|

Don't count retailers out

|

|

May 18, 2000: 5:10 p.m. ET

Internet expected to boost bricks and mortar sales; Buy.com CEO skeptical

By Staff Writer John Chartier

|

CHICAGO (CNNfn) - More people may be browsing the Internet, but when it comes right down to it, they're still going with old reliable - going to an actual store to plunk down money for books, CDs, music and nearly anything else retailers peddle, according to a new research report.

By 2005, U.S. online consumers will spend more than $632 billion in traditional retail stores, catalogs and other off-line channels after doing their initial research on the Internet, according to a study released Thursday by New York-based Internet research firm Jupiter Communications at its two-day Jupiter Shopping Forum in Chicago.

By contrast, consumers are expected to spend $200 billion on the Internet in 2005. The numbers suggest that retailers should focus on meshing traditional bricks and mortar shopping with their online efforts, Jupiter analysts said.

If a customer can't find an item on the shelf, make sure there is an Internet kiosk nearby where they can order online, they said. If they buy it online, but have a problem, make sure customers can return it to the store.

Otherwise, so-called "pure plays" -- Internet-only retailers and traditional-only retailers -- are in danger of a dot.com death, they said.

"...As consumers increase their use of the Internet, the opportunity for the Web to influence their online and off-line shopping behavior grows," said Ken Cassar, a senior analyst with Jupiter. "Simply put, businesses must integrate across channels."

But don't tell that to Greg Hawkins, chief executive officer of online retailer Buy.com (BUYX: Research, Estimates), who was among some 600 retailers, analysts and others attending the shopping forum at the Sheraton Hotel and Towers.

With 2.5 million customers in its first-quarter, the Aliso Viejo, Calif.-based retailer of books, videos and software is one of those new pure-play companies that experts believe could fall victim to the great Internet shakeout. With 2.5 million customers in its first-quarter, the Aliso Viejo, Calif.-based retailer of books, videos and software is one of those new pure-play companies that experts believe could fall victim to the great Internet shakeout.

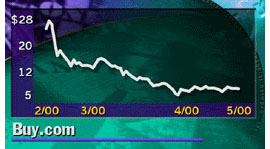

The company's stock has plunged from a 52-week high of 33 in February, when it went public, to the single digits, hurt by the post-holiday season slowdown and competition from BestBuy (BBY: Research, Estimates), Circuit City (CC: Research, Estimates) and Wal-Mart (WMT: Research, Estimates). But Hawkins is confident that Buy.com is going to be around for a long time.

Hawkins believes that pure-plays such as his are better able to work out the logistics of online selling, order fulfillment and customer service than traditional competitors who lack understanding about the subtle differences between attracting and keeping customers online as opposed to in the store.

Online retailers to leverage expertise

While traditional retailers like Toys R Us (TOY: Research, Estimates) and Best Buy grappled with filling orders on time over their Web sites last December, Buy.com spent the time simply getting the word out about its site.

"We've been doing this for a couple of years...and the skills that we built on the basics of the commerce engine are not trivial, the learning that we've gone through, we think puts us in good stead to really take the shopping experience to the next level," Hawkins said.

"So where we think our competitors in the off-line space will be really focused on building the basics of the e-commerce business," he added, "we hope to take those...and basically build an intangible set of benefits that will basically bring the customer back to us."

However, Jupiter projects that consumers will spend more than $235 billion in 2000 both on and off-line as a result of researching products on the Internet.

Online users in the U.S. are projected to account for 75 percent of all expected U.S. retail spending, both on and off-line in 2005, a 43 percent increase from 1999, according to Jupiter.

Hawkins believes that such projections will spur a dot.com "shakeout" that will cull many Internet retailers from the playing field. But it's the large, well-known pure plays such as Amazon.com and of course Buy.com, he believes will survive fierce competition from the likes of KMart and Wal-Mart because of their known brand names and high-level customer service.

"We had a pretty solid performance in the holiday period," Hawkins said. "We didn't run into the problems that a lot of the well-documented guys ran into. We weren't giving out $100 gift certificates because we couldn't ship stuff. So we believe we crossed that bridge...Now we can really focus on shopping experience."

And he could be right.

Specialty dot.coms will survive shakeout

Kurt Barnard, president of New Jersey-based Barnard's Retail Trend Report, an industry newsletter, agrees that many Internet-only retailers are in big trouble because they don't have a traditional store to fall back on, but just who will survive, or how things will eventually level out is anyone's guess, he said.

Barnard is skeptical about Jupiter's numbers, saying they sound too optimistic for bricks and mortar companies.

"I think the future lies in two different kinds of Internet players. The one is the bricks and clicks, and that will be the dominant factor in the business," Barnard said. "The other one will be highly specialized pure play click operations that carry things, do things that are simply not available elsewhere through other channels."

For instance, sites that specialize in upscale niche markets such as antiques or hard-to-find items will survive because they have a captive market, whereas online retailers that cater to more general markets for books, toys and videos will find it increasingly harder to stay alive in a crowded field.

"I think that Jupiter's conclusions are, absent documented evidence of this development, somewhat optimistic," Barnard said. "They (consumers) do their research on the computer, then they buy in the store, but they're not going to buy more than they had planned to buy. They might buy different things from what they had planned to buy, but there are only so many dollars to go around."

Barnard believes that off-line traditional retailers are likely to do a lot of business regardless of whether the Internet exists, so Jupiter's numbers should be taken with a grain of salt, he said.

|

|

|

|

|

|

|