|

Booksellers' earnings mixed

|

|

August 17, 2000: 8:03 p.m. ET

Internet, video losses weigh on Barnes & Noble; Borders' beats forecast

|

NEW YORK (CNNfn) - Internet expansion dragged the two largest booksellers in the United States into the loss column as they posted earnings results Thursday.

Barnes & Noble Inc., the largest U.S. bookseller, posted a much wider-than-expected loss, as losses from a new chain of video stores as well as its Internet investments dragged it deeper into the red.

Meanwhile, Borders Group Inc., which slightly trails Barnes & Noble in market capitalization, reported a quarterly loss that was narrower than Wall Street had anticipated.

Barnes & Noble's (BKS: Research, Estimates) second-quarter losses -- including its holdings in Barnes & Noble.com (BNBN: Research, Estimates), iUniverse.com and Calendar Club -- brought consolidated losses to $8.6 million, or 13 cents per share.

Analysts surveyed by earnings tracker First Call had expected a loss of only 4 cents per share. The company earned $23.5 million, or 33 cents per diluted share, a year earlier.

Executives said operating profit from its traditional bookstores rose 33 percent to $28.4 million, due to strong sales growth and improved operating margins. Profit margins in its core division increased to 3.6 percent from 2.9 percent a year earlier. The company's bookstores, which include Barnes & Noble as well as B. Dalton chains, produced a profit of 19 cents per share in the period, up from 13 cents a share a year earlier.

It said the division should meet its estimates of $1.89 a share in profit from the bookstores for the full year, with new books planned by many leading authors in the fourth quarter.

Executives did not give consolidated-earnings guidance for the year, though. First Call forecast calls for an overall profit of $1.53 a share for the current fiscal year, which would be up from $1.38 a share earned in fiscal year 2000.

But Barnes & Noble's electronic-games retailers Funco Inc., which it bought in May for $161.5 million, and Babbage's Etc., which it bought in October for $215 million, had a much larger-than-expected loss, despite better-than-expected sales. That segment had been expected to lose 5 cents per share, but instead lost 12 cents.

Still, the company said it expects full-year earnings from the new stores to stay on plan, with a strong fourth quarter expected from the introduction of new games platforms, such as Sony PlayStation 2, planned during that period, even though the PlayStation 2's introduction has been delayed by a number of weeks.

Total sales rose to $924 million from $727 million a year earlier, mostly through the addition of Babbage's and Funco's stores that were not part of the company a year ago. Traditional bookstore sales rose 9.6 percent to $797 million. Sales at the Internet subsidiary are not included in revenue numbers. Total sales rose to $924 million from $727 million a year earlier, mostly through the addition of Babbage's and Funco's stores that were not part of the company a year ago. Traditional bookstore sales rose 9.6 percent to $797 million. Sales at the Internet subsidiary are not included in revenue numbers.

Revenue was boosted by the release of Harry Potter and the Goblet of Fire, the children's book that sold an unprecedented 500,000 copies in the bookstores during the quarter. Barnes & Noble said it sold more copies of the bestseller in one month than it sold of the last three novels by author John Grisham combined.

For the first six months of the year, the company had a net loss of 11 cents a share, compared with a 25-cent-a-share profit a year earlier. Year-to-date revenue increased to $1.8 billion from $1.4 billion.

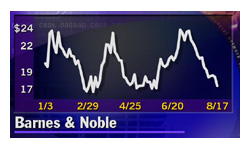

Shares of Barnes & Noble, which released its earnings before the start of trading, ended Thursday's session down 5/8 at 17-3/8.

Borders' losses narrow

After the close of trading Thursday, Borders (BGP: Research, Estimates), which also owns and operated the Walden Book Co. and its chain of retail stores, reported a second-quarter loss that was a penny less than analysts had expected.

Sales across all its businesses increased 11 percent to $699.7 million, led by strong sales growth at its U.S. superstores. Net loss for the quarter was $1.6 million, or 2 cents per share, compared to a $2.6 million loss in the second quarter of last year. Analysts had expected the company to post a loss of 3 cents per share during the quarter.

Borders domestic superstores led the company's overall performance with a 14 percent rise in sales to $462.3 million. At 10.2 million, or 6 cents per share, that division posted a 117 percent increase in profitability from the same period last year. During the quarter, the company opened nine new superstores in the United States, bringing the total to 307.

Meanwhile, sales at Waldenbooks stores were $187.5 million, up a fraction of a percent year-over-year. Waldenbooks accounted for a net loss of $1.3 million during the quarter, the company said.

Borders' International sales increased 25 percent to $44.8 million, and its international business posted a net loss of $3.9 million, or 5 cents per share. Borders' International sales increased 25 percent to $44.8 million, and its international business posted a net loss of $3.9 million, or 5 cents per share.

The company's Borders.com division also posted a loss, totaling $4.2 million or 5 cents per share. Sales through Borders.com increased 55 percent over the same quarter last year to $5.1 million.

"We are pleased with the performance of our core businesses as we drive toward the critical holiday period," Borders' Chief Executive Greg Josefowicz said in a statement. "We anticipate the superstore business will continue to fuel our overall performance while we look to continued reduction in losses at Borders.com, while we maintain focus on improving profitability and our retail convergence strategy."

Borders shares slipped 3/8, or 2.7 percent, to 13-3/8 in New York Stock Exchange trade ahead of the earnings announcement Thursday.

|

|

|

|

|

|

|