|

An educated portfolio

|

|

August 8, 2000: 11:07 a.m. ET

Financial planners give an A+ to the savings plan of a couple in teaching

By Staff Writer Jennifer Karchmer

|

NEW YORK (CNNfn) - Like most young newlyweds, Casey and Denise Shorter have a boatload of questions about saving for retirement. That's not to say that the New Jersey couple doesn't have any savings. In fact, each has stashed away a nest egg through the years since college by living at home instead of renting an overpriced apartment in New York City.

So today, four years after meeting at the New Jersey shore, the Shorters, who live in an apartment in Newfoundland, N.J., are planning to buy a home and have two children in the next few years -- all the while saving for their retirement years.

Portfolio Rx is a weekly CNNfn.com feature that looks at issues like diversification, asset allocation and rebalancing. In each article, we will review an investor's long-term portfolio and ask financial experts to give their advice. If you want help with your nest egg, see below for more information. Portfolio Rx is a weekly CNNfn.com feature that looks at issues like diversification, asset allocation and rebalancing. In each article, we will review an investor's long-term portfolio and ask financial experts to give their advice. If you want help with your nest egg, see below for more information.

As public school educators -- he's an assistant principal; she's an elementary school teacher -- they both contribute to a 403(b) -- a company sponsored retirement plan similar to a 401(k) offered by nonprofits and schools.

"But the big question is: Are we putting enough money away?" said Casey Shorter, 29. "Despite the pension after 25 years, and the 403(b) investments, are we doing enough?"

Putting away enough?

To answer that question, financial planners take into account how much regular savings you're adding to your long-term nest egg. But even more important is how you diversify your savings among different types of investments - that is stocks, bonds, value or growth funds, international securities, and sectors like technology or real estate.

The Shorters, with a combined salary of $110,000, have stashed away about $30,000 in their retirement plans. Casey worked his way up to being named an assistant principal in the Sparta School District recently after serving as a sixth grade teacher and a high school guidance counselor.

Tired of the corporate industry rat race, Denise, 30, recently joined the teaching world after working for several years as a market analyst for Liz Claiborne in Manhattan. Now, she's completing a master's degree while teaching elementary school.

Each contributes about 4 percent of pre-tax dollars to a 403(b) plan provided through the school. Casey has $18,000 in his 403(b) plan; Denise has $12,000 saved in her 403(b) plan. Among some of the funds that they each invest in are: Alliance Global, Alliance Common Stock, MFS Emerging Growth (MFEGX), and Alliance Premier Growth (APGAX).

In addition, the couple owns about $75,000 among the following funds, which are separate from their retirement plans. They would like to use about $50,000 for a down payment on a home and other expenses:

Vanguard Index 500

Vanguard Treasury Money Market

Vanguard Total Bond Market Index Fund

Vanguard Extended Market Index Fund

TIAA-CREF International Equity

Vanguard Prime Money Market

Retirement dreams

With hopes of retiring at age 55, the Shorters plan to work in the education field for their entire careers. At that time, they each will have served at least 25 years in the school district and expect to receive a pension.

Click here to read last week's Portfolio Rx on CNNfn.com!

The pension, coupled with Social Security, the 403(b) plans and other investments will comprise their long-term nest egg.

"It's hard to predict 25 years in advance, but I think it's important to have that goal in mind," Casey said about planning for retirement. "For me, that would be 30 years in the (school) district." He would like to become a principal and possibly a school district superintendent.

Check your mutual funds on CNNfn.com

Meanwhile, the couple has managed to carry no debt by paying off their credit cards promptly.

Also, "we both had the advantage of getting married later than most which enabled us to stay at home out of college and save money," Casey said. "Luckily, we're both savers and have a good chunk of money."

The doctor is in

Mark Podolsky, a certified financial planner (CFP) with Financial Solutions Associates in Boston, Mass., says the Shorters have assembled a strong portfolio with top performing funds, but he suggests some tweaking.

If the couple continues socking away money at the same rate they've been saving - which is 4 percent, Podolsky estimates they'll have about $600,000 in their retirement plans. He arrived at that figure by estimating an 8 percent return on their investments over 25 years on their current $30,000 nest egg.

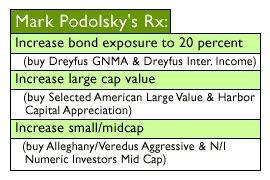

With that in mind, Podolsky recommends that they increase their exposure to bonds. Despite their young age and 25-year time horizon until retirement, Podolsky says bond investments can cushion their portfolio when other investments - like large cap growth stocks - take a beating.

So he suggests increasing the bond fund allocation to 20 percent with an eye on the Dreyfus Basic GNMA Fund (DIGFX) and the Dreyfus Intermediate-Term Income Fund (DRITX), if they are offered in the Shorters' 403(b) plans.

The couple also should consider value and growth funds since their retirement portfolios are overweighted in large cap growth securities.

Podolsky suggests the Selected American Fund (SLASX) and Harbor Capital Appreciation Fund (HACAX).

Learn how to manage your money!

Read CNNfn.com's Checks & Balances every Monday

"In their case, they're in very good shape in terms of money they're saving and money they've accumulated so far," he said. "The focus now is on their allocation mix and appropriate diversification. Pay attention to owning both value and growth funds and have a high enough percentage in international funds."

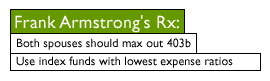

CFP Frank Armstrong, president of Managed Account Services in Miami, Fla., says the couple should maximize their contributions to their 403(b) plans before anything else. It's great that they have outside accounts, but contributions to a 403(b) plan are with pre-tax dollars.

A 403(b), also known as a tax-sheltered annuity or TSA, is similar to a 401(k). You contribute to it using pre-tax earnings, which grow tax-deferred until you withdraw from the fund at retirement. Your employer may offer matching contributions. And you may contribute up to $10,500 per year or up to 20 percent of your salary -- whichever is less.

"Here's a young guy and his wife, together making $110,000 but they're only putting 4 percent of their income into a 403(b)," Armstrong said.

On the right path

So Casey and Denise are pretty well set in their retirement savings if they reallocate their portfolio and diversify their holdings, planners say.

Experts suggest you take a closer look at your holdings in your company-sponsored plan, such as a 401(k), plus any outside investments.

Your age, your retirement goals and how much risk you're willing to take will determine how to allocate your assets. Typically, younger investors can buy more aggressive investments because they have a longer time horizon. Someone closer to retirement might want to be more conservative to preserve his or her nest egg.

"Everyone seems very aggressive as far as retirement planning goes," Casey said. "All my friends have their IRAs and 401(k) plans for the future. There's a lot more forethought for young people in their planning. But no one in my age group is counting on Social Security."

--Staff Writer Jennifer Karchmer covers news about retirement for CNNfn.com. Click here to send her email.

* Disclaimer

If you would like to be considered for our Portfolio Rx feature, send an e-mail to retirement@cnnfn.com with the following information: your age, occupation, income, assets, debt and expenses, your retirement goals, such as when you wish to retire and what type of lifestyle you envision. Also include specifics about your long-term savings portfolio: your 401(k) and IRA accounts; which mutual funds, stocks and other securities you own; and information about any other source of retirement income you expect, such as a pension. If we choose your portfolio, we will use your information including your name in an upcoming story. Please include a daytime phone number so we may reach you.

|

|

|

|

|

|

|