|

Nokia falls on 3Q forecast

|

|

July 27, 2000: 5:03 p.m. ET

Cellphone maker says sees profit shortfall; shares plunge 26.5 percent

|

LONDON (CNNfn) - Nokia reported record-setting second-quarter earnings that were in line with analysts forecasts Thursday, but the company's stock was hammered on news that profits will weaken in the third quarter.

Executives at Nokia in Helsinki, blamed the timing of new product introductions and seasonal effects for the earnings shortfall.

Nokia, the world's largest and most profitable maker of wirless phones, reported a 62 percent increase in second-quarter pretax profit to  1.4 billion ($1.31 billion) and diluted earnings per share of 1.4 billion ($1.31 billion) and diluted earnings per share of  0.20. The company said its revenue rose to 0.20. The company said its revenue rose to  6.98 billion, a 55 percent increase from last year. 6.98 billion, a 55 percent increase from last year.

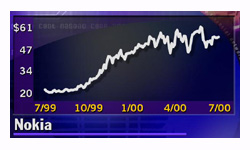

But investors punished the stock after it forecast third-quarter earnings would fall below the  0.20 per share reported for the most recent period. Shares fell 14-13/16, or 26.5 percent, to 41 in heavy-volume New York Stock Exchange trade. 0.20 per share reported for the most recent period. Shares fell 14-13/16, or 26.5 percent, to 41 in heavy-volume New York Stock Exchange trade.

Jorma Ollila, Nokia's chief executive, said the profits will sag before sales of new Internet-enabled models take hold later in the year.

"I understand that this prediction may have been disappointing to some of you, but let me assure you that my confidence in the overall prospects of Nokia remain unchanged," Ollila told analysts in a teleconference Thursday.

Ollila added that overall growth prospects for Nokia in the later part of the year, as well as for the long term, remain unchanged. He said the company would achieve revenue growth above 30-40 percent this year, and earnings will improve in the fourth quarter. Ollila added that overall growth prospects for Nokia in the later part of the year, as well as for the long term, remain unchanged. He said the company would achieve revenue growth above 30-40 percent this year, and earnings will improve in the fourth quarter.

But analysts on both sides of the Atlantic were taken aback by the warning of a relatively weak quarter for Nokia, which over the past few years consistently has beaten market expectations.

"We need to see whether this is a one-off or more serious," Susan Anthony of Credit Lyonnais Securities in London told CNNfn.com.

Anthony pointed out the shock nature of the announcement contrasted with Nokia's recent history of publishing earnings reports that pleased investors: "They've managed everything brilliantly until now," she said.

"When they say this thing that appears to be a profit warning, the market gets insecure," Hagstromer & Qviberg brokerage analyst Johan Brostrom said.

"A company that keeps delivering results that are way over expectations will inevitably be very highly valued. If they don't do that one year, it's going to lower the share price."

Several investment banks downgraded their share recommendations for Nokia following the report, including Morgan Stanley Dean Witter, Donaldson, Lufkin & Jenrette, Banc of America and Bear Stearns.

"We have been concerned about slowing handset growth and these results are another confirmation of this concern," Bear Stearns analyst Wotjek Uzdelewicz wrote in a research note.

But some analysts believed the sell-off was overdone and the result of a generally jittery market.

"This is a buying opportunity," said Jean Danjou at Credit Suisse First Boston, who covers the technology sector, focusing on semiconductor companies, a major supplier to the wireless phone manufacturers.

"The Nokia results are seen as a bad omen for wireless prospects, but...a weaker third quarter is not the end of the world," he said.

Merill Lynch's Adnaan Ahmad reiterated his "buy" rating on Nokia, saying that handsets may erode over the longer term "but are not going to fall off a cliff.

The handset division is by far Nokia's biggest money-spinner, contributing 86 percent of second-quarter operating profit. The company said the unit's quarterly profit nearly doubled to  1.22 billion from 1.22 billion from  671 million a year earlier, with an operating profit margin of 25 percent, up from 22 percent. The margin, which expresses profit as a percentage of sales, is a measure investment and business analysts use to gauge profitability. 671 million a year earlier, with an operating profit margin of 25 percent, up from 22 percent. The margin, which expresses profit as a percentage of sales, is a measure investment and business analysts use to gauge profitability.

"Overall this is a high-quality set of results... and their handset margin of 25 percent is phenomenal," said analyst Matthew Lewis of Daiwa Europe.

And Nokia's warning echoed recent indications from Swedish rival Ericsson that competition in the phone market is increasingly tough, especially with regard to securing essential components.

When Ericsson reported its results earlier this month, executives said its handset division had fallen into the red, blaming lingering component shortages.

In its most recent quarter, Motorola reported improved profitabilty in its handset division, although that unit's sales fell short of some analyst's expectations.

Even so, analysts pointed out that Nokia's strong margin in the second quarter indicated the firm had successfully acquired enough key parts, such as memory chips, without paying inflated prices.

|

|

|

|

|

|

Nokia

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|