|

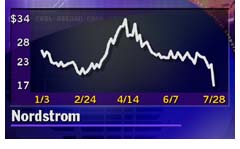

Nordstrom warns on 2Q

|

|

July 28, 2000: 1:37 p.m. ET

Retailer expects earnings to miss Wall St. forecasts of 55 cents a share

|

NEW YORK (CNNfn) - Weak sales prompted upscale specialty retailer Nordstrom Inc. to warn Friday it would miss Wall Street earnings forecasts for the second quarter.

Seattle-based Nordstrom (JWN: Research, Estimates) said its earnings from operations will fall 12-to-16 cents a share short of the consensus of analysts' forecasts, compiled by First Call, of 55 cents a share.

The news sent Nordstrom shares tumbling 5-5/16 to 16-7/8, a 24 percent drop, in morning trading Friday.

"Sales in our recent men's and women's half-yearly clearance events were not as strong as we had anticipated, and sales for the first week of our Anniversary Sale, while modestly better than last year on an event-to-date basis, are below planned levels," Chairman and CEO John Whitacre said in a statement. "Sales in our recent men's and women's half-yearly clearance events were not as strong as we had anticipated, and sales for the first week of our Anniversary Sale, while modestly better than last year on an event-to-date basis, are below planned levels," Chairman and CEO John Whitacre said in a statement.

Nordstrom's anniversary sale is a pre-season sale of fall merchandise, spokeswoman Brooke White said.

Whitacre also said the company would refine its women's merchandise mix and better manage its expenses.

Industry watchers have said the switch to casual workplace attire has caused shoppers to hold off on expensive fashion purchases, particularly women's items.

"There's been kind of a general malaise in apparel over the last couple of years. We are still suffering the effects of the change from traditional business apparel to casual apparel," said Tracy Mullin, president and chief executive officer of the National Retail Federation, a trade organization. "Those (casual wear) carry much lower price points and people still haven't figured out what casual is. People are waiting to see how it's going to shake out. Where a woman may have bought a $100 skirt in the past, she's now buying a $20 skirt."

Nordstrom also said it will take a charge of 4-to-5 cents a share related to the decline in value of its original $33 million investment in an Internet grocery business, Streamline. The company said the investment's value may fall further.

Nevertheless, Whitacre said, "We are guardedly optimistic concerning our performance over the second half of this year."

At least one analyst attributed the sluggish sales to higher interest rates, which have prompted consumers to be a little tighter in their spending, and a general falloff in women's fashion apparel.

"I think they made a lot of fashion changes, but there's been a general malaise in women's fashion apparel," Steve Kernkraut, an analyst with Bear Stearns, said. "What's somewhat concerning here is that Nordstrom has transitioned totally to fall merchandise. The question is, is the earlier fashion not on target, or is the consumer really concerned about the rising gas prices?"

The retailer, which earned 51 cents a share in the second quarter a year ago, expects to report results Aug. 16. Nordstrom employs 47,000 people and operates 110 stores nationwide.

Nordstrom's warning is the latest in a string to come from retailers in recent weeks as the effects of higher interest rates begin to take effect - consumers easing off on shopping as their credit card rates increase.

Earlier this week Kmart (KM: Research, Estimates), the nation's No. 3 retailer, and Circuit City (CC: Research, Estimates) both warned that massive restructuring efforts would force them to take charges, causing them to miss quarterly estimates. Kmart said it will close 72 under-performing stores, while Circuit City said it was getting out of the appliance business.

|

|

|

|

|

|

Nordstrom

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|