|

Brokers top 1Q forecasts

|

|

April 18, 2000: 7:23 p.m. ET

PaineWebber, DLJdirect cite strong rise in commissions, client assets

|

NEW YORK (CNNfn) - PaineWebber Group Inc. and DLJdirect Tuesday became the latest traditional and online brokerage companies to post better-than-expected first-quarter results.

PaineWebber weighed in with record net income of $176.3 million, or $1.16 per diluted share. Analysts surveyed by earnings tracker First Call forecast the company to have earned $1.09 a share in the quarter. The brokerage concern earned $160.3 million, or $1.01 a share, a year earlier.

Net revenue climbed 21.5 percent to $1.6 billion from $1.3 billion a year earlier. The biggest driver of that growth was commission income, which climbed 41 percent to $676.2 million.

On Monday, Merrill Lynch & Co. (MER: Research, Estimates) and Charles Schwab Corp. (SCH: Research, Estimates) beat estimates, and other brokers also have reported strength during the bull market in tech stocks earlier this year. On Monday, Merrill Lynch & Co. (MER: Research, Estimates) and Charles Schwab Corp. (SCH: Research, Estimates) beat estimates, and other brokers also have reported strength during the bull market in tech stocks earlier this year.

PaineWebber said net new assets flowing into the firm grew 46 percent in the quarter compared with a year earlier. Despite the recent sell-off in stocks, it said it does not believe that trend will reverse.

"We expect this trend to continue, fueled by the firm's investments in technology to enhance online capabilities and the growth of productive financial advisers," PaineWebber Chairman and CEO Donald Marron said.

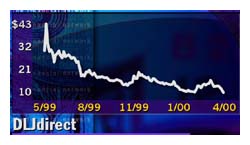

DLJdirect posted a 90 percent surge in first-quarter earnings to $13.6 million, or 13 cents per diluted share, with record trading volume at home and internationally. Analysts polled by First Call estimated the online brokerage business of Donaldson Lufkin & Jenrette would earn 4 cents a share.

The online brokerage, like its more traditional counterparts, has benefited from surging demand for stock trading from customers despite volatile market conditions.

DLJdirect executed 2.8 million trades in the U.S. during the first quarter, 1 million more that in the prior quarter. Globally, the company is regularly clocking up more that 50 thousand trades a day, a 65 percent increase from the previous record set in the fourth-quarter of 1999.

"With record setting volume and market volatility this quarter, our systems were certainly pressure tested," DLJdirect President Glenn Tongue said. "With record setting volume and market volatility this quarter, our systems were certainly pressure tested," DLJdirect President Glenn Tongue said.

The online broker attracted more than $29.4 billion in assets from its clients and signed up 82,000 new accounts in the first quarter, taking its total active customer base to 429,000.

Shares of DLJdirect (DIR: Research, Estimates) rose 1-1/16 to 10-5/8 in midday trading. Parent DLJ (DLJ: Research, Estimates) gained 1-13/16 to 41-7/16, while PaineWebber (PWJ: Research, Estimates) rose 1-1/4 to 40-1/16.

|

|

|

|

|

|

PaineWebber

DLJdirect

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|