|

Exxon: merger savings up

|

|

August 1, 2000: 11:56 a.m. ET

No. 1 oil company says savings will total $4.6B; share buyback planned

|

NEW YORK (CNNfn) - Exxon Mobil Corp., the world's No. 1 oil production company, indicated Tuesday that the cost savings from its recent merger would be roughly 65 percent higher than first anticipated, allowing the company to dramatically increase its capital spending in coming years.

The Irving, Texas-based company also announced that it planned to resume its stock buyback program in an attempt to jump-start its sluggish stock price.

Exxon Mobil -- which is the result of a blockbuster $81 billion merger last year that united the oil industry's two largest producers, Exxon and Mobil -- said it now expects to wring $4.6 billion in cost savings from the union, a dramatic increase from the $2.8 billion originally expected and 20 percent higher than the $3.7 billion projected just seven months ago.

Lee Raymond, Exxon Mobil's chairman and chief executive, told investors at a meeting in New York that surprise synergies between the two company's research programs, which were closely held until the merger was completed, helped accelerate the savings rate. Lee Raymond, Exxon Mobil's chairman and chief executive, told investors at a meeting in New York that surprise synergies between the two company's research programs, which were closely held until the merger was completed, helped accelerate the savings rate.

"Let me give you my take on the merger," Raymond said. "It is essentially behind us."

Exxon Mobil (XOM: Research, Estimates) also said it now expects 19,000 merger-related job cuts by 2002, equivalent to approximately 15 percent of the company's 123,000 member work force, up from the 9,000 it originally projected and 16,000 it predicted last December.

Those combined savings will allow the company to boost its capital spending to between $11 billion and $12 billion this year, and increase that tally to $13 billion a year through 2005 -- an increase that will be focused on increasing the company's production.

"The rise in capital spending that we anticipate through 2005 means that production will increase at an even higher rate," Raymond said.

No details given on share buyback

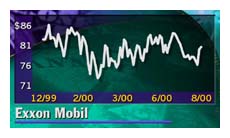

The company provided few details about the highly anticipated resumption of its stock repurchase program, meant to provide some forward momentum to its stock, which has hardly budged in the last year.

Analysts have blamed the lack of growth on the flood of new company shares that hit Wall Street when the merger closed late last year. Analysts' calls to restart the stock repurchase program to help offset that dilution grew louder after the company reported a cash surplus in the first half of the year of more than $8 billion.

But Exxon Mobil officials gave few details about the buyback program, saying only that it would continue to update its treasury share purchase as part of its quarterly earnings reports.

Exxon Mobil shares did react much to the news, however. The company's stock shed 1/2 to 80-11/16 in late morning trading.

--from staff and wire reports

|

|

|

|

|

|

Exxon Mobil Corp.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|