|

Motorola outsources $30B

|

|

May 31, 2000: 4:29 p.m. ET

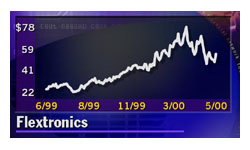

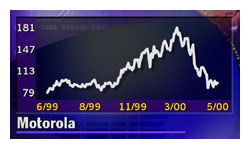

Flextronics to build wireless phones, pagers in five-year manufacturing pact

|

NEW YORK (CNNfn) - Motorola Inc., the world's second-largest supplier of wireless phones, signed a $30 billion manufacturing alliance Tuesday with contract electronics manufacturer Flextronics International Ltd.

Under the terms of the five-year pact, Flextronics will build a range of components and complete products for Motorola, including wireless phones, two-way pagers, and wireless infrastructure products.

Additionally, Motorola said it would pay $100 million for the rights to buy 11 million shares of Flextronics stock at a future date, representing roughly a five percent stake in the Singapore-based company.

Separately, Motorola executives told analysts at a conference in Schaumburg, Ill., that they expect sales in the company's network systems segment, including its cellular infrastructure business, and its broadband communications segment, to post strong growth in 2000.

The news sent shares of Flextronics (FLEX: Research, Estimates) sharply higher, adding 4-3/8 to close at 54-7/16. Motorola (MOT: Research, Estimates) stock gave back earlier gains, edging down 2-11/16 to close at 93-3/4. The news sent shares of Flextronics (FLEX: Research, Estimates) sharply higher, adding 4-3/8 to close at 54-7/16. Motorola (MOT: Research, Estimates) stock gave back earlier gains, edging down 2-11/16 to close at 93-3/4.

Motorola's deal with Flextronics represents the latest step in its own move to outsource more of its manufacturing operations to cut costs, and reflects a broader trend that has been taking place in the wireless communications industry.

Companies like Flextronics, which focus specifically on manufacturing and supply-chain management, can leverage their purchasing power and manufacturing infrastructure to more efficiently build the products, according to J. Keith Dunne, an analyst who tracks the contract electronics manufacturing industry at Robertson Stephens in San Francisco.

"As the communications world gets more deregulated, privatized and globalized, they're finding an increased need to be more cost competitive," Dunne said.

"Ericsson was the first to make a major announcement a few years back," Dunne added. "More recently, we saw Nortel, and that was followed by Lucent's announcement a few weeks ago, which will probably ultimately end up at about $10 billion being outsourced there. And now we have Motorola making a major announcement for outsourcing."

Motorola said its Communications Enterprise subsidiary, which currently produces its wireless communications components, will continue to be in "full-line manufacturing," but will see roughly 15 percent of its total output cut by this deal.

For Flextronics, the deal provides a significant boost to the company's top line. Last year, Flextronics generated revenue of $5.7 billion, providing manufacturing services to customers including Cisco Systems (CSCO: Research, Estimates), Philips Electronics and Ericsson (ERICY: Research, Estimates). For Flextronics, the deal provides a significant boost to the company's top line. Last year, Flextronics generated revenue of $5.7 billion, providing manufacturing services to customers including Cisco Systems (CSCO: Research, Estimates), Philips Electronics and Ericsson (ERICY: Research, Estimates).

Separately, Ed Breen, executive vice president of Motorola and president of the broadband communications sector, told analysts that the newly-formed division expects over $3.1 billion in sales in 2000.

In a meeting with financial analysts, Breen said the new unit, which created from the merger with General Instrument Corp. in January, should see digital set-top shipments increase 50 percent in 2000 over 1999, while cable-modem shipments are expected to exceed 2.5 million units and operating margins are expected to improve 2 percent.

Bo Hedfors, president of the company's network solutions sector, said he expects sales in that division, which including its cellular infrastructure business, to grow 10 percent-to-15 percent this year.

He added that operating margins will be flat with 1999 in that business unit, as the company continues "significant investments" in research and development in that area. That segment is on track for a 25 percent increase in overall order growth, and sales are expected to increase up to 20 percent, Hedfors said. Both those figures exclude satellite sales.

|

|

|

|

|

|

Motorola

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|