|

OPEC to raise oil output

|

|

June 21, 2000: 6:10 p.m. ET

Top oil producers agree to increase crude oil supply by a modest 3 percent

By Staff Writer Rod Cant

|

VIENNA, Austria (CNNfn) - Ministers from the world's top oil-producing nations agreed Wednesday to boost crude oil output modestly, but observers said the move is unlikely to provide much relief from record-high gas prices in the United States and around the world.

|

|

VIDEO

|

|

CNN's Dan Ronan reports on the big jump in gas prices across the country.

CNN's Dan Ronan reports on the big jump in gas prices across the country.

|

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

The Organization of Petroleum Exporting Countries approved a production increase of 708,000 barrels per day, or about 3 percent, for its 10 member countries. That would lift production to 25.4 million barrels per day, from 24.7 million barrels. The oil cartel said in a statement that it agreed to the increase "in recognition of its responsibility to contribute to market moderation and stability."

OPEC wants $25 a barrel

At a news conference in OPEC's Vienna headquarters Wednesday evening OPEC secretary general, Rilwanu Lukman, said:

"We'll do whatever it takes to bring the crude price to a reasonable level," adding that a "reasonable" level was "not below $20, and not above $30...the crux of the matter is that OPEC wants a price around $25." "We'll do whatever it takes to bring the crude price to a reasonable level," adding that a "reasonable" level was "not below $20, and not above $30...the crux of the matter is that OPEC wants a price around $25."

However, in an apparent admission that Wednesday's measures may not be enough to take the steam out of crude oil prices, Lukman promised further action if the price remained out of OPEC's target range. He did not rule out another emergency conference of ministers before OPEC's regular September conference. OPEC heads normally meet every March and September, but Wednesday's extraordinary meeting was called because of the excessive volatility in the market.

Click here to see what OPEC agreement means for investors

Lukman said in addition to the OPEC agreement, non-OPEC countries are expected to raise production by about 200,000 to 300,000 barrels per day. Non-OPEC oil producer Mexico said Wednesday it was raising its oil exports by 75,000 barrels per day to 1.745 million barrels per day on July 1.

In a sign of newly found unity, the agreement, effective July 1, will include Iran, which refused to sign a March deal to raise production out of anger over what it saw as heavy-handed U.S. lobbying efforts. Iran is OPEC's No. 2 producer after Saudi Arabia. Sanctions-bound Iraq, OPEC's eleventh member, is excluded from the pact.

Modest inflow of oil

The production increase would represent only a modest increase inflow of crude to the market. Major importers such as the United States have pushed for a 1 million barrel-a-day rise to calm pressure from consumers. U.S. motorists are angry that gas prices are pushing near $2 a gallon, while in western Europe, where taxation is higher, a gallon of gas costs almost $5.

The net effect of OPEC's move, in addition to extra supply from non-OPEC producers, is likely to be only an extra 600,000 to 800,000 barrels a day (rather than 1 million) on world markets, according to Lukman. The shortfall arises because some OPEC members have not stuck to their original quotas, and are already producing more oil than they promised to in March.

Experts say OPEC's move likely is not enough to lower oil prices toward the $25-per-barrel price OPEC is targeting.

The increase is "not nearly enough to make a significant dent in (barrel) prices," said Bruce Lanni, oil analyst at CIBC World Markets.

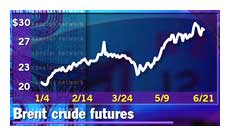

Oil prices rose slightly after the announcement, after swinging sharply earlier in the day.

Europe's benchmark for oil prices, Brent crude oil for delivery in three months, gained 23 cents to $29.25. Prices for U.S. crude also rose, with the August contract for light sweet crude up 55 cents at $31.20. Europe's benchmark for oil prices, Brent crude oil for delivery in three months, gained 23 cents to $29.25. Prices for U.S. crude also rose, with the August contract for light sweet crude up 55 cents at $31.20.

"We might see some reflection on crude prices as well as gasoline prices going forward, but not by much," Fadel Gheit, an analyst at Fahnestock & Co., told CNNfn just after the OPEC announcement. "I hope that people do not have high hopes for much lower crude prices or gasoline prices, because that is not in the cards."

Earlier in the day, one Wall Street analyst said that OPEC members were engaged in a lot of "wrangling," but would grudgingly agree to raise quotas.

"They know they can't leave here without a measurable production increase because at this price level, everybody's uncomfortable," Michael Rothman, an oil analyst at Merrill Lynch, told CNNfn. (393KB WAV)(393KB AIFF)

However, "there are a lot of countries within the OPEC who have questioned what the true need is within the market, and the underlying fear is pushing too many barrels in, and having prices weaken like they did in '98."

Scurrying through marble corridors

Venezuela holds the current presidency of OPEC and met Wednesday morning with delegations from Saudi Arabia, Algeria and Qatar amid the marble-floored corridors at the Hotel Bristol in central Vienna. The ministers had to battle their way through dozens of journalists and cameramen just to get through the hotel lobby, dislodging potted plants and shaking cabinets filled with expensive objects d'art. The media posse reflected the intense global interest in deliberations over a commodity which supplies 40 percent of the world's energy.

Saudi Arabia was believed to favor a larger rise, and while smaller exporters remain wary of triggering a sharp fall in prices, they too appeared to have fallen into line. Saudi Arabia was believed to favor a larger rise, and while smaller exporters remain wary of triggering a sharp fall in prices, they too appeared to have fallen into line.

"We want $25 a barrel," Chakib Khelil, Algeria's minister for energy and mines, said as he arrived for a meeting with his Venezuelan counterpart.

At its last meeting in March, OPEC members agreed after three days of talks to boost production by 7 percent. That partly reversed output cuts introduced 12 months earlier, which had led to a tripling in oil prices by the first quarter of 2000. Rising energy costs have forced interest rates higher in the United States and Europe as central banks try to keep inflation under control.

Dealers say that crude prices would be lower were it not for new environmental rules this summer in the United States that have restricted the U.S. gasoline supply pool.

Meanwhile, U.S. regulators have launched an investigation into whether gas prices in the Midwest resulted from price gouging by oil companies. The Federal Trade Commission plans to issue subpoenas to several oil companies.

|

|

|

|

|

|

|