|

Lilly jumps on study result

|

|

June 29, 2000: 5:04 p.m. ET

Drug maker's experimental treatment for sepsis meets clinical targets

By Staff Writer Martha Slud

|

NEW YORK (CNNfn) - Eli Lilly and Co. announced a potential breakthrough Thursday in the quest to create a treatment for sepsis, a deadly bacterial infection that has confounded drug makers for years, triggering an 18 percent jump in the company's share price.

The Indianapolis-based pharmaceutical firm released promising test results of an experimental compound to treat the disease, which strikes about 1.5 million people worldwide each year and has a mortality rate of more than 30 percent. If the proposed treatment, Zovant, is approved, Lilly would succeed where many others have failed. Drug companies have tested at least 30 other experimental compounds to treat sepsis, but none has proved safe and effective.

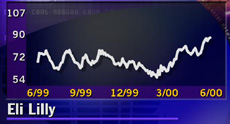

The surprise news led to a one-day jump in Eli Lilly (LLY: Research, Estimates) stock that was more typical of a highflying biotechnology company than a large-cap pharmaceutical stock. Shares gained 15-5/8 to 102-13/16 at 4 p.m. ET, after hitting as high as 109 earlier in the session, cracking a previous 52-week high of 89-7/16.

The stock was the most actively traded on the New York Stock Exchange, with about 24.3 million shares trading hands.

"This is a spectacular announcement," said Bernard Liu, a senior analyst at OrbiMed Advisors, which tracks pharmaceutical stocks. "Over the years we've just had so many product setbacks in sepsis trials." "This is a spectacular announcement," said Bernard Liu, a senior analyst at OrbiMed Advisors, which tracks pharmaceutical stocks. "Over the years we've just had so many product setbacks in sepsis trials."

Lilly said the results of an advanced Phase III clinical study of Zovant are so encouraging that the company has halted enrollment of new patients in the trial. A preliminary analysis of the results show the study has already met its goals, the company said.

The decision follows a recommendation by an independent board that is monitoring the study, which tracked 1,520 patients taking the drug.

"We're going to be saving hundreds of thousands of lives with this product," Eli Lilly CEO Sidney Taurel said in an interview with CNNfn.

"It's also a product which will have a tremendous economic benefit, because it is estimated that in this country alone sepsis costs $10 to $15 billion to the health care system" each year, he said. "This is an example of innovation which brings both longer lives to patients, and economies to the health care system." (WAVE393K) (AIF393K)

Zovant is based on a compound formulated from recombinant human activated protein C, a protein in the body that appears to be deficient in sepsis patients. Zovant is believed to help prevent clot formation, break up existing clots and reduce inflammation that occurs in the blood vessels.

Sepsis is a toxic condition caused by the spread of bacteria in the body.

Conditions such as pneumonia, trauma, surgery and burns, or illnesses such as cancer and AIDS typically trigger the disease, which often occurs among hospitalized patients. In the United States, the disease hits roughly 700,000 people each year.

On the market in 2001?

The clinical trial still requires another month or so of work, Taurel said. If the drug passes the trial, Lilly could apply for U.S. Food and Drug Administration approval in the first quarter of 2001.

The FDA then could grant an expedited review -- which often happens when regulators are considering a drug to treat a fatal illness - potentially allowing the product to go on the market by the end of next year.

The company would not comment on potential sales figures of Zovant. Drug analyst Bert Hazlett, of Robertson Stephens, says the market is hard to calculate, because there are no pharmaceuticals currently available to treat sepsis, but that Eli Lilly's drug could reach annual sales of at least $1 billion.

Eli Lilly is best known as the maker of antidepressant Prozac, its best-selling drug. But Prozac, which had sales of about $2.6 billion last year, is rapidly losing market share to newer rivals. The drug also will face generic competition after its patent expires in 2003.

Industry analysts say that the introduction of Zovant would help calm investor concerns over the future of the company's product pipeline. Industry analysts say that the introduction of Zovant would help calm investor concerns over the future of the company's product pipeline.

"There is clear unmet medical need in sepsis," said Liu, who has a "buy" rating on the stock. "A product like this for Lilly would enhance their long-term growth prospects."

Analysts also point to promising results in late-stage trials of the company's experimental bone-building hormone, known as PTH.

Wall Street analysts had mixed opinions about the runup in Lilly stock. While J.P. Morgan upgraded Lilly shares to a "buy" from "market perform," the brokerage Wasserstein Perella cut its rating on the stock to "hold" from "buy," concerned that the one-day surge in Lilly shares was not justified.

|

|

|

|

|

|

Eli Lilly and Co.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|