|

Motorola profit soars

|

|

July 12, 2000: 8:06 p.m. ET

Wireless telephone maker equals estimates; sales rise 22 percent

By Staff Writer Richard Richtmyer

|

NEW YORK (CNNfn) - Motorola Inc., the world's second-largest supplier of wireless phones, on Wednesday reported a second-quarter operating profit that nearly doubled from the same period last year amid stronger sales in broadband communications and network systems.

Profits in the company's key wireless handset business also improved, but that unit's sales fell short of some analyst's expectations.

Excluding special charges, Motorola logged earnings from continuing operations of $515 million, or 23 cents per share, matching the consensus estimate of analysts polled by earnings tracker First Call.

Sales from ongoing operations rose 22 percent to $9.3 billion from $7.6 billion a year earlier.

Including one-time charges, Motorola's net income for the quarter was $204 million, or 9 cents per share, compared with $255 million, or 12 cents per share a year ago. The 1999 figures have been restated to reflect the company's $17 billion merger with General Instrument Corp. and a 3-for-1 stock split which was effective June 1.

"Overall company results continue to show solid improvement in sales and profits," Robert L. Growney, Motorola's president and chief operating officer, said in a statement.

"We are particularly pleased by the performance of the Broadband Communications and Network Systems segments," Growney added.

Handset profits improve, revenue misses target

But the business line Wall Street was focusing on is Motorola's Personal Communications segment, which includes its production of wireless phones. In April, Motorola reported a sharp decline in that unit's operating profit, which executives blamed on a shift toward selling lower-end phones and increased spending on electronic components and advertising.

In the most recent quarter, the company reported that sales in that segment rose 20 percent to $3.3 billion and operating profit increased to $132 million, compared with $125 million during the same period last year.

The Personal Communications' units operating profit margin in the second quarter was 4 percent of sales, versus 2 percent of sales in the first quarter. The improvement was driven by improved gross margins from phone products and better overall conversion costs in manufacturing, executives said.

"We made good progress in addressing the profitability issues experienced by the Personal Communications Segment in the first quarter," Growney said.

However, analysts said it appeared as if much of the improvements in profitability had been derived from reduction in sales of some lower-end phones in Europe. By doing so, the company was able to improve operating margins, but its handset revenue came in below expectations, they said.

"They showed some improvement on operating margins in handsets, which is what everybody was looking at," Pete Peterson, an analyst with Prudential Volpe Technology Group, told CNNfn.com.

"The interesting thing there, though, is that they did cut back on sales of lower margin phones. That helped them get the higher operating margin, but it did cost them some revenue," Peterson added.

Peterson said he had been expecting the Personal Communications group's revenue to be $3.6 billion.

Wireless handset sales also fell short of Deutsche Banc Alex. Brown analyst Brian Modoff's forecast. He had expected to see a figure closer to $3.9 billion.

"We don't have unit numbers yet, but it's like déjà vu with the quarter," Modoff said. "The other businesses are strong, and parts of the handset business are strong. But handsets, overall, are begging some questions."

Executives at Motorola will field those questions Thursday morning when they host a conference call with analysts and investors that also will be available by live Webcast beginning at 8:00 a.m. EDT.

"The thing we're going to want to know is where do unit sales go moving forward," said Prudential's Peterson. "We'd like to see plans for unit growth to continue along with margin growth."

"We'd also like some assurances that the company can meet its previously-stated goal of roughly 10 percent operating margins for handsets by the end of the year."

Motorola began the second quarter with significant backlog on its newer lower-tier wireless phones, up more than 60 percent versus a year ago, the company reported.

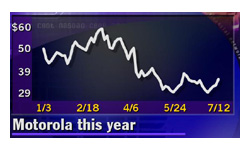

Motorola (MOT: Research, Estimates) shares rose 2-13/16, or 8.4 percent, to 36-3/8 in New York Stock Exchange trade ahead of the earnings announcement. They slipped to 33-1/16 shortly after the news, but then bounced back to 35-1/2, on the Instinet ECN.

The stock, however, is down sharply from its 12-month high of 61-1/2 in early March.

Other units show signs of strength

Sales of broadband communications equipment, such as cable modems, rose 23 percent to $768 million, and orders increased 28 percent to $900 million from a year ago, the company said. Operating profit in the segment rose to $129 million from $78 million a year earlier, which executives attributed to sales growth and synergies achieved through the merger with General Instrument.

Sales within the company's Network Systems segment, which includes satellite communications equipment, rose 23 percent to $2 billion, and orders were up 37 percent at $2.1 billion, the company said. Operating profit there increased to $256 million from $169 million a year ago. Sales within the company's Network Systems segment, which includes satellite communications equipment, rose 23 percent to $2 billion, and orders were up 37 percent at $2.1 billion, the company said. Operating profit there increased to $256 million from $169 million a year ago.

Motorola's semiconductor sales increased 27 percent to $2 billion. Orders were up 31 percent at $2.2 billion while operating profits rose to $166 million from $24 million a year ago.

Sales within Motorola's Commercial, Government and Industrial Systems segment rose 22 percent to $1.1 billion. Orders rose 5 percent to $1.2 billion, and operating profits increased to $114 million from $91 million last year.

Two-way radio equipment sales were higher in all regions, with very significant growth in Europe. Orders were higher in all regions, with particular strength in Asia, Motorola said.

During the quarter, the company inked contracts with the cities of Phoenix and Mesa, Ariz., and with the Korea High Speed Rail Corp. for two-way radio communications systems compliant with the Project 25 standard for digital public safety communications. Motorola also was awarded contracts for equipment based on the TETRA (Terrestrial Trunked Radio) standard for deployment in Malaysia, Nigeria, South Africa, and Spain.

Looking ahead, Christopher B. Galvin, Motorola's chairman and chief executive, promised continued improvements in the company's profitability as it continues to sharpen its focus on the growth areas of its business.

"This is our eighth consecutive quarter of delivering on our promises to achieve a significant turnaround, improved profitability and a strategic refocusing of Motorola around wireless, broadband and the Internet," Galvin said in a statement.

"Given the expected strength of global economies over the next year or so, we intend that Motorola shareholders will benefit from our continued focus on crisp execution and improving profitable growth," Galvin added.

For the first half of the year, sales from Motorola's ongoing operations rose 21 percent to $18 billion from $14.9 billion during the first half of 1999. Including sales from businesses sold after the second quarter in 1999, sales increased 14 percent from $15.8 billion a year ago.

First-half earnings from ongoing operations, excluding special items, were $963 million, or 43 cents per share, compared with $453 million, or 21 cents per share a year earlier. Including the earnings from discontinued operations, the company's profit was $964 million, or 43 cents per share, compared with $524 million, or 24 cents per share a year earlier.

|

|

|

|

|

|

|