|

ING bids $6B for ReliaStar

|

|

May 1, 2000: 3:08 p.m. ET

Dutch financial group revives U.S. growth plans with cash deal for insurer

|

NEW YORK (CNNfn) - Dutch bank and insurance company ING Groep revived its U.S. expansion plans Monday with an agreed $6.1 billion cash offer for life insurer ReliaStar.

ING agreed to pay $54 a share in cash for ReliaStar, the eighth-largest U.S. life insurer, including $1 billion in assumed debt.

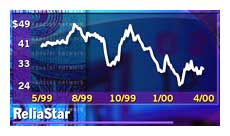

Minnesota-based ReliaStar stock jumped nearly 16 percent, or 6-15/16, to 50-15/16, in afternoon trading on the New York Stock exchange.

The deal will make ING the third-largest U.S. life insurance firm, boosting its pro forma assets under management to $75 billion from $39 billion; ReliaStar's Pilgrim Funds unit is among the 10 largest in the U.S. market. Premium income in the United States will rise to $12.4 billion from $8.2 billion. Also, if the deal is terminated, ING will pay ReliaStar about $150 million.

The deal follows the rejection in March of ING's joint bid with WellPoint Health Networks (WLP: Research, Estimates) to buy privately held Aetna (AET: Research, Estimates), the largest U.S. health insurer, for around $10 billion. But according to the company, ING is still interested in other U.S. acquisitions and another offer for Aetna has not been completely ruled out.

The agreed price is 25.6 percent above ReliaStar's (RLR: Research, Estimates) closing price of 43 Friday, and 75 percent above Thursday's closing price. The stock jumped 12-3/16 Friday in anticipation of the ING offer. The agreed price is 25.6 percent above ReliaStar's (RLR: Research, Estimates) closing price of 43 Friday, and 75 percent above Thursday's closing price. The stock jumped 12-3/16 Friday in anticipation of the ING offer.

Glen Hilliard, chairman and CEO of ING's Americas region, said in a conference call that the offer of 54 cents per share is fair and hones value for the company.

"The price represents the mainstream for significant, important deals," Hilliard said.

ING said the deal would enhance earnings beginning with the first year and will generate cost savings of $25 million in 2001, rising to $65 million by 2005.

Layoffs possible

Both companies did not exclude the possibility of layoffs, but did not specify the number of job cuts that may occur after the acquisition.

"Our expectation is that we'll be able to maintain our work force level here in Minneapolis for instance, but there are redundancies," said ReliaStar president and COO, Bob Salipante, in a conference call. Salipante said a "handful" of people would go, but the companies are not far enough in the process to determine who will be affected.

ING will keep's its Americas unit headquartered in Atlanta, but all of its U.S. life insurance business will be headquartered in Minneapolis. Also, the acquired company will be renamed ING ReliaStar.

The acquisition bid is the latest in a series of moves by European insurers into the U.S. market. Dutch-based Aegon last year paid $10.8 billion for Transamerica.

ING is one of the largest of Europe's so-called "bancassurers" - groups which combine insurance, consumer and commercial banking operations -- and last year bid $2 billion to acquire Germany's BHF Bank. Its bid to acquire France's CCF bank last November was blocked by French regulators. CCF was subsequently acquired last month by London-based HSBC (HSBA).

ING's insurance unit reported a 19 percent rise in operating profit to 1.9 billion euros ($1.73 billion) in 1999. Group net earnings climbed 54 percent to 3.2 billion euros. ING Americas generated 9 percent of the group's earnings last year.

ING (ING: Research, Estimates) shares rose 1-7/16, or 2.67 percent, or 55-3/8.

|

|

|

|

|

|

ING Groep

ReliaStar

Aegon

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|