|

Amazon plunges 14%

|

|

July 27, 2000: 4:04 p.m. ET

Stock dives after sales miss targets; analysts cut estimates

By Staff Writer Michele Masterson

|

NEW YORK (CNNfn) - Shares of Amazon.com plummeted Thursday after several leading analysts - disappointed by the company's second quarter sales growth - slashed their price targets and predicted more red ink for the Internet retailer.

In midday trading, Amazon (AMZN: Research, Estimates) slumped 5-1/16, or 14 percent, to 31, bringing the total amount of market capitalization lost by the Seattle-based company over the last month to a whopping $4 billion.

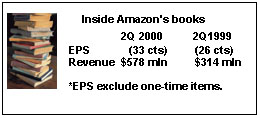

And even though Amazon posted a smaller-than-expected second quarter loss Wednesday, analysts said the company's revenue growth was disappointing, raising doubts about Amazon's ability to increase revenues without sacrificing profits.

"Amazon has to do two things well," Prudential analyst Mark Rowen said. "They have to drive growth and drive toward a solid economic model at the same time.

"They've shown that they can grow revenue and lose a lot of money and they've shown that they can improve economics, but that slows revenue growth. They're going to have to find a balance to do both," Rowen said.

The bottom line

PaineWebber analyst Sara Farley said that during Amazon's conference call following release of its second-quarter results, the company placed less emphasis on revenue growth and more focus on improving operating efficiencies and bottom line performance.

"While improving operations is certainly important, we do not necessarily believe that it will be enough," Farley said in a research note. "With the company running at 30 to 50 percent capacity, and given a business that scales with volume, this must be a revenue story. More efficient operations can only take you so far."

Farley said that if Amazon is to leverage its network during the next 3 to 5 years, its revenues will have to increase an average of 28 to 50 percent annually.

"With annual revenue already slowing from 170 percent last year to about 68 percent this year, this is not necessarily a slam dunk," Farley said.

A period of adjustment

Banc of America Securities analyst Tom Courtney already cut Amazon to a "buy" from "strong buy" a day ahead of the second quarter release, and said he had lost confidence in the company's ability to generate the growth needed to meet his estimates.

"The company has tried to grow as fast as it can, tried to do a lot of things at the same time," Courtney told CNNfn.com. As it matures, I think they clearly know that they have to get toward profitability.

"We think they will, but the question for the stock is: in the year 2005, do they do $8 billion in sales or do they do $20 billion in sales? If they do $8 billion, then it isn't going to be worth as much as if they had done $20 billion," Courtney said.

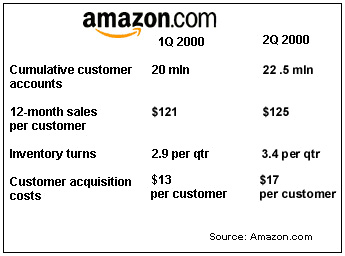

Courtney said he finds that now people are wondering if this is a period of readjustment for the stock and said the answer is yes. Courtney feels the correction isn't so much because of the market changing its opinion about the Internet stock group, as much as because Amazon's sales growth has slowed down dramatically in the last two to three quarters and, he said, is likely to continue to slow.

"In the fourth quarter of calendar 1999, sales grew 170 percent year-over-year. In the second quarter they just reported, sales grew 84 percent. So, if you went back six months, Amazon's market capitalization when they generated that 170 percent growth was probably around $25 to $30 billion. Today it's $15 billion," Courtney said.

"Is it $15 billion because of the collapse of the business-to-consumer market or it is $15 billion because sales growth slowed down by 50 percent in the last two quarters? Probably, it's a little bit of both, but I think it's more of the latter," Courtney said.

Analysts weigh in

Amazon, once a Wall Street darling, has come under increased scrutiny recently as investors try to determine which Internet stocks will offer the best return.

On Thursday, a number of analysts downgraded their ratings on Amazon and slashed their price targets in light of the slowdown in second quarter revenue growth.

Prudential's Rowen cut Amazon' to a hold from a strong buy and slashed his price target to $40 a share from $80.

Rowen said that sales of books, music and videos at Amazon, its biggest business, grew 38 percent from a year earlier, which is "pretty good for a traditional retailer, but for an Internet company, we would expect much faster growth."

Goldman slashes price target

Goldman Sachs analyst Anthony Noto told CNNfn.com that he is also keeping his "buy" rating, but reduced Amazon's price target to $75 a share, down from $95, and is also lowering estimates.

"The shortfall in revenue is a transitory concern, I don't think it is a secular concern," Noto said. "I was actually very happy with the progress in profitability metrics. So, the revenue shortfall is somewhat disappointing, but I don't think it's a long-term issue."

Noto widened his 2000 earnings estimate to a loss of $1.26 a share from

$1.20 a share previously. For 2001, Noto predicts Amazon will lose about 41 cents a share, versus an earlier estimated loss of 15 cents.

PaineWebber also cuts price target

Paine Webber analyst Sara Farley told CNNfn.com that she is maintaining her "neutral" rating and has reduced Amazon's price target to $30 a share. The price target had been at $60, but was under review for the past month. The bearish outlook was prompted by what she sees as Amazon's revenue miss.

"This is a business that scales with volume and with revenue slowing significantly, it gets more difficult to actually reach scale," Farley said. Farley said she took into account that the quarter is seasonally tough, but said that the factor was already built into her numbers.

Analysts at Credit Suisse First Boston and DLJ were more bullish about Amazon's prospects, but still lowered revenue forecasts.

"We believe that this quarter's results will be the final straw for some of those investors that were taking a leap of faith on Amazon," said CSFB analyst Heath Terry in a research note. "While we believe now is the wrong time to throw in the towel, the market will likely take a 'prove it' attitude towards the company's future."

Jamie Kiggen at DLJ also foresee a sell-off in Amazon's shares on disappointing quarterly revenue but said he believes the company will make steady progress towards profitability throughout the year.

"Amazon remains a core Internet holding and we are willing to stay with the story in anticipation of a high quality fourth quarter," Kiggen said in a research note.

Salomon keeps price target

Salomon Smith Barney analyst Tim Albright said he kept his "buy" rating on the stock and held his price target at $80 a share.

Albright pointed to improvement in gross profit, which he called a good sign. "That's a first step as you're working your way down the income statement," he told CNNfn.com. He noted that the June quarter is seasonally tough for most retailers, not just Amazon, so it actually did well.

"Amazon at this level is a large retailer," Albright said. "So, 84 percent year-over-year growth is not bad in a very seasonally tough quarter, particularly given that Amazon's core categories are at their seasonally weakest in the June quarter. You did see that in their segment breakout. Books, music and video grew at 38 percent, but June is the toughest quarter."

Citing criticism that Amazon has not been able to achieve sales growth in other business segments, Albright said the company's new businesses were up 22 percent on a quarter-over-quarter basis, which is "clearly a good sign," and he also pointed out that business is at its strongest level in the September through December period. Citing criticism that Amazon has not been able to achieve sales growth in other business segments, Albright said the company's new businesses were up 22 percent on a quarter-over-quarter basis, which is "clearly a good sign," and he also pointed out that business is at its strongest level in the September through December period.

"I think that people who are going out and downgrading the stock right now, given the operational improvements and given the fact that they were still up 84 percent on the year-over-year basis, may be picking some what of an inopportune time to do that, since we're moving on the seasonal strength," he said.

But even Amazon's biggest cheerleader, Merrill Lynch's Henry Blodget acknowledged the company's revenue shortfall and said the quarter was "soft" and that it missed his revenue estimate of $585 million.

"The Amazon story continues to transition from growth to earnings, and because growth has slowed even more than expected, this transition will

likely require more patience than we had hoped," Blodget said in a research note."

|

|

|

|

|

|

Amazon

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|