|

BMW finds buyer for Rover

|

|

May 9, 2000: 11:32 a.m. ET

Purchase will save thousands of U.K. jobs; BMW future control still in doubt

|

LONDON (CNNfn) - BMW agreed Tuesday to sell its money-losing Rover unit to U.K. investment firm Phoenix in a deal that will save thousands of British jobs, while analysts said uncertainty remains over the German automaker's future ownership.

The Munich-based company said it will lend Phoenix £500 million ($766 million) to take over production and distribution of Rover cars, thus providing it with start-up support as the buyer restructures Rover. It said Phoenix, a venture capital consortium led by the U.K. car unit's former chief executive, John Towers, will pay a symbolic purchase price of £10 ($15.36). The companies would not provide further financial details of the deal.

Phoenix plans to maintain production of the Rover 25, 45 and 75 models and is buying the MG sports car and the popular Mini small-car names, though it said there will be some 1,000 job cuts. BMW will retain ownership of the Rover brand name, although Phoenix will be able to use the badge under a licensing deal.

Analysts welcomed the agreement, which removes the threat that BMW would have to take the politically unpopular step of closing Rover. Two weeks ago Alchemy Partners, then the leading candidate to buy the unit, pulled out of negotiations. BMW had warned it would shut down Rover if it didn't find a buyer by the end of May.

"BMW has lost something like $6 billion since they acquired Rover, and they are getting rid of something that has been losing $2 million a day and been a specific problem in terms of the drag on management time," Richard Baldwin, an auto analyst at Chase Securities in London, told CNNfn.com. "BMW has lost something like $6 billion since they acquired Rover, and they are getting rid of something that has been losing $2 million a day and been a specific problem in terms of the drag on management time," Richard Baldwin, an auto analyst at Chase Securities in London, told CNNfn.com.

BMW said it would book a  3.2 billion charge for the sale of Rover, though Baldwin noted that this would be offset by the $2.9 billion Ford Motor Co. (F: Research, Estimates) agreed to pay to buy its Land Rover unit, a maker of sport/utility vehicles. 3.2 billion charge for the sale of Rover, though Baldwin noted that this would be offset by the $2.9 billion Ford Motor Co. (F: Research, Estimates) agreed to pay to buy its Land Rover unit, a maker of sport/utility vehicles.

"BMW will now be able to turn its attention back to its core brands," Baldwin added. He said, though, that the company's future as an independent company remains clouded by whether or not the Quandt family, which has effective control of BMW, chooses to sell its shares.

Speculation has surrounded the Quandts' future role for months, with General Motors (GM: Research, Estimates) tipped as a favorite to buy BMW should they decide to sell. Baldwin said BMW would make a good fit for GM, which lags Ford, the owner of the British Jaguar and Aston Martin makes, in the field of luxury cars.

BMW ownership at stake

BMW and Phoenix had been locked in talks since the collapse of the Alchemy bid. Phoenix Monday secured vital financial backing from a unit of North Carolina-based First Union (FTU: Research, Estimates).

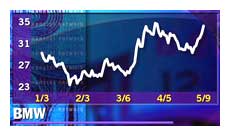

BMW (FBMW) shares rose 2 percent in Frankfurt to BMW (FBMW) shares rose 2 percent in Frankfurt to  33.91 in late afternoon trading. 33.91 in late afternoon trading.

BMW's attempts to find a way to withdraw from the Rover business by either selling or closing it had stirred up a political controversy between Britain and Germany. The closure of Rover, which BMW bought in 1994, would have directly caused the loss of 9,000 jobs at its main Longbridge factory, while about 40,000 jobs in companies supplying parts and services to Rover also were expected to go.

"After intense negotiations, we have managed to find a buyer for Rover whose aim is to continue to run Rover and who will therefore prevent the loss of thousands of jobs in the Rover plant in Birmingham, in the supplier industry and in the retail business," BMW Chief Executive Joachim Milberg said.

The rival Alchemy proposal would have drastically slimmed down Rover. Industry observers had tipped Phoenix as the best commercial bet, maintaining Rover as a mass-market producer.

Peter Schmidt, an analyst at consultant Automotive Industry Data, said he believes Rover could reclaim a 10 percent share of the U.K. market, having slipped to just 5 percent last year.

Phoenix plans to maintain production at Rover's main assembly line at around 200,000 cars a year. Phoenix chief Towers told a news conference the first priority is to stabilize the business and noted that the acquisition includes Rover's spare parts business, which is important in terms of cash flow.

The deal with BMW gives Phoenix options to buy the Powertrain and Swindon assets. Powertrain makes transmissions and engines and Swindon operates a stamping plant.

Towers said Phoenix has a chief executive in mind for Rover but declined to identify his preferred candidate. Towers declined to comment on the financial arrangements of its deal with BMW.

|

|

|

|

|

|

BMW

Rover Cars

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|