|

Excite@Home posts loss

|

|

April 19, 2000: 6:39 p.m. ET

Internet company posts 1 cent a share loss, missing expectations by a penny

|

NEW YORK (CNNfn) - Internet service company Excite@Home posted on Wednesday a first-quarter loss that was a penny short of Wall Street expectations, despite a sharp jump in both revenue and total subscribers from a year ago.

The Redwood City, Calif.-based company also unveiled an aggressive growth plan that it hopes will explode its number of subscribers in 2002 to 10 million from about 1.5 million today, and boost annual revenue to $2 billion by 2002.

Excite@Home, a high-speed Internet access provider and Web content company, reported a first-quarter pro forma loss of $4.6 million, or one cent a share, excluding goodwill. Its revenue increased by 75 percent to $138 million from pro forma revenue of $78.7 million in the year-ago quarter.

Wall Street analysts had expected Excite@Home (ATHM: Research, Estimates) to break even in the quarter, according to earnings tracker First Call/Thomson Financial.

Pro forma results combine the historical results of Internet portal Excite Inc. and high-speed cable Internet service At Home Corp., which merged in May 1999 in a deal valued at $6.7 billion.

Including expenses for the amortization of goodwill, the company had a net loss of $676.5 million, or $1.75 per share, compared with a loss of $18.1 million, or 8 cents per share, last year.

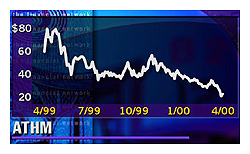

The results were announced after the close of regular trading on Wednesday. The company's shares ended the regular session at 20, down 2-7/8.

George Bell, the company's president and chief executive, attributed the slim loss to difficulty reworking Web pages related to their recent acquisitions of content sites Bluemountain and Webshots.

"All other key metrics, (such as) subscribers, foot print expansion, page views and registered users, were very strong," Bell told analysts in a conference call.

In the first quarter, Excite@Home's residential broadband subscriber base grew by about 350,000 new subscribers to 1.5 million, up 30 percent from year-end 1999, and up 220 percent from March 31, 1999.

Plans to 'go big'

The company said it has decided to "go big" with its plans to attack the market of providing customers with high-speed access to the Internet, and Web-based entertainment, information and the connections

"The best thing that we can do for the value of our company today is to hit a heavy growth mode as regards to subscribers and content services," Bell said.

"We are at the sweet spot of an early stage hyper-growth market," he said.

While the rollout of high-speed access to the Internet has been slow, experts believe that in coming years most Internet users will have a broadband link, via cable modems, high-speed telephone modems or satellite connections. Many users already access high-speed content by their connections to the Web at work.

Analysts generally shrugged off the narrow quarterly loss, and smiled on the company's aggressive growth plan.

"I think they needed to do it," said Warburg Dillion Read analyst Michael Wallace. "They might as well do it now while they have a leading position."

Wallace noted that Excite@Home's closest competitor is Road Runner, which has less than one million broadband subscribers. Road Runner is a venture of several of the nation's largest media, telecommunications and technology players, including Time Warner Inc., the parent of CNNfn.com.

Excite@Home stated that its goals are to have a total of at least three million residential broadband subscribers by the end of 2000, growing to six million subscribers by the end of 2001 and 10 million subscribers by the end of 2002.

"We have changed the focus of this company from the profit story to a growth story," Bell said on the call.

In achieving those goals, it will increase investment efforts worldwide to boost its broadband subscriber growth.

As a result, the company expects to incur operating losses for the full-year 2000 totaling between 25 cents and 30 cents per share, excluding the amortization of goodwill, and certain other non-operational gains and expenses.

Before the announcement, Wall Street analysts had expected the company to achieve a profit of between 8 and 12 cents a share for the full year 2000.

|

|

|

|

|

|

|