|

China snubs Qualcomm

|

|

June 5, 2000: 7:41 p.m. ET

China's second-largest phone company backs away from wireless deal

|

NEW YORK (CNNfn) - Qualcomm Inc. confirmed Monday that China's second-largest phone company has postponed a decision to use its wireless communications technology.

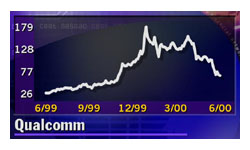

The news sent Qualcomm (QCOM: Research, Estimates) shares down 5-7/16, or 7.5 percent, to 67-1/4 in heavy Nasdaq trading.

Qualcomm, a San Diego-based company which owns the rights to a wireless communications standard called code-division multiple access, or CDMA, in February granted China Unicom royalty-bearing licenses to make and sell wireless handsets and infrastructure equipment using that technology.

However, China Unicom has decided instead to wait for a later version of the CDMA technology, according to Qualcomm spokeswoman Christine Trimble.

"We believe that CDMA will be deployed in China," Trimble said. "What they're talking about is deploying third-generation technology that uses Qualcomm's patents." She would not elaborate on the time frame under which CDMA is expected to be adopted there.

According to a report published over the weekend in China's official state newspaper, China Daily Business Weekly, China Unicom executives said they decided not to widely deploy CDMA because it uses narrow-band transmission rates. Instead, they have decided to wait until a later version that uses wide-band transmission rates, called WCDMA, becomes available.

Some analysts said that could push back China Unicom's plans to use Qualcomm technology in its infrastructure by as much as three years. And it raised even more questions about the developing competitive landscape in China's burgeoning wireless communications market.

"People were speculating that China would go CDMA, so clearly there were some disappointments," said Banc of America Securities analyst Mark McKechnie.

Though Qualcomm still stands to profit from the build-out of China's wireless infrastructure, many analysts had expected a substantial amount of Qualcomm's profit from its deal with China Unicom to come from sales of its own chipsets into the Chinese market.

In light of this development, there now are real questions as to how competitive the company will be in chipset sales, according to Pete Peterson, an analyst with the Prudential Volpe Technology Group. In light of this development, there now are real questions as to how competitive the company will be in chipset sales, according to Pete Peterson, an analyst with the Prudential Volpe Technology Group.

Qualcomm may lose some of that market to European companies, such as Ericsson (ERICY: Research, Estimates), which are aggressively pushing their own WCDMA programs, Peterson said.

"Qualcomm will still get royalties, because they have key intellectual property rights for using CDMA in mobile telephony," Peterson said. "What is a little more at risk is what it means for Qualcomm in terms of their chipset business."

"Qualcomm's strength was in selling chipsets into its own technology," Peterson added. "Inasmuch as China does not, on a dominant scale, deploy Qualcomm's technology, the prospects for their chip business are changed."

Shares of Qualcomm, which posted $3.9 billion in sales and earnings of $420 million or $2.46 per share for fiscal 1999, have shed nearly two-thirds of their value since January.

When the company posted its fiscal second-quarter earnings in April, Qualcomm executives reported a slowdown in sales of chipsets, but said they expected demand to pick up in the current quarter.

However, Wall Street now will be carefully re-evaluating the company's future business prospects, according to Peterson.

"Investors now have some ambiguity as to what share of the pie Qualcomm truly will have," he said. "There also is some ambiguity as to how big the pie will be. The expectation was that it was going to be a Qualcomm-flavor CDMA technology in China.

"Now it looks like the pie is going to have a significant portion of WCDMA in it, and the investment community has not developed a comfortable consensus on what that means," Peterson added. "That's why we're seeing the fluctuation."

-- Reuters contributed to this report

|

|

|

|

|

|

|