|

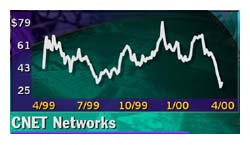

CNET beats estimate

|

|

April 19, 2000: 6:46 p.m. ET

Internet content provider gets profit boost from radio, licensing revenue

|

NEW YORK (CNNfn) - Online media company CNET Networks posted an unexpected first-quarter profit, excluding one-time items, beating Wall Street estimates on a boost in revenue from CNET Radio and license agreements for databases.

The San Francisco-based company registered pro forma net income of $1.5 million or 2 cents a share. Analysts polled by First Call had expected a loss of 6 cents a share.

"This is a solid result. They've moved into profit ahead of schedule," said Matt Finick, an analyst at Thomas Weisel Partners. "CNET has two sides to it, visitors and merchants, and both are generating revenue. It's no longer a media company it's reducing its reliance on advertising, and moving to recurring license fees. That's the model you need."

Finick has a buy rating on the stock.

However, including one-time items, the company lost $19.5 million, or 23 cents a share, for the three months to March 31, compared to a profit of $20.3 million, or 23 cents a share, in the year earlier period. Revenue more than doubled to $45.4 million.

The company "expanded its reach with new content services and turned on new revenue streams, including CNET Data Services and CNET Radio," said Shelby Bonnie, chief executive of CNET Networks. The company "expanded its reach with new content services and turned on new revenue streams, including CNET Data Services and CNET Radio," said Shelby Bonnie, chief executive of CNET Networks.

CNET (CNET: Research, Estimates) launched CNET Radio - the country's first all technology radio format - with partner AMFM, the largest radio broadcaster in the U.S., in San Francisco and plans to roll the service across the country. The company also agreed to provide broadband content to AOL (AOL: Research, Estimates).

CNET runs a Web site providing information about computers, the Internet and marketplaces for technology products.

The online media company said strong demand for content has led to increased traffic over its sites and partner sites, which in turn has boosted revenue. Web traffic increased to 16.5 million average daily page views in the first-quarter.

In March, the company completed the acquisition of mySimon, the Internet's leading comparison-shopping service, in a $700 million stock deal. The business registered revenue of $1.8 million for the first quarter.

CNET expects 2000 revenue to exceed $200 million, and reassured investors by saying it had more than $300 million in cash and $35 million invested in publicly traded companies. Many analysts that have questioned the valuations attributed to dot.coms have predicted than many will run out of capital.

The board also agreed to buy back shares worth as much as $100 million, without specifying a time frame.

|

|

|

|

|

|

CNET

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|