|

Railroads beat forecasts

|

|

April 20, 2000: 2:11 p.m. ET

UP and Canadian Pacific improve profit margins with improved freight traffic

|

NEW YORK (CNNfn) - Two major North American railroads - Union Pacific Corp. and Canadian Pacific Ltd. - reported better-than-expected results in the most recent quarter, as increasing fuel prices served as a double-edge sword for both.

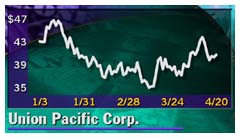

Union Pacific Corp., owner of continent's largest railroad, posted net income of $185 million, or $.74 per diluted share, which exceeds the 70 cents a share forecast of analysts surveyed by earnings tracker First Call. The company earned $129 million, or 52 cents a diluted share, a year earlier.

The company's trucking subsidiary, Overnite Trucking Co., moved back to the black with a $1 million operating income, down from a $10 million operating income of a year earlier but an improvement from the $13 million loss in the fourth quarter. The International Brotherhood of Teamsters has been striking the company since October, but since it represents a minority of employees they have not been able to halt operations.

Revenue for Union Pacific Corp. (UNP: Research, Estimates) rose 6 percent to $2.9 billion from $2.7 billion a year earlier.

UP putting congestion problems behind it

Union Pacific Railroad, which is responsible for more than 90 percent of the parent corporation's revenue, continued its improvement from merger-related problems that plagued it and its customers from 1997 to 1998.

Shipments of new vehicles saw the greatest growth in traffic, as it handled 17 percent more rail cars of vehicles in the quarter. But a cut in those rates limited the revenue growth in the segment to 15 percent to $290.1 million.

The greatest gross revenue gain came from a 10 percent gain in intermodal traffic, which is freight shipped on rail in containers or truck trailers. That traffic is most vulnerable to competition from trucks or other railroads, and its growth is a key sign of recovery from congestion problems. The greatest gross revenue gain came from a 10 percent gain in intermodal traffic, which is freight shipped on rail in containers or truck trailers. That traffic is most vulnerable to competition from trucks or other railroads, and its growth is a key sign of recovery from congestion problems.

Intermodal rates also increased along with the traffic, as fuel surcharges in the trucking industry opened the way for higher rail rates. So the segment saw a 14 percent rise in revenue to $441.1 million.

The railroad's ratio of operating expenses to revenue, a key measure of a railroad's financial performance, improved to 82.9 percent from 85.8 percent a year ago. The improved margins came despite a 65 percent increase in fuel costs. However, even with the increase, fuel represents only 13 percent of operating expenses, which is less than many other modes of transportation, including many trucking companies.

Shares of Union Pacific gained 1/2 to 40-13/16 Thursday.

Higher energy prices help CP

Canadian Pacific (CP: Research, Estimates), a conglomerate that includes rail, shipping and energy concerns, reported net income of 302.6 million Canadian dollars, or 93 Canadian cents a diluted share, well above the 71 Canadian cents forecast of analysts surveyed by First Call. The result equates to US$205.3 million, or 63 U.S. cents a share.

In the year earlier period the company earned C$118 million, or 35 cents Canadian.

Much of the gain in profits came from its PanCanadian Petroleum division, which saw net income soar 385 percent to C$160 million from C$33 million a year earlier. Higher prices for natural gas and oil and greater natural gas production drove the record results for the division. Much of the gain in profits came from its PanCanadian Petroleum division, which saw net income soar 385 percent to C$160 million from C$33 million a year earlier. Higher prices for natural gas and oil and greater natural gas production drove the record results for the division.

But the other divisions also saw gains, with Canadian Pacific Railroad's income rising 52 percent to C$85 million from C$56 million, and its ratio of operating expenses to revenue improving to 79.5 percent from 83.1 percent, despite lower rates.

Revenue rose to C$3.5 billion from C$2.5 billion a year earlier.

Shares of Canadian Pacific slipped 1/8 to 24-1/4 in New York trading Thursday.

The two companies are the first major railroads to report results in the quarter. UP competitor Burlington Northern Santa Fe Corp. (BNI: Research, Estimates) is forecast to earn 55 cents a share, up from 50 cents a year earlier, and CP competitor Canadian National Railway (CNI: Research, Estimates) is forecast to report earnings of 64 U.S. cents a share, up from 43 cents a share. Those two railroads had their proposed merger blocked by U.S. rail regulators in March.

The two eastern U.S. railroads which last year incorporated the former Conrail into their system - CSX Corp. (CSX: Research, Estimates) and Norfolk Southern Corp. (NSC: Research, Estimates) - are both expected to post reduced profit as they struggle to deal with their own merger problems. CSX is forecast to earn 15 cents a share, down from 36 cents a share, while Norfolk Southern is seen earning only 4 cents a share, down from 30 cents a share.

|

|

|

|

|

|

|