|

Online sales on the rise

|

|

August 15, 2000: 7:33 p.m. ET

Leading research firms see continued growth in electronic retailing

By Staff Writer Richard Richtmyer

|

NEW YORK (CNNfn) - The recent stumble on Wall Street of some high-profile electronic commerce companies may have cast a gloomy shadow over the "e-tailing" sector, but the number of consumers who have chosen to shop in cyberspace over the past three years has far exceeded expectations.

And while their forecasts vary somewhat, the two leading Internet research firms see that growth continuing.

In 1997, Forrester Research and Jupiter Communications each pegged a forecast for the total number of dollars consumers would spend online this year that was well below what they actually spent.

For example, Forrester had predicted that consumers would ring up $7.2 billion on Internet purchases in 2000.

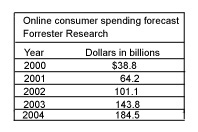

So far this year, they already have spent about $18 billion, and are expected to spend about $38.8 billion before the year is over, according to Forrester analyst Christopher Kelley. So far this year, they already have spent about $18 billion, and are expected to spend about $38.8 billion before the year is over, according to Forrester analyst Christopher Kelley.

"The U.S. really hit a hyper-growth phase," Kelley said.

Forrester describes the trend in online shopping over the last three years as a "retail growth spiral."

The idea is that as more people moved to the Web for shopping, more retailers set up shop in cyberspace to meet their needs. With more vendors online came an increased supply of products. Dramatic improvements in the technology behind e-commerce also added to the momentum.

"All roped up with this is the fact that the price of computers and Internet access have been pummeled in the last three years," Kelley said. "If somebody told you in 1997 that PCs were going to go down to $500 and Internet access was going to be free, nobody would have believed you."

"So as you have an increasing supply and the lower costs of the technology to be able to act on the supply, you had a hyper-growth of e-commerce between 1997 and 2000 which led us to the levels that we are today," Kelley added.

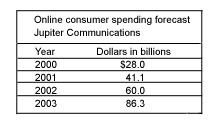

Jupiter also substantially underestimated the potential of online sales. In 1997, that firm had expected Web shoppers to buy $15.6 billion worth of merchandise in 2000. In its most recent online consumer spending forecast released this week, Jupiter bumped that number up to $28 billion.

"Our approach has always been to make relatively sober, conservative forecasts," said Vipul Patel, director of forecasting at Jupiter. "And given the dynamic nature of online usage and activity, things just took off a lot quicker than expected." "Our approach has always been to make relatively sober, conservative forecasts," said Vipul Patel, director of forecasting at Jupiter. "And given the dynamic nature of online usage and activity, things just took off a lot quicker than expected."

Patel chalked up much of the growth in online retailing over the past three years to vast marketing efforts by Internet companies such as America Online aimed at drawing users to the Internet. Because they exerted that kind of influence on consumer behavior, it off the growth forecasts, he said.

"What happened in the last couple of years is that the firms tried to jumpstart that behavior by the marketing campaigns," Patel said. "That created in some ways an almost artificial jump past the point at which you would expect normal consumer behavior to change."

Looking ahead another three years, Jupiter now is expecting consumers to ring up $86.3 billion in online sales in 2003. Meanwhile, at $143.8 billion, Forrester's 2003 forecast is a little more optimistic.

"In 2000, we're going to have 11 million new online shopping households," Forrester's Kelley said. "That is the single biggest growth year in terms of the number of households coming online to buy for the first time. So is e-commerce in terms of consumer demand losing momentum? No. It still has a lot of momentum. It's no longer just the early adopters. It's nearly everybody now."

Jupiter's Patel, however, pointed out that the unanticipated marketing and advertising spending that fueled the higher-than-expected growth over the past three years may not continue over the next three, which could lead to slower growth.

"In the last couple of months, people have been concerned that maybe the Internet economy is going to slow down because it was so overheated and because there's now such a lack of funding out there," he said.

"We're kind of at a turning point where there's not necessarily, at least from an industry-wide perspective, consensus about whether the markets are going to take off dramatically or whether they're going to flatten out," Patel added. "I think people are seeing things both ways at this point."

|

|

|

|

|

|

|