|

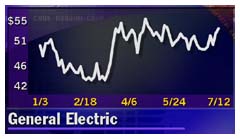

GE beats 2Q forecasts

|

|

July 13, 2000: 8:55 a.m. ET

Posts record profit as e-commerce efforts help lift sales, improve margins

|

NEW YORK (CNNfn) - General Electric Co. posted record second-quarter profits Thursday, edging past forecasts for the period as strong gains in its finance and power systems divisions and an increase in its Internet-related business helped boost its bottom line.

The company had net income of $3.4 billion, or 34 cents a diluted share. Analysts surveyed by earnings tracker First Call forecast earnings of 33 cents a share.

The Fairfield, Conn.-based conglomerate earned $2.8 billion, or 28 cents a share, a year earlier when adjusted for a 3-for-1 stock split since then.

The company's operating margin improved to 20.4 percent of sales from 19.3 percent a year earlier. The company's operating margin improved to 20.4 percent of sales from 19.3 percent a year earlier.

Earnings improved across all its various divisions, with GE Capital, its largest, showing a 17 percent gain in profits to $1.3 billion. Power systems, its second-largest unit, had a 46 percent profit gain to $752 million. Its NBC television unit's profits rose 17 percent to $635 million, despite the fact that ABC's "Who Wants to Be a Millionaire" game show allowed it to catch NBC's ratings in the key 18-to-39 age demographic group.

Revenue for the Dow Jones industrial index component rose 20 percent to $32.9 billion from $27.4 billion a year earlier. Each unit reported double-digit revenue growth in the period. While the company said that e-commerce initiatives in its various units helped sales, it did not give details.

The period was the last second quarter that Jack Welch will head the company as chairman and chief executive. Welch, one of the nation's most admired chief executives, is set to retire in April. Concerns about his yet unnamed successor have hurt stock performance this year despite its strong earnings.

Welch said the second-quarter results position the company to post record full year results. First Call forecasts the company to earn $1.25 a share in 2000, up from $1.07 a share a year earlier when adjusted for the stock split.

For the first six months, net income rose 20 percent to $6.0 billion, or 59 cents a share, from $5.0 billion, or 50 cents a share, a year earlier. Revenue gained 22 percent to $62.8 billion from $52.6 billion.

Shares of GE (GE: Research, Estimates), the world's largest company in terms of market capitalization, slipped 5/8 to 58-1/8 in early trading Thursday.

|

|

|

|

|

|

GE

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|