|

Apple noses by estimates

|

|

July 18, 2000: 8:22 p.m. ET

Apple stock dips as sales of iMac's are slower than expected

|

NEW YORK (CNNfn) - Apple Computer Inc. reported slightly better than expected fiscal third quarter profits Tuesday, but its stock declined in after-hours trading as sales of its popular iMac line came in below expectations.

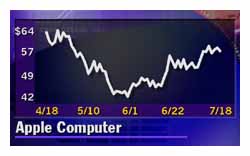

In trading Tuesday, Apple closed down 1-1/16 to 57-1/4. Shares fell another 3-1/4 to 54 after-hours.

After the market closed Tuesday, the Cupertino, Calif.-based company said that it earned $200 million, or 55 cents a share, in the three months ended July 1, down from $203 million or 60 cents a share in the same period a year ago. However, excluding one-time gains of $37 million, Apple earned 45 cents a share in the latest period, a penny ahead of Wall Street estimates.

Sales rose 17 percent to $1.83 billion compared to $1.56 billion a year ago, with gross margins rising to 29.8 percent from 27.4 percent in the same period last year. Apple (AAPL: Research, Estimates) said that international sales accounted for 46 percent of the quarter's revenue.

Apple reported sales of 1.016 million units during the quarter, including 350,000 Power Mac G4 systems and 450,000 iMac systems. The company said that iMac sales were below expectations, apparently because consumers are waiting for the company to introduce a new version of the machine, rather than because of industry-wide softness. Apple hasn't updated the iMac since last October, when it unveiled a family of machines featuring desktop video.

"I don't think we have any evidence that it is an industry-wide slowdown," Fred Anderson, Apple's chief financial officer, said during a conference call with analysts after the earnings were released.

However, product changes are on the way for Apple users. Wednesday's highly anticipated MacWorld tradeshow in New York City will feature a number of new product introductions, most likely presented by Steve Jobs in his keynote address, Anderson said.

"It's been about nine months since we have had any major introductions," the CFO said. "We're going to change that tomorrow and we think you will be impressed. We have a strong pipeline of future products in place and will introduce many new products in the coming 12 months."

Outlook for the fourth quarter

Apple said it expects both units and revenue to increase sequentially in the fourth quarter because of planned product introductions. Gross margins are expected to decline because of increases in component prices and the anticipated product mix, the company said. Operating expenses are projected to rise by about $15 million.

Looking ahead to fiscal 2001, Anderson said that Apple aims to increase its revenue by 20 percent and its earnings per share by 15 percent. Looking ahead to fiscal 2001, Anderson said that Apple aims to increase its revenue by 20 percent and its earnings per share by 15 percent.

Circuit City to sell iMacs

Apple also announced a deal with Circuit City (CC: Research, Estimates), in which the company's iMacs, iBooks and AirPort product lines will be sold in Circuit City's 570 stores. Apple's Anderson said that the Circuit City deal has been in the planning stage for some time and had no impact on third quarter sales.

"We believe the addition of Circuit City will complement our existing retail coverage and help us to reach new customers, especially first-time buyers," Apple said. "We'll start shipping products to them in the next few weeks and we are working with them to create an attractive buying experience."

Analysts won't bite

Many Apple watchers were waiting until after Wednesday's analyst meeting before issuing their thoughts about the third-quarter numbers.

Bear Stearns analyst Andrew Neff said in a research note ahead of the earnings results: "The stock usually runs up in anticipation of the keynote speech and earnings and often sells off on the news, no matter how good it is."

"Steve Jobs' presence at the analyst meeting can help to energize the financial community and offset some of the 'sell on the news' pressures," said Neff.

"Investors do not appreciate the superior financial dynamics at Apple and do not accord it the valuation it deserves - because, in our minds -- Apple is still viewed by many as a reformed alcoholic - just one step away from returning to the gutter. We have a different view and think there is a great team," Neff said.

|

|

|

|

|

|

Apple Computer

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|