|

Can biotech make a buck?

|

|

July 24, 2000: 1:25 p.m. ET

After rocky start, the biotech industry is on the verge of becoming profitable

By Staff Writer Martha Slud

|

NEW YORK (CNNfn) - Well before the arrival of the Internet, biotechnology companies were Wall Street's wild bunch -- burning through cash, racking up massive losses and often written off as nothing more than a flash in the pan.

But now, many observers say, the two-decade-old industry is on the verge of a major turnaround -- with scores of maturing biotech firms expected to transform themselves from money-losing ventures into profitable corporations over the next few years.

Biotech companies have had a long gestation phase -- spending years engaged in costly research and development and risky, early-stage clinical trials. But thanks to major scientific advances and a slew of cutting-edge drugs expected to go on the market soon, real revenue and sustainable profit for many firms may be within reach.

"The industry is still pretty young, so it's not surprising that it's taken a while to reach this stage," notes Charles Bugg, chairman and chief executive officer of BioCryst Pharmaceuticals Inc. (BCRX: Research, Estimates), a 14-year-old Birmingham, Ala.-based company that's expected to become profitable sometime next year.

"Profitability has been a real focus of our company -- that's kind of a new thing in biotech," he said. "Profitability has been a real focus of our company -- that's kind of a new thing in biotech," he said.

BioCryst has licensed development of an experimental drug to treat and prevent influenza to pharmaceutical powerhouse Johnson & Johnson (JNJ: Research, Estimates). The flu drug, known by research number BCX-1812, is now in late-stage clinical trials.

Based on successful completion of those trials and continued milestone payments by J&J, BioCryst is expected to post earnings of 40 cents per share next year, up from an estimated 35-cent loss in 2000, according to biotech analysts surveyed by earnings tracker First Call.

An elite group

Currently, only about two dozen of the several hundred publicly traded U.S. biotech companies are in the black, estimates Timothy Bepler, manager of the Orbitex Health and Biotechnology Fund.

But over the next five years, the number of profitable biotech firms should jump to more than 100, he said.

"This industry is unique in having a very long product development cycle," he said. "That's why the industry hasn't really made money for the past 20 years."

Profitable firms include industry bellwethers Amgen Inc. (AMGN: Research, Estimates), Biogen Inc. (BGEN: Research, Estimates) and Genentech Inc. (DNA: Research, Estimates), as well as MedImmune Inc. (MEDI: Research, Estimates) -- maker of the children's respiratory illness drug Synagis -- and Immunex Corp. (IMNX: Research, Estimates), which developed the rheumatoid arthritis drug Enbrel.

Of course, lack of profit hasn't stopped biotech firms from moving forward -- or discouraged investors from pouring money into these companies. Of course, lack of profit hasn't stopped biotech firms from moving forward -- or discouraged investors from pouring money into these companies.

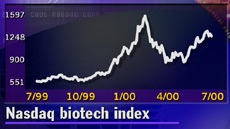

The biotech industry went on an unprecedented bull run last fall, fueled in part by excitement over the burgeoning field of genomics -- the study of the mapping of genes.

Most stocks in the sector have fallen sharply since the biotech wave crested in early spring, but shares in many companies are still trading many times higher than their year-ago levels.

For biotech companies, becoming profitable will improve their balance sheets -- making them less reliant on outside funding -- and go a long way toward gaining Wall Street's trust, analysts say. For biotech companies, becoming profitable will improve their balance sheets -- making them less reliant on outside funding -- and go a long way toward gaining Wall Street's trust, analysts say.

Transforming themselves into money-making businesses also will improve companies' bargaining power when negotiating product licensing deals with bigger firms, allowing them to share more of the profits, analysts say.

The brightening financial outlook isn't the result of anything magical -- instead it's the culmination of years of investment, notes Ken Kam, manager of the Marketocracy Medical Specialty Fund.

It's no longer a bet on whether the science will work, he said. Many companies are well beyond the experimental stage and have promising compounds in late-stage trials -- lessening the chance of failure, he said. It's no longer a bet on whether the science will work, he said. Many companies are well beyond the experimental stage and have promising compounds in late-stage trials -- lessening the chance of failure, he said.

Last year, the U.S. Food and Drug Administration approved 22 biotech drugs and vaccines, bringing the total number of biotech drugs and vaccines on the market to 92, according to the Washington-based Biotechnology Industry Organization. Roughly 350 biotech drugs are now in advanced clinical trials.

"The bottom line is this is fueled by something that is real and tangible," said Kam. "This isn't just people waking up and saying, 'I'm bullish on biotech today.' It's fueled by real scientific advances."

Genomics firms not included

The profitability outlook for the highly touted genomics sector is not as clear.

Many analysts are dubious about the business models of some of these companies, with a lot of unanswered questions about how they will make money over the long run.

Celera Genomics Group (DRA: Research, Estimates), which captured headlines last month along with the publicly funded Human Genome Project by announcing it had mapped virtually the entire human genome, is not expected to become profitable for the foreseeable future.

The Rockville, Md.-based company, which licenses access to its genomics database to pharmaceutical and biotech companies and other researchers, is expected to continue losing money at least through 2002.

Up until now, genomics companies have generated revenue by selling access to their databases, notes Kam. But "the real money comes when they can identify targets (mutant genes that could be treated with drugs)," he said. "All of that sort of starts now." Up until now, genomics companies have generated revenue by selling access to their databases, notes Kam. But "the real money comes when they can identify targets (mutant genes that could be treated with drugs)," he said. "All of that sort of starts now."

A number of genomics companies, however, do anticipate making money in the next few years. Human Genome Sciences Inc. (HGSI: Research, Estimates), which is developing drugs for cancer and other diseases based on genetic discoveries, is projected to begin turning a profit in 2002.

The company, also based in Rockville, Md., is expected to lose $2.11 per share this year; lose another $1.09 next year, and turn around with a 17-cent-per-share gain in 2002.

Another genomics firm, Incyte Genomics Inc. (INCY: Research, Estimates) of Palo Alto, Calif., is expected to begin making money in the first quarter of 2001, with a 16-cent per-share gain anticipated for the year, compared with a projected loss of $1.01 per share this year, according to First Call estimates.

What does profitability really mean?

Analysts note that even if a company becomes profitable, it's only negligibly significant from an investment standpoint if shares are trading at sky-high levels.

For a company with a stock valued at about $100 a share which then begins earning a few cents per share each year, the profits often will mean little for investors' bottom line, notes Bepler.

Still, analysts say, the beginning of profitability should signal the next phase of biotech's development -- an era marked by rapid growth and driven by earnings.

"This industry is changing into the second stage of its life cycle," Bepler said.

|

|

|

|

|

|

|