|

Baby Bells in wireless pact

|

|

April 5, 2000: 1:28 p.m. ET

BellSouth, SBC combine operations to form nation's No.2 wireless concern

By Staff Writer Tom Johnson

|

NEW YORK (CNNfn) - BellSouth Corp. and SBC Communications Inc. agreed Wednesday to combine their wireless telephone operations, forming the nation's No. 2 wireless concern, and promised to grow the new company quickly through acquisitions and, most likely, an initial public offering.

The alliance will form a powerful nationwide wireless network boasting 16.2 million wireless subscribers, reaching 19 of the nation's top 20 markets and 40 of the top 50, and generating annual revenues of $10.2 billion.

At that size, SBC/Bellsouth will be capable of competing head-to-head with current industry leaders Verizon Wireless, the new venture created this week by Bell Atlantic Corp. (BEL: Research, Estimates) and Vodafone AirTouch (VOD: Research, Estimates), and with AT&T Corp. (T: Research, Estimates) and Sprint PCS (PCS: Research, Estimates).

Company officials said it was very likely the new venture would be taken public, particularly given similar plans announced in the last week for both Verizon Wireless and AT&T Wireless, although no announcement was imminent. Company officials said it was very likely the new venture would be taken public, particularly given similar plans announced in the last week for both Verizon Wireless and AT&T Wireless, although no announcement was imminent.

"We have not determined any time frame ... but it certainly a terrific option that's available," said Edward Whitacre, SBC's chairman and chief executive officer.

In the meantime, Whitacre promised the company would actively look to expand its network, which initially will be concentrated primarily in the Southwest, Midwest and California. That leaves gaping holes in the lucrative Northeast and Northwest markets, but Whitacre said the companies would not wait until the deal closes -- expected during the fourth quarter -- before moving to fill them.

"This new company we're forming doesn't have to wait around for approval to get moving," he said. "So we will undertake some activities prior to closing."

Equal management control

Terms of the agreement call for SBC (SBC: Research, Estimates) to own 60 percent of the new, unnamed venture, with BellSouth (BLS: Research, Estimates) owning the rest.

The ownership percentages are based on the value of the assets each company is contributing to the venture. The new company's earnings will flow back to its parent companies in the same proportion.

Company officials said they expected some cost savings from the alliance, although they did not indicate how much, and expected the union to have no negative impact on either company's future earnings.

In addition, because the two wireless networks feature almost no overlap -- the only two shared markets are New Orleans and Indianapolis -- and use similar technologies, there also will be minimal upfront capital investment.

The companies will share management control of the new company through an independent four-member board, and are conducting an internal and external search for a chief executive officer to run the operation.

Racing to create a national network

The deal comes at a critical time for both companies. U.S. wireless carriers have been rapidly expanding their operations in recent months to gain nationwide coverage and eliminate "roaming" charges for customers.

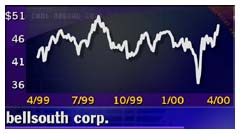

Both BellSouth and SBC have seen their stocks suffer recently, as investors clamor for more expansive wireless networks. Both BellSouth and SBC have seen their stocks suffer recently, as investors clamor for more expansive wireless networks.

BellSouth, for instance, fell as low as 35-3/4 in late February before rebounding recently when rumors of a possible wireless tie with SBC surfaced. By early afternoon Wednesday, BellSouth gained 1-1/8 to 50, while SBC rose 7/16 to 46-7/16.

The new venture will be the second-largest wireless operator in the country. By size, it will fall behind Verizon Wireless, which currently serves roughly 20 million subscribers but will gain an additional 4 million when Bell Atlantic acquires GTE Corp. But the new alliance will be larger than the wireless operations of AT&T Corp., with its 12.2 million wireless customers.

Both AT&T Wireless and Verizon said recently that they will take their companies public, hoping to capitalize on the red-hot IPO market for wireless ventures and fuel continued expansion of their networks.

Whitacre said the alliance had "nothing to do" with the firms' desire to keep up with Verizon Wireless, which announced its initial public offering and a $3 billion capital investment Tuesday.

He did say, however, that the SBC/BellSouth initiative would move on some of its expansion initiatives before the end of the second quarter.

|

|

|

|

|

|

|