million, or 74 cents a diluted share, compared with $465 million, or 48 cents a share, a year earlier. Analysts surveyed by First Call had forecast 69 cents a share earnings in the latest quarter.

The gain came despite an 11 percent decline in revenue to $15.2 billion.

For the year, net income more than doubled to $2.3 billion, or $2.49 a diluted share, from $1.1 billion, or $1.15 a share. Revenue rose to $57.99 billion from $56.15 billion in 1998. The company's commercial jet deliveries in 1999 were a record at 620.

The company said revenue should fall to $50 billion in 2000, not including its planned purchase of the Hughes Electronics satellite unit.

But Boeing expects its operating margin to improve to 7 percent from 5.5 percent this year.

Boeing Chief Executive Phil Condit said Wednesday he sees renewed customer interest in the jumbo 747 passenger jet, and the company may boost production of the aircraft by early 2001.

Cost controls cited

Officials attributed the results to better cost controls since 1998, when production problems caused expenses such as overtime to soar.

After what it saw as a disappointing 1998, the company reorganized its business units, streamlined production and trimmed its work force by more than 30,000 workers last year. As many as 10,000 more jobs could get cut this year.

One of the keys of Boeing's turnaround was the renewed profitability of its commercial jetliners. Boeing Commercial Airplane Group's operating earnings for 1999 exceeded $2 billion compared with a loss of $266 million in 1998.

Boeing was helped by the economic rebound in Asia, where the company experienced renewed growth in orders.

"I think the key is that next year, even though Boeing will see about a 15-16 percent decline in revenue, they should still be able to show improvement in the bottom line," said Peter Jacobs, an analyst with Ragen MacKenzie in Seattle.

"We're on the downward slope of the commercial airplane cycle," Jacobs added. "But given the rebound the company has been able to make in improving production efficiencies, they should be able to offset the decline in revenue as operating profits improve going forward."

Despite its record number of deliveries, Boeing received fewer orders for planes in 1999 than European rival Airbus Industrie. Boeing booked 388 orders in 1999, compared with 417 for Airbus.

"Airbus had a splendid year in 1999 in achieving record new airplane orders, no doubt about it," Jacobs said. "At the same time, you have to remember that Boeing has an incredibly strong backlog of business -- nearly 1,500 airplanes. They should be able to the deliver the majority of new airplanes in the future."

Jacobs also said Boeing would benefit more from a rebounding Asian economy than Airbus, given Boeing's strong Asian presence.

Last week, Boeing announced its plans to acquire the space and communications arm of Hughes Electronic Corp. for $3.75 billion in cash, giving the company a complete package of rocketry and satellite services. Boeing officials said the acquisition will be reflected in second-quarter earnings.

-- from staff and wire reports

|

|

|

|

|

|

The Boeing Company

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|