NEW YORK (CNNfn) - For nearly a decade, the get-rich-quick investment community has been chasing stocks.

With tech issues turning in triple-digit gains, and the Dow Jones industrial average hovering at 11,000 - up from 5,300 in mid-1996, it's easy to see why.

But experts say this new breed of untrained, untested investor is underestimating the power of portfolio diversification, and more specifically the benefits of fixed-income securities.

"Today, the $64,000 question is: Are bond yields high enough to be competitive with stocks?" said Robert Rodriquez, a principal and chief investment officer of First Pacific Advisors in Los Angeles.

According to Rodriquez, the consensus among investors, "in terms of how people are placing their bets is an unequivocal no."

Don't be shy

Fixed-income securities, or bonds, help to pad investment portfolios, since they are normally less volatile and less risky than stocks.

The advantage of owning them is derived from the fact that they provide a steady income in the form of regularly scheduled payments. Due to their stability, however, the income they provide is often far less than equity market returns.

(Click here for the latest bond market rates)

Experts say that's part of the reason many investors shy away from bonds -- because they lack the sex appeal and high return potential found on

Wall Street.

The other part stems from intimidation.

Even educated investors get blurry-eyed when conversations turn to spreads and yields, coupons and maturation. It's a complex market made no easier to digest by the dramatic swings we've seen in fixed-income rates in the last few days. Even educated investors get blurry-eyed when conversations turn to spreads and yields, coupons and maturation. It's a complex market made no easier to digest by the dramatic swings we've seen in fixed-income rates in the last few days.

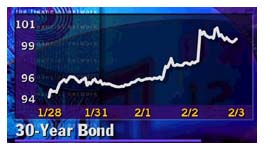

Take, for example, the Treasury Department's decision Wednesday to scale down its issuance of 30-year bonds and buy back existing long-term debt.

The move sent prices of the 30-year soaring, and yields tumbling to 6.14 from 6.28, as supplies of the endangered list security dry up. However, within 24-hours, the rally had almost completely reversed itself, with the yield back at 6.27 percent.

Go for the spread

So what does all of this mean to you?

Experts say if you were thinking of breaking into the bond market, before Treasurys got blindsided this week, your instincts were correct. You should still move forward, they say, with a minor adjustment to your strategy.

"Investors need to be focused on buying bonds for the diversification benefits to stocks," said Mario DeRose, a bond analyst for Edward Jones. "If you are worried about a stock market correction, you should have some bonds for the steady income they provide. It's true that 30-year Treasuries are coming down, because of supply and demand concerns, but there are plenty of alternatives for individual investors."

For starters, he said, investors can turn to spread products: such as corporate bonds, municipal bonds and mortgage-backed securities.

"For corporate bonds, he said, you can still get rates close to 8 percent for A-rated investment bonds and that's an attractive number," DeRose said.

Sharon Lee, a fixed-income strategist for Legg Mason, agrees.

"I'm not a real fan of individuals trying to time the market, but I think it makes sense for investors to start scaling into the bond market."

-- Sharon Lee, Legg Mason

"I'm not a real fan of individuals trying to time the market, but I think it makes sense for investors to start scaling into the bond market," she said.

Lee noted mortgage-backed securities, such as those issued by Fannie Mae and the federal Home loan bank are also good bets, since those agencies offer a indirect federal guarantees.

"If the investor's objective is to buy bonds for the income they yield, and not to try to play the market (like the pros), then I'd buy spread products right now," she said. "There's a lot of volatility in the Treasury market now so I don't think the individual investor would benefit by getting in middle of the

fray."

Lee said she "still likes corporate bonds, mainly the 2-year and 5-year bonds." But she warned those buying corporate debt should screen for investment grade bonds and those with a high credit rating.

"I think the bond market is going to be very unforgiving of credit deterioration later this year and any company with a perceived credit (downgrade) will be penalized," she said, suggesting investors ask their broker to do the screening for them.

"As the economy slows down, it's going to affect corporate earnings and you're going to see more credit downgrades," she said.

Yields on corporate bonds are higher than Treasurys because they are not backed by a government guarantee, meaning you could get burned by a default.

They are also, however, unaffected by the supply and demand concerns that rattle the Treasury market.

Muni bonds

Those in a higher tax bracket should probably consider municipal bonds - also a spread product - instead. That's because the interest you earn on muni-bonds have the added bonus of being tax free.

If you're in the 36 percent tax bracket, and you buy a long-term AAA insured muni with a yield of more than 6 percent, your added tax benefit actually

drives your real yield up to 9.42 percent.

In other words, you'd have to buy a corporate bond with a rate of 9.42 percent to match a muni-bond worth about 6 percent in that tax bracket.

"You just can't find a AAA-rated corporate bond with a yield that high," Lee said.

Rates right now on muni-bonds, market watchers say, are looking good. The 20-year A-rated muni-bond Friday morning stood at 5.93 percent.

"Whenever you can get a muni-bond at or over 6 percent, that's a very attractive rate," DeRose said.

Inflation evaluation

If you do forge into the fixed-income securities market, keep in mind that your greatest risk is inflation.

If you earn 7 percent on a 10-year bond today, with an inflation rate of 2.5 percent, you're essentially pocketing the difference of 4.5 percent. If inflation

climbs to 4 percent, however, your true yield would have dropped to 3 percent.

But with the Federal Reserve stepping in to keep inflation under control, some say concerns there are minimal these days.

"I don't see much risk of inflation, partly because the Fed will do whatever it needs to do to keep it low," Lee said.

DeRose agrees, adding the latest consumer price index report helped to further quell inflationary concerns, and prove the economy can remain in an

expansionary mode without overheating.

He noted any additional rate hikes in the months to come - as are widely predicted - won't likely put a damper on the bond market. And he predicted rates will fall back down during the second half of the year.

"Rates are going to go higher in the short-term, but they'll be heading back down," he said. "You've got to get in on the bond market before that happens."

The incremental approach

As for portfolio allocation, Lee said, it all depends on your age, risk tolerance and financial profile. Older adults who are retired, she said, should invest more

heavily in bonds because of the stability and steady income they provide. Lee suggests as much as 70 percent. heavily in bonds because of the stability and steady income they provide. Lee suggests as much as 70 percent.

Younger investors, in their mid-20s and early 30s, should keep their bond holdings to a minimum, putting their money to work for them in the

aggressive equity market.

DeRose, however, said he believes even younger investors should have up to 20 percent of their portfolios invested in fixed-income.

He suggests a lattered approach to buying. That means a mix of long-term and short term bonds, even a few certificates of deposit.

"That way you kind of cover your bets," DeRose said. "If rates go up, the short-term bonds mature faster and you can just reinvest that money. But if

rates go down, you'll want to have longer bonds in your portfolio to lock in that income."

Funds

Lastly, adding fixed-income exposure to your portfolio may be easiest to achieve by buying mutual funds.

You've just got to pick your poison carefully.

The majority of bond funds last year turned in a paltry performance, but there were a few bright stars in the bunch.

The top performing Intermediate bond fund last year was Calvert Income A, which produced total returns of 7.23 percent. BT Pyramid Preserv Plus Inc. came in second with 5.99 percent, and BT Pyramid Preserv PL Invmt ranked third with 5.5 percent.

(Click here for a chart of the top 20 Intermediate

funds in 1999.)

(Rodriquez's FPA New Income fund, which invests in bonds, is one of few that ended 1999 in the black.)

|