|

3M exceeds 2Q forecasts

|

|

July 26, 2000: 12:31 p.m. ET

Dow component's profit creeps past consensus on 9% revenue growth

|

NEW YORK (CNNfn) - Minnesota Mining & Manufacturing Co. reported second-quarter earnings Wednesday that slightly exceeded Wall Street forecasts, boosted by a 9 percent sales gain.

The diversified manufacturer, which makes products ranging from Scotch tape to auto parts, earned $470 million, or $1.18 a diluted share, up from $421 million, or $1.17 a share, in the year-earlier period. The 1999 results do not include a one-time gain from divestitures of $104 million.

The company was expected to earn $1.16 per share in the latest period, according to the First Call consensus estimate of analysts.

Sales totaled $4.22 billion, a 9 percent increase over $3.9 billion in the year-earlier period. Sales totaled $4.22 billion, a 9 percent increase over $3.9 billion in the year-earlier period.

Sales would have risen 10 percent excluding currency fluctuations, which reduced the value of sales in U.S. dollars.

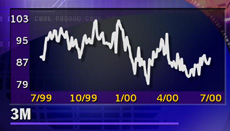

After the results were released, 3M (MMM: Research, Estimates) stock jumped 2-1/2 to 90-13/16 in late-morning trading. The stock is one of 30 components of the Dow Jones industrial average.

"We continue to deliver solid growth," Chairman and Chief Executive L.D. DeSimone said. "We're growing through a strong flow of innovative products, increasing participation in dynamic industries and our strong global presence."

Morgan Stanley Dean Witter analyst Robert Ottenstein, who follows the company, said 3M managed to beat estimates despite rising raw materials prices and the impact of currency exchange. He cited the company's 12 percent volume growth as a strong driver of the quarterly results.

"I think it's indicative of the fact that this is a growth company," he said. "It is a misconception on the street in general that this is kind of a sluggish, 'old economy' name."

Ottenstein has an "outperform" rating on 3M stock.

For the first six months, net income totaled $926 million, or $2.31 per diluted share, up from $805 million, or $1.98 per share, in the year-earlier period. Sales rose 8 percent to $8.28 billion.

|

|

|

|

|

|

3M

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|