|

Retail sales up, PPI tame

|

|

August 11, 2000: 8:44 a.m. ET

Retail sales remain strong in July, but wholesale prices ring in flat

|

NEW YORK (CNNfn) - Retail sales rose at a faster-than-expected pace in July, but a measure of wholesale prices indicated that inflationary pressures remain in check, U.S. government reports released Friday showed.

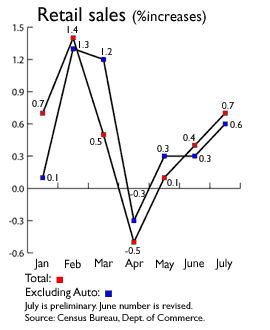

Retail sales advanced 0.7 percent from June levels to $270.6 billion, a report from the U.S. Commerce Department said. Sales, excluding autos, climbed 0.6 percent in the month. A survey by Briefing.com forecast a 0.4 percent increase in both measures, following a revised 0.4 percent gain in overall retail sales in June and a revised 0.3 percent increase excluding auto sales.

The report comes at the end of a week when many major retailers reported a softening of sales in their earnings reports for the period ending in July, as well as in their guidance of future results. The report comes at the end of a week when many major retailers reported a softening of sales in their earnings reports for the period ending in July, as well as in their guidance of future results.

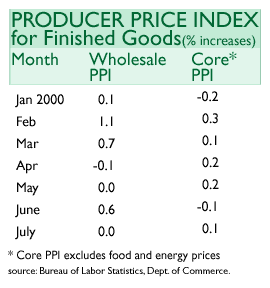

In a separate report, the producer price index -- a closely watched measure of wholesale price inflation -- was unchanged in July, compared with the 0.1 percent gain forecast by analysts surveyed by Briefing.com. The increase follows a 0.6 percent rise in June. The so-called core PPI, which excludes volatile food and energy prices, rose 0.1 percent, in line with forecasts. The core PPI slipped 0.1 percent in June.

The drop in oil prices in July was the main driver in the slowing of prices. Energy prices fell 0.7 percent, led by a 9.1 percent decrease in gasoline prices.

Prices for raw materials were even more in check in the period, with those goods other than food or energy falling 1.8 percent in the period.

With the Federal Reserve set to meet on short-term interest rates Aug. 22, investors were looking to these reports as a clue to the future direction of the rates. Reports that showed a slowing economy in recent months have led many to believe that rates will be left unchanged. Stocks opened mixed Friday. With the Federal Reserve set to meet on short-term interest rates Aug. 22, investors were looking to these reports as a clue to the future direction of the rates. Reports that showed a slowing economy in recent months have led many to believe that rates will be left unchanged. Stocks opened mixed Friday.

Mickey Levy, chief economist with Bank of America, told CNNfn's Before Hours program that the retail sales report could spur investors' fears that earlier signs of a slowdown were temporary.

"Now the market has to be concerned, was that just temporary or will the softness continue," he said. "I would say this type of number is borderline."

But at the same time, he said, the PPI numbers and other signs of low inflation should be encouraging to the markets and the Fed. But at the same time, he said, the PPI numbers and other signs of low inflation should be encouraging to the markets and the Fed.

"If you can get 3.5 percent growth and stay with low inflation, we're in great shape," he said. (285KB WAV) (285KB AIFF)

Other economists said they did not think that the stronger-than-expected rise in retail shares should change Fed thinking about the need to raise rates later this month. One suggested that the numbers are in line with the Fed's goal of slowing economic growth without plunging it into recession.

"Although the July bounce is quite strong, it should not rock the boat in terms of the Fed," said David Orr, chief economist with First Union. "An annual rate [of retail sales increase] of 5 percent to 6 percent could, in fact, be considered the definition of a soft landing."

Other economists say the Fed should be very pleased with the PPI results.

"Energy prices stopped rising in July, and so did the PPI," Oscar Gonzalez, economist with John Hancock Financial Services, said. "So the worst may be over."

|

|

|

|

|

|

|