|

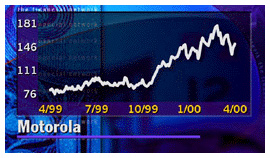

Motorola beats estimates

|

|

April 10, 2000: 8:45 p.m. ET

First-quarter earnings rise 144 percent, as sales rise in all business sectors

|

NEW YORK (CNNfn) - Motorola Inc. posted a first-quarter profit just above Wall Street's estimates Monday, as sales rose across all of its major business segments.

The Schaumburg, Illinois-based company is benefiting from strong sales of digital wireless phones, including models that can access the Internet, and broadband communications equipment, such as cable modems. Motorola also has become the leading maker of embedded chips that go into automotive electronics and cellular phones.

Excluding special charges, Motorola (MOT) logged earnings from continuing operations of $449 million, or 59 cents per share, up 144 percent from $184 million, or 26 cents per share, during the first quarter of 1999.

Analysts polled by earnings tracker First Call had expected Motorola to post a profit of 58 cents per share.

The company's revenue from continuing operations rose 19 percent to $8.8 billion from $7.3 billion.

The 1999 results are restated to reflect Motorola's $17 billion purchase of cable equipment maker General Instrument Corp., which was completed Jan. 5.

"Motorola's growth in sales has continued to accelerate, and our earnings are on an improving trend," said Robert Growney, president and chief operating officer. "We are especially pleased by the results in our new Broadband Communications Sector, which was formed after the merger with General Instrument, the improvements in our network systems business, and the sequential growth in quarterly earnings for semiconductors." "Motorola's growth in sales has continued to accelerate, and our earnings are on an improving trend," said Robert Growney, president and chief operating officer. "We are especially pleased by the results in our new Broadband Communications Sector, which was formed after the merger with General Instrument, the improvements in our network systems business, and the sequential growth in quarterly earnings for semiconductors."

In the first quarter of 2000, Motorola reported special items resulting in a net charge of $2 million pre-tax, which consisted of $100 million of costs associated with the General Instrument acquisition, offset by gains from the sales of investments and a business unit. Excluding the results of businesses that were sold, Motorola's net margin on sales rose to 5.1 percent in this year's first quarter from 2.5 percent in the same period last year.

In Motorola's Personal Communications segment, which includes its production of wireless phones, sales rose 24 percent to $3.2 billion, and orders increased 20 percent to $3.2 billion. However, operating profit plunged to $49 million from $83 million a year ago, as the company shifted toward selling phones with lower margins and had to spend more for components and advertising.

Motorola introduced 20 wireless phones during the quarter, and has shipped several million units with miniature Web browsers.

Sales within Motorola's Commercial, Government and Industrial Systems segment rose 16 percent to $998 million, but orders declined 9 percent to $1.1 billion. The company attributed the decline in orders to "very strong" orders in the first quarter of 1999. Operating profit increased to $93 million from $48 million last year.

Motorola's sales of broadband communications equipment, such as cable modems, rose 15 percent to $678 million, and orders increased 46 percent to $880 million. Operating profit rose to $91 million from $61 million a year ago as a result of what the company said were synergies from its acquisition

Motorola received orders from the cable company Comcast for one million additional digital consumer devices, including interactive set-top terminals and high-speed cable modems.

Motorola's semiconductor sales increased 24 percent to $1.9 billion, and orders rose 21 percent to $2.0 billion. Operating profit rose to $123 million from $10 million a year ago. The segment has achieved sequential profit growth in each of the last five quarters.

Sales within the company's Network Systems segment, which includes satellite communications equipment, rose 11 percent to $1.8 billion, and orders increased 4 percent to $1.8 billion. Operating profit increased to $280 million from $193 million a year ago. Motorola built and operated the satellites for the failed Iridium LLC, one of the costliest corporate fiascos ever.

Motorola already has taken $2.5 billion in reserves and write-offs for its role in the failed Iridium project, which has been reported to cost between $5 billion and $7 billion to build. However, Motorola still faces a $2 billion lawsuit from Iridium's bondholders.

|

|

|

|

|

|

Motorola Inc.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|