|

Hughes posts 1Q loss

|

|

April 12, 2000: 4:17 p.m. ET

Satellite services unit of General Motors cites higher costs; revenue rose 85%

|

NEW YORK (CNNfn) - Hughes Electronics Corp. posted on Wednesday a first-quarter loss, despite sales that jumped 85 percent from the year-ago quarter.

The digital television and satellite services subsidiary of General Motors Corp. reported a first-quarter net loss of $81.9 million, compared with earnings of $73 million a year ago.

However, revenue for the quarter jumped 85.4 percent to $1.7 billion from $918.4 million a year ago. Earnings before interest, taxes, depreciation and amortization rose 57.1 percent to $142.2 million, compared with $90.5 million a year ago.

Hughes is traded as a GM unit tracking stock. The company did not report per-share earnings due to a new Securities and Exchange Commission regulation prohibiting per-share earnings reports for tracking stocks. Hughes is traded as a GM unit tracking stock. The company did not report per-share earnings due to a new Securities and Exchange Commission regulation prohibiting per-share earnings reports for tracking stocks.

But spokesman Richard Dore said the company posted a net loss of 23 cents a share compared with net earnings of 20 cents a share in the year-ago quarter.

The El Segundo, Calif.-based company attributed the loss to expenses related to its deals to buy United States Satellite Broadcasting Company Inc. and Primestar, an increase in interest expense, and greater losses in Hughes' portion of DirecTV Japan.

The company's first-quarter performance was also impacted by a one-time $94 million after-tax gain from a settlement of a 1999 patent suit, and $49 million after-tax costs from the termination of a contract with the Asia Pacific Mobile Telecommunications satellite system, officials said.

"This quarter's results reflect the success of our ongoing strategy to be a services-driven company," said Michael Smith, the company's chief executive officer in a prepared statement. "The primary driver continued to be DirecTV, where we added over half a million new subscribers worldwide, including 405,000 here in the United States."

DirecTV revenue jumps

First-quarter revenue for the company's DirecTV business more than doubled to $1.1 billion, from $557 million in the year-ago quarter. Quarterly revenue for the DirecTV business in the United States more than doubled to $1.1 million because of continued strong subscriber growth and additional revenue from subscribers obtained through he USS and Primestar acquisitions, officials said.

DirecTV added 405,000 new subscribers to the high-power DirecTV service in the quarter, a 33 percent increase over the 304,000 new subscribers it added in the year-ago quarter. In addition, the acquisition of PrimeStar added 275,000 new customers as of March 31. The additions brought the total subscriber base to 8.3 million.

Latin America business grows

In Latin America, DirecTV took in $114 million in sales for the quarter compared with $61 million in the year-ago quarter because of continued strong subscriber growth and the consolidation of its Brazilian and Mexican divisions.

The number of new Latin American DirecTV subscribers grew 50 percent to 105,000 in the quarter, bringing the total number of subscribers there to 909,000.

PanAmSat (SPOT: Research, Estimates), the satellite communications company of which Hughes holds an 81 percent stake, reported first-quarter revenue of $299.1 million compared with $193.5 million a year ago.

Last month, the company announced its new high-speed Internet network and also warned that its 2001 earnings would fall short of expectations.

The first-quarter revenue jump primarily reflects $94 million in sales and sales-type leases of satellite transponders for customers on the recently launched Galaxy XR satellite.

Hughes Network Systems, the division that produces satellite TV receiving equipment, posted a 57.9 percent jump in sales to $364 million from $230.9 million in the year-ago quarter. The unit shipped 980,000 DirecTV receiver systems in the first-quarter compared with 190,000 units in the first-quarter of 1999.

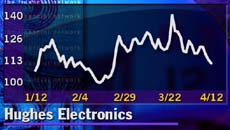

Shares of General Motors (GMH: Research, Estimates) H-Class stock slipped 2-7/16 to 110-3/4 in late-afternoon trading Wednesday on the New York Stock Exchange.

|

|

|

|

|

|

|