|

Genome stocks end mixed

|

|

June 26, 2000: 12:43 p.m. ET

Many investors collect profit after announcement of gene milestone

|

NEW YORK (CNNfn) - Shares in many genomics companies closed lower Monday, as investors turned to profit taking after the landmark announcement that public and private researchers have completed a rough draft of the human genetic code.

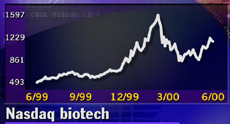

The retreat follows weeks of investor anticipation over the announcement of the genetic milestone. Many stocks in the turbulent sector - one of the most volatile on the market -- surged last week amid news that scientists were near completion of a blueprint of all the genes in the human body.

Shares of Celera Genomics (CRA: Research, Estimates), which together with the publicly funded Human Genome Project announced at the White House Monday that it had created a "rough draft" of the human genome, fell 15 to 112 in Monday trading.

The highly volatile stock has surged from a low of about $7 per share a year ago to as high as $276 in early March. The stock slid sharply this spring - as did other biotechnology stocks - amid concern over the company's business model and patent fears, but shares have recovered somewhat recently. In the past month, shares have jumped roughly 150 percent.

Incyte Genomics (INCY: Research, Estimates) slipped 2-5/8 to 89-5/16, recovering from bigger losses earlier in the session, while Human Genome Sciences Inc. (HGSI: Research, Estimates) slipped 2 to 143-3/8, up from as low as 128-7/16 earlier in the day. Gene Logic (GLGC: Research, Estimates) lost 1-11/16 to 37-1/16.

But some stocks in the sector finished higher. Millennium Pharmaceuticals (MLNM: Research, Estimates) edged up 1-15/16 to 121-1/2, after losing ground earlier in the day, and shares of Affymetrix Inc. (AFFX: Research, Estimates) also turned around, adding 5-25/32 to 181-15/32 after falling to as low as 155.

Analysts say that investors have known for months that the milestone announcement was due sometime in June. For many investors, the official announcement signaled it was time to sell, said Eric Schmidt, a genomics analyst at S.G. Cowen. Analysts say that investors have known for months that the milestone announcement was due sometime in June. For many investors, the official announcement signaled it was time to sell, said Eric Schmidt, a genomics analyst at S.G. Cowen.

"It was pure profit taking," he said. "These stocks have had big runs."

Also, many investors still are jittery about the prospects for biotech companies involved solely in genomics, analysts say. Most of these companies are not yet profitable, and there are many questions of how they will translate their genetic knowledge into profit.

For the long term, genomics has the potential to revolutionize medicine - giving scientists an in-depth understanding of the role genes play in causing disease - but practical applications from this knowledge likely are years away, said Faraz Naqvi, portfolio manager of the Dresdner RCM Biotechnology Fund.

"To say that this is going to be just a straight upward trajectory I think is wrong," he said. "What you need to do is understand that this is going to go up, it's going to go down, and it's going to do that in a pretty aggressive way." "To say that this is going to be just a straight upward trajectory I think is wrong," he said. "What you need to do is understand that this is going to go up, it's going to go down, and it's going to do that in a pretty aggressive way."

The publication of the human genome rough draft is only a first step, he said.

"It really is the blueprint," he said. "We have a long ways to go to build the skyscraper from those blueprints."

|

|

|

|

|

|

|