|

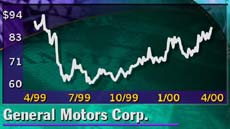

GM drives past 1Q forecast

|

|

April 13, 2000: 8:19 a.m. ET

Strong vehicle sales lead world's largest automaker to higher earnings

|

NEW YORK (CNNfn) - General Motors Corp. posted first-quarter results Thursday that easily beat earnings estimates, as it said it continues to see strong vehicle sales but a tough pricing environment for the rest of the year.

The world's largest automaker said it now believes that total North American vehicle sales will top last year's record. But the first quarter saw pricing per vehicle in North America drop 0.7 percent from the year-earlier level once incentives and marketing costs are considered. The company said that pricing is likely to stay lower than year-earlier results during the second quarter, although not by a large a percentage.

The company reported net income of $1.8 billion, or $2.80 a share, in the quarter. Analysts surveyed by earnings tracker First Call had forecast the company would earn $2.66 per share in the quarter. A year earlier, GM (GM: Research, Estimates) reported then-record earnings of $1.8 billion, or $2.68 a diluted share on more shares outstanding, excluding the results of its Delphi Automotive Systems (DPH: Research, Estimates) auto parts division, which was spun off during that quarter.

In the year-earlier period the company was building and selling vehicles rapidly in an effort to recover from 1998 strikes. In the year-earlier period the company was building and selling vehicles rapidly in an effort to recover from 1998 strikes.

Revenue rose to $46.9 billion in the latest quarter from $42.4 billion a year earlier. Revenue from vehicle sales rose to $40.4 billion from $36.6 million, while its financing operations saw revenue rise to $4.1 billion from $3.5 billion.

The earnings per share gain came from a repurchase of shares in the past year by the company that reduced shares outstanding by 4 percent. The company was also helped by a tax credit from the sale by its Hughes Electronics division's DirecTV operations in Japan, which produced a tax credit and lowered Hughes' tax rate. That tax credit tempers the upside surprise of the earnings, said John Casesa, analyst with Merrill Lynch & Co., in an interview on CNNfn's Before Hours Thursday.

"I think expectations were a little low and they did a little better than expected," he said. "It was a good quarter, but not a knockout. Shares are still under pressure."

Casesa said GM and other automakers will have a hard time improving on last year's record sales results.

"We are a very high point in the cycle," he said. "Unit demand is great, but it takes a lot of price cuts to keep the customer coming. This cycle is running on fumes."

Company officials agreed that they are facing tough pricing despite strong sales demand.

"One reason we're seeing as strong a market as we're seeing is the industry in total has been reducing prices," said Mike Losh, chief financial officer of the company, in comments to analysts. "That is essentially a healthy environment."

GM reported that 11 of 13 vehicle categories had sales gains in the quarter, and overall North American vehicle sales rose 11 percent. Sales in the profitable truck segment rose 20 percent to a company record, and company officials said the mix of vehicles sold improved to more profitable models.

Despite those gains, the pricing pressure meant North American operating profit slipped to $1.3 billion from a record $1.4 billion a year earlier. But the company posted improved operating results everywhere else around the globe.

"Record market demand in North America and Europe was accompanied by unrelenting competitive pressures, while economic conditions continued to affect markets in the Latin America and Asia-Pacific regions," Chairman and CEO Jack Smith said. "We're particularly pleased that GM Europe improved its profitability during the period, and that both GM Latin America/Africa/Middle East and GM Asia Pacific were profitable, a significant improvement over the first quarter last year."

Shares of Dow component GM fell 15/16 to 86-9/16 in trading Thursday.

(Click here for more earnings news)

|

|

|

|

|

|

General Motors

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|