|

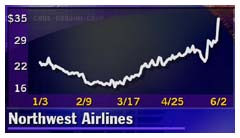

Northwest stock takes off

|

|

June 2, 2000: 3:12 p.m. ET

Report of deal with American spurs shares of nation's fourth largest carrier

By Staff Writer Chris Isidore

|

NEW YORK (CNNfn) - Shares of Northwest Airlines took off Friday on reports that it is in early negotiations to be bought by the owner of American Airlines, a merger that could create new leader among the world's airlines.

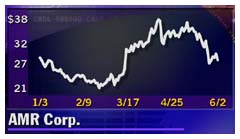

But concerns about complications and the costs associated with such a merger pushed down the shares of AMR Corp., owner of American.

At midday trading shares of Northwest were up 5-13/16, or 20 percent, to 34-7/8, while shares of AMR fell 1-1/2, or 5 percent, to 27-5/16.

The airlines had no comment on the report of talks, aired late Thursday by a television station in Northwest's home state of Minnesota. The station said top officials had met and held early talks about a possible deal. The airlines had no comment on the report of talks, aired late Thursday by a television station in Northwest's home state of Minnesota. The station said top officials had met and held early talks about a possible deal.

The report came in the wake of last week's announced deal by UAL Corp. (UAL: Research, Estimates), owner of United Airlines, the world's largest carrier, to buy US Airways Group Inc. (U: Research, Estimates), the nation's sixth largest airline. That $11.6 billion deal, which needs approval of regulators and shareholders including the employee-owners at UAL, would be the largest in industry history.

Pilots unions expect that talks will occur

Neither American nor Northwest would comment on the report. Officials with the powerful pilots unions at the two carriers say they have not been told of any negotiations being held, although they said they would not be surprised if such discussions are under way.

Top officials of the independent Allied Pilots Association, which represents American Airlines' flight crews, met with Donald Carty, AMR's chairman and chief executive, for more than two hours at a regularly scheduled labor-management meeting Thursday, said Gregg Overman, director of communications for APA, but there was little discussion of mergers other than general talk about the UAL-US Airways deal.

"Certainly there was no mention whatsoever of Northwest," said Overman. "That said, it wouldn't surprise any of us if they made a move in that direction. They looked at that two years ago. If you look at route structure of the two carriers, they're some complementary aspects to combing the two." "Certainly there was no mention whatsoever of Northwest," said Overman. "That said, it wouldn't surprise any of us if they made a move in that direction. They looked at that two years ago. If you look at route structure of the two carriers, they're some complementary aspects to combing the two."

The Air Line Pilots Association, which represents flight crews at Northwest and many other leading carriers including United and US Airways, also has not been told of any merger discussions, according to a statement put out on the union's hotline for Northwest pilots on Wednesday. But the union's leadership at Northwest thought there was enough chance of a merger that it has decided to reconstitute a merger committee as a precaution.

"We assume that discussions may occur among the remaining airlines in every possible combination," said Mark McClain, the head of the Northwest pilots unit at ALPA, in a statement Friday.

American and Northwest seen as good fit

An American-Northwest deal would likely dwarf that deal though, as it combined what are now the nation's second and fourth largest airlines to create a much larger player with strength around the globe. Where US Airway's stock is being purchased for $4.3 billion under terms of the UAL deal, Northwest's has a market capitalization of $4.2 billion before any takeover premium.

Jim Higgins, airline analyst with Donaldson Lufkin & Jenrette, said that a bid for Northwest by American would probably come in just under $60 a share, or a premium of about 66 percent above Friday's prices.

Higgins and other analysts contacted Friday said they believe there is serious, if early, talks taking place between American and Northwest.

The two carriers are a pretty good fit of networks with one another, said Ray Neidl, airline analyst with ING Barings. Northwest has strength in the Northern United States, American in the Sunbelt, and American's international strength in Latin American and trans-Atlantic routes, while Northwest is a major player in trans-Pacific traffic.

"It's a logical fit and logical action to take," said Neidl. He said the Northwest's strength in Asia is one of its most attractive features.

"I think American would kill to get that system," he told CNNfn Friday morning. (181KB WAV) (181KB AIFF)

Merger would put American in first for now

Adding last year's passenger traffic at American and Northwest comes to 184.4 billion passenger revenue miles, the common measure of airline traffic that counts each mile that a paying passenger flies. That would top United's 125.5 billion revenue passenger miles it recorded last year, and if US Airway's 41.6 billion revenue passenger miles are added in.

Higgins believe that the United-US Airways combination gives the combined carriers more growth potential and market domination long-term than an American-Northwest deal would.

"United is already much stronger than American on West Coast. With US Airways, it'll be stronger than American on the East Coast," he said. "If you dominate the two coasts, you dominate transcontinental flying. And United has a better international route structure than American does, or American plus Northwest does."

Both analysts say that concerns of Justice Department and Department of Transportation officials about airline competition and objection from unions makes any major merger difficult to achieve. Despite the interest in Northwest stock Friday, US Airways shares were trading Friday down 11/16 at 42-11/16, or almost 30 percent below the $60 a share offer price from UAL, reflecting investors' doubts the deal will be complete. Meanwhile UAL shares rose 11/16 to 53-13/16, as investors' fears of a bidding war for US Airways lessened.

"The stock prices (Friday) are telling you two completely different things," said Higgins. "Investors are very confused what is possible and what is not."

-- Click here to send email to Chris Isidore

|

|

|

|

|

|

|