|

Bank America to cut jobs

|

|

July 28, 2000: 12:40 p.m. ET

Bank plans to cut up to 10,000 management-level jobs to reduce costs

|

NEW YORK (CNNfn) - Bank of America Corp. said Friday it will cut up to 10,000 jobs, or 7 percent of its work force, in an effort to improve efficiency and drive up revenue growth.

The biggest U.S. bank said the cuts will be principally among middle and senior management and should be carried out within a year. The company will absorb a charge of $300 million-to-$500 million in the third quarter as a result of the cuts.

The Charlotte, N.C.-based bank, which has about 151,000 employees and $656 billion in assets, plans to use savings from the job cuts to improve its financial performance.  The company said its "days of growth by merger and acquisition are behind us" and the company now must move on to streamlining its business. The company said its "days of growth by merger and acquisition are behind us" and the company now must move on to streamlining its business.

"To date, despite our many successes in individual businesses, we have not made the degree of progress we would like toward realizing that potential," Chief Executive Hugh McColl said. "We've assembled the right parts, but after years of additions, our resulting structure is neither as efficient nor as effective as it needs to be."

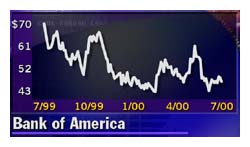

Wall Street registered little reaction to the news. Bank of America (BAC: Research, Estimates) stock slipped 3/8 to 46-3/8 in Friday afternoon trading.

"They're going to do a number of things including eliminating some of the imbedded bureaucracy in the company and invest more heavily in the Internet," said Joseph Morford, a financial services analyst at Dain Rauschel Wessels. But, he said, "the Street wants to see revenue growth."

While the job eliminations will cut costs, Bank of America will have to reinvest in its business and improve customer service to build revenue, Morford said. Dain Rauschel Wessels has a "buy" rating on the stock, saying shares are trading below their real value.

The stock is near its 52-week low of 42-5/16; the yearlong high is 76-3/8.

Bank of America said it will invest an additional $70 million in e-commerce initiatives over the next six months and will quicken the launch of Internet services at its banks. The company also will further invest in asset management and investment banking.

The bank said it still expects earnings from operations to increase 12-to-15 percent in 2000 and 2001.

Bank of America has about 4,500 branches in 21 states and Washington, D.C.

|

|

|

|

|

|

Bank of America

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|