|

Sara Lee to shed units

|

|

May 30, 2000: 2:14 p.m. ET

Firm will dump Coach, Champion divisions; buy coffee, sausage interests

|

NEW YORK (CNNfn) - Sara Lee Corp. said Tuesday it is shedding divisions with more than $4 billion in annual sales, including the Coach leather and Champion sports apparel units, and making smaller acquisitions in an attempt to refocus its business.

The divisions' sales constitute about 20 percent of the company's current sales base. Two of the divisions will be divested through initial public offerings in a process expected to stretch into 2002. The sales are expected to leave the company with $2.5 billion in funds, at least part of which is expected to go into future acquisitions.

The units include Coach, a leather goods maker with annual sales of $550 million; PYA/Monarch, the nation's fourth-largest foodservice distributor, with annual sales of $2.7 billion; sports and casual apparel maker Champion, which has annual sales of $500 million; and International Fabrics, a $400 million-a-year maker of raw materials used in intimate apparel, which the company recently acquired as part of its purchase of British fiber maker Courtaulds.

The company plans IPOs for Coach and PYA/Monarch by the end of the year, but will retain more than 80 percent in each company immediately after the IPO. It plans to sell its remaining interest in the units during the following 18 months. It plans direct sales of Champion and International Fabrics and already has talked to about nine potential buyers about International Fabrics and a number of potential buyers about Champion, according to C. Steve McMillan, the company's president and chief operating officer. The company plans IPOs for Coach and PYA/Monarch by the end of the year, but will retain more than 80 percent in each company immediately after the IPO. It plans to sell its remaining interest in the units during the following 18 months. It plans direct sales of Champion and International Fabrics and already has talked to about nine potential buyers about International Fabrics and a number of potential buyers about Champion, according to C. Steve McMillan, the company's president and chief operating officer.

Sale of foodservice unit to competitor possible

Part of the reason for the sale of PYA/Monarch is that it has put the company in the position of being a major supplier and competitor of foodservice distributors at the same time, said McMillan, who will assume the chief executive title in July. He said an IPO is planned due to potential tax consequences of the sale, but that it may yet be sold to a competitor.

"We have no aversion to selling to a strategic buyer," he said. "When we called foodservice companies over the weekend, we had a fair amount of interest by people who compete with PYA/Monarch. I'm not opposed to going down multiple tracks at the same time."

The specific financials for Coach and PYA/Monarch are not yet available from the company. But the foodservice division, of which PYA/Monarch is the primary operation, had sales of $2.1 billion in the nine months ended April 1, up 6.6 percent from a year ago. Net income was $43 million, up 10.5 percent.

Coach is seen in the industry as a very successful brand, but McMillan said it is just not a good fit for Sara Lee because of its strong fashion component, which makes it a more cyclical business than Sara Lee wants to focus on.

Offerings could generate interest in weak IPO market

Despite a weak current market for IPOs, some analysts believe these two offerings will do well.

"In a cooler IPO market, these are the types of deals that work better," said Irv DeGraw, research director of WorldFinanceNet.com, an online research firm in Sarasota, Fla. "These are fundamental deals that have some intrinsic value; real companies making real money. They won't go to the moon, but they wouldn't have gone to the moon anyhow. They'll come out and do reasonably well."

The acquisitions announced Tuesday include: Uniao's coffee business, which is the largest coffee roaster and seller in Brazil, the second-largest coffee market after the United States; Sol y Oro, the No. 1 branded intimate apparel and men's underwear company in Argentina; and a minority stake in Johnsonville Sausage Co., a U.S. maker of fresh sausage products. Each of those companies is privately owned.

McMillan said the company eventually intends to buy all of Johnsonville, following its pattern in previous minority investments.

Sara Lee did not disclose terms of the three acquisitions. The company said that the moves would affect earnings in fiscal 2001, which begins July 2. It also said that while it couldn't give details of charges and gains at this time, it believes the net effect will be a small one-time gain, and that the moves will have a slightly positive impact on earnings per share.

Food sector seeing hot M&A activity

The food industry has seen a flurry of merger and acquisition activity lately, with Dutch-Anglo consumer products company making an unsolicited $18.4 bid for Bestfoods (BFO: Research, Estimates). Snack maker Nabisco Holdings (NA: Research, Estimates) may be on the block as parent Nabisco Group Holdings (NGH: Research, Estimates) examines strategic options.

McMillan would not comment on whether Sara Lee would be looking to become a player in any of the deals, or in buying any of the brands of those companies once a sale is concluded. He said Sara Lee is willing to look at larger deals than it eyed in the past, though, including acquisitions that might lower earnings per share in the short term. But his focus appeared to be smaller deals, especially those that would further broaden its global reach in existing products.

"You can invest a lot of money filling in the gaps," he said.

Sara Lee (SLE: Research, Estimates) said it would focus on its food and beverage, intimates and underwear, and household products divisions. Its brands include Sara Lee, Douwe Egberts, Hillshire Farm, Hanes and Playtex. It has annual sales of about $20 billion.

McMillan said as part of the refocusing the company will start to have more centralized management of its various division, perhaps combining sales forces or other corporate support staffs. But he said the reorganization is not expected to lead to any large-scale reduction in employment, other than through the loss of employees who work for the divisions being sold.

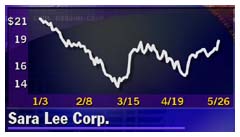

Investors were not excited about the news, sending Sara Lee shares down 5/16 to 18-7/16 in trading Tuesday, after a slight rise earlier in the session.

|

|

|

|

|

|

Sara Lee Corp.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|