|

WCOM, Sprint disconnect

|

|

July 13, 2000: 3:47 p.m. ET

Telecoms terminate $117.7B merger pact; Wall St. speculates on next move

|

NEW YORK (CNNfn) - Faced with seemingly insurmountable regulatory obstacles, WorldCom Inc. and Sprint Corp. called off their $117.7 billion merger Thursday, leaving investors to ponder the independent futures of both companies.

In hanging up on their deal, the richest ever at the time of its announcement last October, the No. 2 and No. 3 U.S. long-distance companies said they could not comply with conditions demanded by the U.S. Department of Justice; conditions they claimed would "compromise the customer benefits and financial benefits of the merger."

Both companies went on to proclaim their operations sound and able to grow independently. But the official cancellation only served to further fuel speculation on Wall Street that Sprint and Worldcom will both jump back into the M&A game quickly.

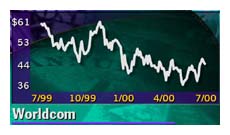

WorldCom (WCOM: Research, Estimates) shares soared 4-3/8 to 48-7/8 in mid-afternoon Thursday, while Sprint shed its early gains, falling 3/16 to 46-13/16.

Analysts have widely linked Sprint (FON: Research, Estimates) as a likely acquisition target of several suitors, including Germany's Deutsche Telekom, which has compiled a $100 billion war chest to capture a sizable share of the U.S. telecommunications market.

But Sprint Chief Operating Officer and President Ronald LaMay told CNNfn.com that his company had not been contacted by any other suitors and didn't plan to initiate any discussions.

"We have no intention of initiating any contact with any of these reported suitors that everyone has been talking about," LaMay said. "We have enormous opportunities and our energy is focused capitalizing on those opportunities."

DOJ 'welcomes' cancellation

The failed union comes two weeks after the Department of Justice sued to block the merger, claiming the deal would harm competition in the U.S. long-distance market and stifle the technological innovation that has driven the Internet's growth. The DOJ said it could not proceed with any trial on the matter until next year at the earliest.

"We very much regret that our merger with Sprint was not allowed to proceed," said WorldCom CEO Bernard Ebbers, who has been openly critical of DOJ chief Janet Reno and Assistant Attorney General Joel Klein in recent days. "We very much regret that our merger with Sprint was not allowed to proceed," said WorldCom CEO Bernard Ebbers, who has been openly critical of DOJ chief Janet Reno and Assistant Attorney General Joel Klein in recent days.

"Opposition to this merger just adds to the list of (Federal Communications Commission Chairman William) Kennard-Klein policies that ultimately will reduce innovation and choice and raise the cost of telephone services for residential customers, particularly those in rural America," Ebbers said.

LaMay agreed with Ebbers and said U.S. telecommunications companies would have to think long and hard before jumping into a major deal again, given the stance DOJ officials took on the Sprint/Worldcom deal.

"I think a different orientation toward public policy is going to have to prevail if carriers in this country are going to get the opportunity to expand and compete on a global basis," he said. "We think the DOJ got it wrong for sure [on this deal]. We think the merger we had proposed was very pro-competitive."

Still, Klein said he welcomed word that the deal had collapsed.

"The merger would have led to higher prices, lower service quality, and less innovation for millions of American consumers and businesses," he said. "America's consumers and businesses will continue to reap the benefits of competition in the long distance, internet backbone and data network services businesses."

Since both companies mutually agreed to terminate the merger, no break-up fee will be incurred by either side.

Deal talk heats back up

Still, analysts said the speculation of future deals was inevitable. In addition to the Sprint/Deutsche Telekom rumors, some analysts have speculated Worldcom (WCOM: Research, Estimates) might quickly move to make a bid for wireless carrier VoiceStream Communications (VSTR: Research, Estimates), hoping to fill the void Sprint's wireless subsidiary was poised to fill.

"We're all guessing at this point, basically throwing darts at a number of possible scenarios," said Gregory Miller, a telecommunications analyst with ING Barings.

"For Sprint, I expectation is that they do wind up being bought eventually, maybe not immediately, though," said Anna-Mara Kovacs, an analyst with Janney Montgomery Scott.

Still, Kovacs said that, fundamentally, Sprint's balance sheet appears sound, although Wall Street will get a better look at things next week when the company unveils its second-quarter earnings.

LaMay insisted Sprint is poised to continue its record of solid growth, despite speculation that the loss of several key executives during the merger process would hurt the company.

"We realized that the completion of this merger was not a certainty," he said. "We also approached this that we were going to go into the merger with the greatest momentum possible. As the reports have unfolded, I think our employees have been adapting as we've gone alone."

|

|

|

|

|

|

Sprint Corp.

WorldCom

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|