|

Telekom eyes U.S. merger

|

|

July 11, 2000: 5:16 p.m. ET

Investors hedge bets on where Deutsche Telekom's true intentions lay

By Staff Writers Tom Johnson and Jamey Keaten

|

NEW YORK (CNNfn) - Deutsche Telekom AG's voracious appetite for U.S. telecommunications assets left analysts and investors mulling a number of possible merger scenarios Tuesday, although a consensus favorite did not immediately emerge.

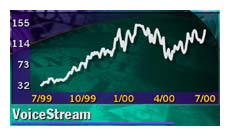

Both the Wall Street Journal and Financial Times reported Tuesday that Germany's Deutsche Telekom, Europe's largest telecom company and the world's third-largest carrier, had entered advanced talks to acquire VoiceStream Wireless: Negotiations that the Financial Times said values the U.S. wireless company in excess of $30 billion.

Word of the discussions follow on the heels of renewed speculation that the German powerhouse, which has compiled roughly $100 billion to spend on acquisitions, is gearing up to make a play for telecom conglomerate Sprint Corp., which is mulling calling off its $119 billion merger with Worldcom Corp.

Analysts said Tuesday that either scenario would fulfill Deutsche Telekom's long-stated goal of gaining significant access to the U.S. telecommunications market, although acquiring VoiceStream would still leave the company looking to add wireline operations as well, possibly in the form of Qwest Communications (Q: Research, Estimates), the No. 4 U.S. long-distance company behind Sprint. Analysts said Tuesday that either scenario would fulfill Deutsche Telekom's long-stated goal of gaining significant access to the U.S. telecommunications market, although acquiring VoiceStream would still leave the company looking to add wireline operations as well, possibly in the form of Qwest Communications (Q: Research, Estimates), the No. 4 U.S. long-distance company behind Sprint.

"Deutsche Telekom is playing its hand right now, in my opinion," said Frank Marsala, a wireless analyst with ING Barings. "It's hard to call at this point. I could defend both scenarios."

Most analysts interviewed by CNNfn.com Tuesday called the timing of the press reports linking Deutsche Telekom and VoiceStream most likely a ploy on the German company's part to bring Sprint (FON: Research, Estimates) to the negotiating table, although a bid for both companies isn't out of the question, the Times said, offering no sources.

There's also constant speculation that Deutsche Telekom might make a play for Nextel Communications (NXTL: Research, Estimates), the largest remaining independent mobile phone operator remaining in the United States. Like VoiceStream, however, Nextel would leave Deutsche without a significant wireline backbone to carry data.

"My guess is they are talking to everybody," said Christopher Larsen, an analyst with Prudential Securities. "They'd be foolish not to. One of the reasons they may have leaked this is they want to get Sprint to the table."

VoiceStream (VSTR: Research, Estimates) would give Deutsche Telekom a nationwide U.S. mobile phone company that uses the same technology and platform as the one used by Deutsche and other European cell phone operators -- the global system for mobile communication, or GSM.

A Deutsche Telekom spokesman said the company wouldn't comment on media speculation, but reiterated the company's "four pillars" of growth strategy: online services, mobile communications, Internet access, and infrastructure and business systems. A Deutsche Telekom spokesman said the company wouldn't comment on media speculation, but reiterated the company's "four pillars" of growth strategy: online services, mobile communications, Internet access, and infrastructure and business systems.

A VoiceStream spokeswoman also declined comment.

Acquiring Sprint would provide Deutsche with a more mature wireless operation in Sprint PCS (PCS: Research, Estimates), currently the No. 3 U.S. wireless operation, although it will fall to No. 4 when SBC Communications (SBC: Research, Estimates) completes its planned purchase of certain wireless assets held by the former GTE Corp. and seals an alliance with BellSouth Corp. (BLS: Research, Estimates).

It also would give the company the wireline assets it covets, something VoiceStream cannot offer. Analysts also believe a deal for VoiceStream and a separate wireline company, such as Qwest, could ultimately prove more expensive for Deutsche Telekom, even though it would likely have to pay close to the $119 billion Worldcom proposed for Sprint.

"I don't know Deutsche Telecom very well, but in discussions with our European analysts, it appears Sprint is a better fit," said Jeffrey Hines, an analyst with Deutsche Banc Alex Brown, who valued VoiceStream at between $160 and $192 per share, or $34 billion to $41 billion.

Another analyst, who spoke on the condition of anonymity, said Deutsche Telekom would have to offer a premium of "at least 20 [percent] to 25 percent" for VoiceStream.

Based on its closing price of 139-1/16 Tuesday, up 14-1/8 for the day, that would put the Bellevue, Wash.-based company's price tag in the neighborhood of $37 billion.

But some analysts believe that price could climb significantly higher because Deutsche Telekom is apparently not the only company interested in VoiceStream, which boasts about 1.8 million customers with a presence in 23 of the 25 top U.S. markets.

France Telekom, the company's main rival, has also reportedly shown an interest and some analysts believe Worldcom could enter the fray if its deal for Sprint falls through. Additionally, Deutsche Telekom bid could step up pressure on Japan's Nippon Telephone & Telegraph (NTT).

Media reports in May said NTT held talks with VoiceStream about buying a slice of the U.S. company. Hong Kong-based conglomerate Hutchison Whampoa already has a 23 percent stake in VoiceStream, while Finnish telecom operator Sonera owns 9 percent.

Sprint, meanwhile, retreated 4-1/4 to 47-1/2 in midday trading on the belief that Deutsche Telekom's interest might be waning. The Westwood, Kan.-based company is still legally bound to its merger agreement with Worldcom (WCOM: Research, Estimates), even though the European Union has already blocked the deal and the U.S. Department of Justice has filed suit to do the same.

Sprint/Worldcom announcement expected soon

Sources familiar with Sprint's thinking said Tuesday the company is expected to make a "definitive" announcement later this week concerning its future plans with Worldcom. But even if the company decides to walk away from the Worldcom merger, Sprint is not expected to immediately announce another deal, the sources said.

Following a speech to the Wireless Communications Association Tuesday, Worldcom President and CEO Bernard Ebbers declined to comment on the merger process, according to the Associated Press.

"I don't think there is much left to say," he said.

Either way, there could also be significant regulatory hurdles to consider if Deutsche Telekom attempts to swallow a U.S. company. Last Friday, 30 U.S. senators signaled their opposition to a Telekom takeover of Sprint, describing any bid by a company owned by another government as contrary to U.S. law. The German government owns 59 percent of Deutsche Telekom.

That makes purchasing both Sprint and VoiceStream even more unlikely, analysts said.

"You could do a deal for PCS, but then you have regulatory problems," Hines said. "So the question becomes, is there a cheaper way?"

One possibility, Hines said, is Telephone and Data Systems (TDS: Research, Estimates), a local carrier boasting more than 3.4 million customers, which also owns majority stake in United States Cellular and 14 percent of VoiceStream.

Hines valued TDS at $151 per share, which values the company at more than $9.1 billion. TDS closed Tuesday at 117-15/16, up 10-7/16.

Shares of Deutsche Telekom (FDTE) shed nearly 3 percent to 59.70 euros in Frankfurt Tuesday. The company's American depositary receipts, traded on the New York Stock Exchange, lost 2 to 56-7/8.

|

|

|

|

|

|

|