|

Bausch & Lomb eyes rival

|

|

March 23, 2000: 4:40 p.m. ET

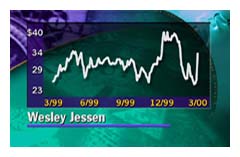

$600M offer for Wesley Jessen, already betrothed, may spur other offers

|

NEW YORK (CNNfn) - Bausch & Lomb Inc. made an unsolicited $600 million cash offer Thursday for Wesley Jessen VisionCare Inc., a specialty contact lens manufacturer that recently proposed buying one of Bausch's rivals in the clear contact lens market.

The bid, which came after a month of fruitless merger negotiations between the two companies, calls for Bausch & Lomb to exchange $34 in cash for each outstanding Wesley Jessen share, a 37 percent premium over the company's closing price of 24-7/8 Wednesday.

But analysts and investors alike were speculating that the offer  could induce a competing third-party bid, spurring a prolonged takeover battle that will reshape the power structure of the contact lens industry. could induce a competing third-party bid, spurring a prolonged takeover battle that will reshape the power structure of the contact lens industry.

Wesley Jessen (WJCO: Research, Estimates) shares traded as high as 34-5/8 Thursday morning, but had once again fallen below the offer price of 34 by late Thursday afternoon, trading up 8-11/16 to 33-9/16.

"I'm not surprised that Bausch & Lomb surfaced here," said Hans Van Der Luft, an analyst with McDonald Investments Inc. "Wesley Jessen has a very valuable contact lens line and they have been interested in them for quite some time. But there is potential for another company to enter here, remote as it may be."

That other company most likely would be Johnson & Johnson (JNJ: Research, Estimates), one of the world's largest health care products manufacturers and a major Bausch & Lomb competitor, analysts said. J&J developed the world's first disposable clear contact lenses in 1993.

J&J spokesman John McKeegan said his company would not comment on market rumors. J&J shares lost 1-3/4 to 80-1/2 late Thursday afternoon.

B&L meets Wesley at the altar

Bausch & Lomb's bid comes three days after Des Plaines, Ill.-based Wesley Jessen agreed to buy Ocular Sciences (OCLR: Research, Estimates) for approximately $413 million in stock, a deal that would create the world's second-largest soft contact lens producer behind Bausch & Lomb. Ocular Sciences has a growing position in the disposable lens market.

William Carpenter, Bausch & Lomb's chairman and chief executive officer, said he initially approached Wesley Jessen about a possible merger in early February and spoke to them as recently as Feb. 28. He said he was both surprised and disappointed by the Ocular Sciences deal.

He declined to comment on whether the $34 a share bid was his company's final offer, but said Bausch & Lomb (BOL: Research, Estimates) was prepared to pursue the merger, even if it meant taking the issue to Wesley Jessen shareholders directly. He declined to comment on whether the $34 a share bid was his company's final offer, but said Bausch & Lomb (BOL: Research, Estimates) was prepared to pursue the merger, even if it meant taking the issue to Wesley Jessen shareholders directly.

"It is clearly our preference that WJ recognize the merits of this so we can sit down and chat about it on a very cooperative basis on the near term," Carpenter told analysts and reporters during a conference call. "But, as I commented, we are considering all of our options including a tender offer."

"It sounds like that they are pretty intent on seeing this all the way through," said Lawrence Keusch, an analyst with Goldman Sachs.

A possible tender bid is complicated by several factors, however. Wesley Jessen currently has a poison pill defense mechanism in place, and, according to one analyst, the deadline for nominating a possible competing slate of directors for its board is next Monday.

A Wesley Jessen spokeswoman did not return several phone calls seeking comment.

Offer includes break-up fee compensation

Carpenter said the merger made good strategic sense for both companies because they largely concentrate on different ends of the market.

Bausch & Lomb is the world's leading manufacturer of contact lenses and lens-care products, but has had difficulty growing its domestic business in recent years while international sales have soared.

Meanwhile, Wesley Jessen currently is the No. 1 producer of tinted specialty contact lenses, the industry's fastest growing and most profitable segment. Analysts said the company offers a substantial upside for U.S.-based growth, although its sales overseas have, to date, been relatively week because of a lack of marketing.

"I think it's a great strategic deal for B&L," said Suey Wong, an analyst with Robert W. Baird & Co. "Its U.S. business had been soft recently, so Wesley color lens business could be a great acquisition for them."

"This is a really smart way to add a little content and depth to their content of lenses," agreed Kenneth Goldman, an analyst with Lehman Brothers.

Bausch & Lomb officials said they believe they can generate a minimum of $30 million in cost savings from the merger, but declined to comment on whether it would create top-line synergies as well.

Carpenter did say the merger would be accretive to the company's earnings during the first full year after it is completed.

Carpenter would not indicate exactly what price range the companies were discussing before the Ocular offer. He said the $34 per-share price did make some concession for the break-up fee between Wesley Jessen and Ocular, which some analysts have put at $20 million.

Ocular Sciences shares shed 3/4 to 16-1/2 shortly after noon Thursday, while Bausch & Lomb fell 1-1/4 to 55-1/8.

|

|

|

|

|

|

|